Regulatory lapses haunt nine NBFIs as liquidation looms

BABUL BARMAN AND MOHAMMAD MUFAZZAL

Published :

Updated :

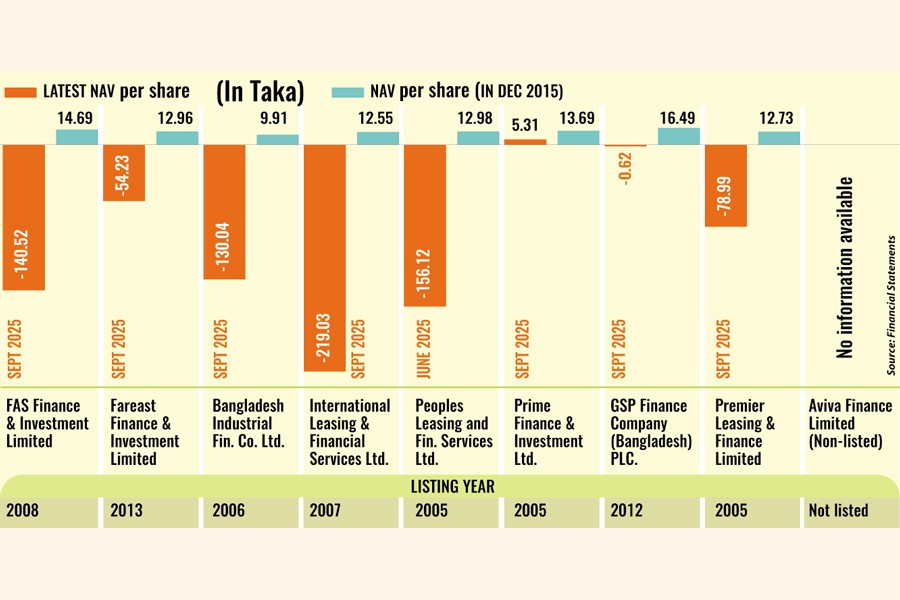

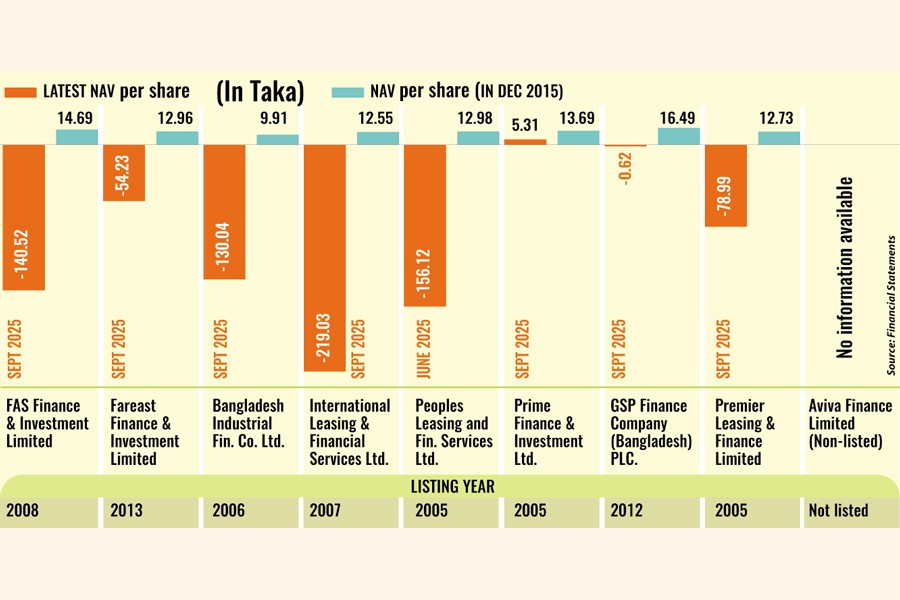

The nine non-bank financial institutions (NBFIs) now heading for liquidation under a Bangladesh Bank initiative were in good financial health even a decade ago.

Their condition has gradually eroded over the years due to irregularities, loan scams and mismanagement under the watch of regulatory bodies during the previous regime.

