Published :

Updated :

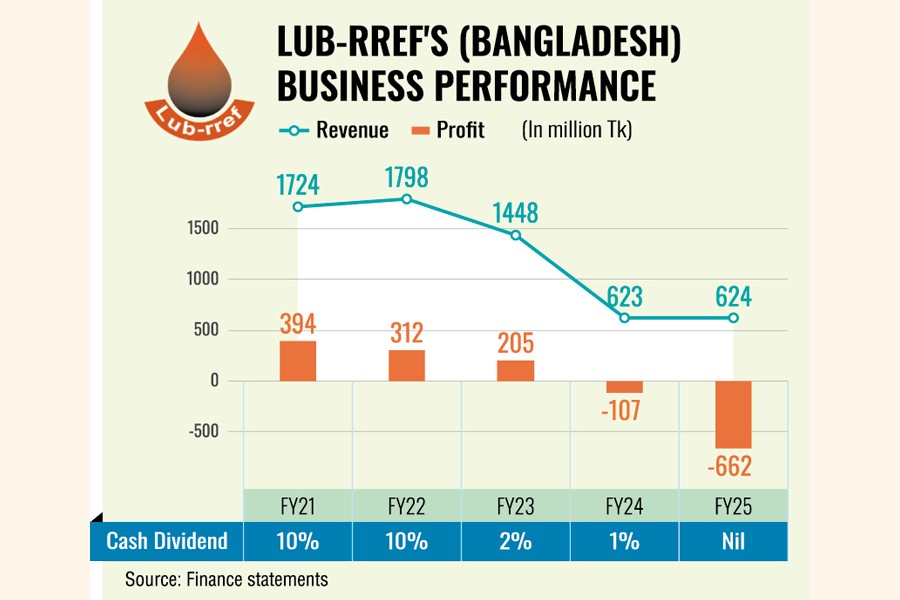

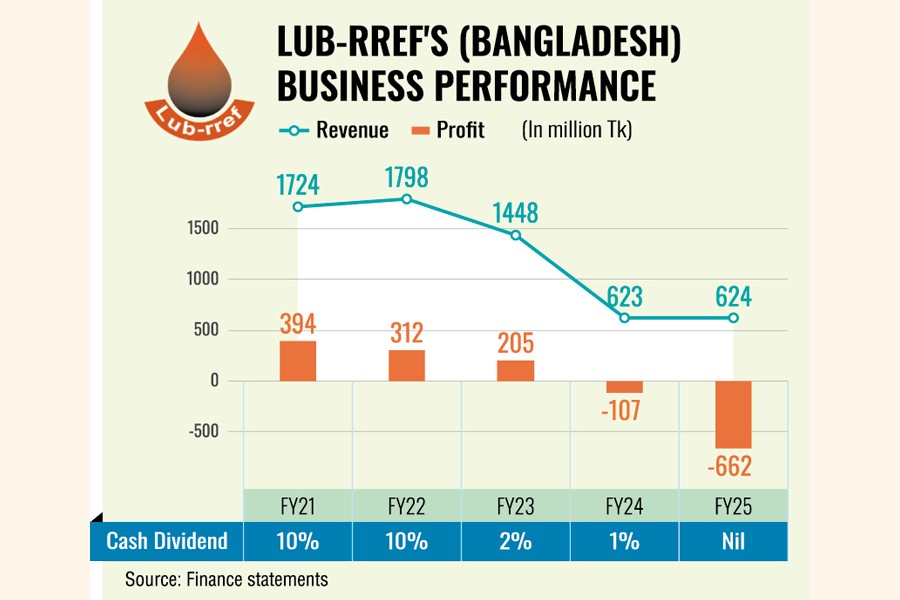

Lub-rref (Bangladesh) has sunk deeper into the red within five years of listing, as its post-IPO expansion plan went haywire.

The lubricant producer reported a loss of Tk 662 million for the year ended June this year, up from a loss of Tk 107 million a year earlier.

The poor financial performance resulted from failed partnerships with banks in implementing a Tk 15 billion investment plan at Julda Industrial Park in Chattogram.

The project was supposed to be funded through syndicated bank loans led by Social Islami Bank, along with Tk 1.50 billion raised from the 2021 initial public offering.

Of the IPO proceeds, Tk 200 million has remained stuck with Social Islami Bank, which is now undergoing a merger process with four other cash-strapped Islamic banks.

Under the expansion plan, the company acquired and developed 40 acres of land at Julda Industrial Park. However, the remaining components of the plan-construction of a base oil refinery, a tank terminal with a berth-operating jetty, a bitumen plant, a hydrogen plant and a power plant-could not be implemented.

As a result, the investments already made did not translate into income but instead increased finance expenses. The woes were further intensified by a working capital shortage and high procurement costs, said company secretary Kabir Hossain.

Meanwhile, sales revenue rose slightly to Tk 624 million in FY25, but that was not enough to offset finance expenses and other costs.

Finance expenses alone jumped to Tk 445 million in FY25 from Tk 138 million the previous year, leading to heavy losses, Mr Hossain said.

The board of directors declared no dividend for FY25, while the company paid only a 1 per cent cash dividend for the previous year.

Following the earnings disclosure, Lub-rref's stock plunged nearly 19 per cent to Tk 10.3 per share on Sunday on the Dhaka Stock Exchange (DSE).

Akramul Alam, head of research at Royal Capital, said the post-IPO increase in losses reflected cost pressure and inefficiency in debt management.

"The company should prioritise cost control, revenue diversification and effective debt management to restore profitability and financial stability," he added.

The company had undertaken the expansion plan to produce higher-grade lubricant products.

It expected that the base oil refinery, once built, would be the first of its kind in Bangladesh, significantly reducing dependence on imports, creating valuable employment opportunities and saving foreign currency.

However, the project could not proceed halfway after raising the required equity, acquiring technology and securing land, due to unmet commitments by financial partners.

Unforeseen global events also severely disrupted the project's execution. During the Covid-19 outbreak in 2021, foreign experts were unable to reach the site.

This was followed by the Russia-Ukraine war, which drove the US dollar-taka exchange rate up from Tk 85 to Tk 121, while local bank interest rates began to rise, creating further financial hurdles.

"Our planned Tk 15 billion project cost has ballooned to Tk 22 billion. As a result, our loan burden and interest expenses soared, and raw material costs increased significantly due to import dependency," the company secretary explained.

Production of superior multi-grade engine oil, which requires imported virgin base oil and other chemicals, has faced constraints due to difficulties in securing letters of credit (L/Cs) and a lack of support from the company's primary banking partners, including Social Islami Bank.

"Constrained letter of credit facilities severely impacted the company's ability to import raw materials, leading to reduced production capacity and an inability to meet market demand," Mr Hossain said.

Limited liquidity has also led to underutilisation of manufacturing capacity, exacerbating revenue losses, he added.

However, the company secretary said they remain optimistic about the future.

As corrective measures, the company is considering addressing the L/C problem and working capital shortage through other banks instead of Social Islami Bank.

"We remain focused on addressing the challenges that have hindered our growth, particularly the successful completion of the expansion project."

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.