For instance, International Leasing, listed in 2007, performed well until 2015. It later fell victim to loan scams committed by Proshanta Kumar Halder, popularly known as PK Halder, and his associates, along with three other NBFIs.

A central bank investigation in 2019 revealed that PK Halder had siphoned off nearly Tk 10 billion from International Leasing alone by taking loans in the names of companies that existed only on paper. The amount now accounts for one-fourth of the company's existing non-performing loans.

With no interest paid on the bad loans, accumulated losses at International Leasing reached Tk 50 billion over the seven years through 2024.

So, when the central bank sees no option but to liquidate the NBFIs, it raises questions about whether regulatory intervention could have come earlier to the benefit of depositors and general shareholders.

"The financial distress is not sudden. The institutions have long been plagued by poor governance and unchecked irregularities," said Salim Afzal Shawon, head of research at BRAC EPL Stock Brokerage.

"Had action been taken earlier as per the regulatory rules, much of the current damage could have been prevented," he added.

Together, the nine NBFIs accounted for 52 per cent of total defaulted loans in the NBFI sector, estimated at around Tk 251 billion at the end of 2024.

Given the current financial condition, general investors have little to hope for, as they would come at the bottom of the repayment hierarchy, said Akramul Alam, head of research at Royal Capital.

Under liquidation rules, external creditors are paid first, followed by depositors, debenture holders and preferential shareholders.

Who is responsible?

There has been a collective failure of auditors, regulators - including the Bangladesh Bank and the Bangladesh Securities and Exchange Commission (BSEC) - and company management behind the collapse of the institutions.

Investors were misled by financial statements that concealed the true extent of defaulted loans.

"Auditors and credit rating agencies must be held accountable. Regulators, too, cannot avoid responsibility," said Mr Shawon of BRAC EPL.

Industry insiders also blame the central bank for approving faulty financial statements. In many cases, it set the amount of provisions the companies were required to maintain.

Bangladesh Bank spokesperson Arief Hossain Khan said the central bank was unable to ensure good governance due to political influence and regulatory limitations.

"Besides, many clients of the companies obtained court orders against being labelled as defaulters," Mr Khan said.

The companies that are going to be liquidated under the Bank Resolution Ordinance 2025 had also hidden the actual condition of their loan portfolios. The ordinance is the country's first comprehensive framework for resolving failing banks and non-banks.

The central bank has been emphasising the need to eliminate the culture of producing fabricated balance sheets, Mr Khan told The FE.

The incumbent top brass of the companies should bear in mind that they may meet the same fate as previous board members who scammed the organisations, he added.

The role of negative equity

Many NBFIs have subsidiaries, including brokerage firms and merchant banks.

Ahead of the 2010-11 stock market debacle, some NBFIs imprudently channelled funds to their subsidiaries, which were then disbursed as margin loans, often in violation of securities regulations.

At the time, capital market lenders were allowed to disburse loans at ratios such as 1:0.5 or 1:1. However, many market intermediaries provided loans at ratios of 1:5 or higher.

As a result, a large portion of NBFI funds was funnelled into margin lending. Following the market crash, those loans became unrecoverable.

Consequently, subsidiaries of several NBFIs topped the list of companies with negative equity.

"The disbursement of margin loans using NBFI funds is a major reason behind their present moribund state," said Asif Khan, chairman of EDGE Asset Management.

International Leasing Securities, a subsidiary of ILFS, had negative equity of Tk 3.05 billion while Prime Finance Capital, a subsidiary of PFIL, recorded negative equity of Tk 2.10 billion as of October last year, according to the securities regulator.

Cumulative effect

Bangladesh Bank's decision to wind up nine NBFIs marks the first such large-scale liquidation in the country's financial sector and aims to protect depositors and restore stability.

Bangladesh Bank Governor Ahsan H. Mansur confirmed that depositors would be paid before liquidation proceedings. He said the government has verbally approved about Tk 50 billion to repay depositors of the NBFIs.

According to central bank data, a total of Tk 153.70 billion in deposits belonging to individuals and institutions remains locked in the nine NBFIs.

"Depositors will get some of their money back," Mr Shawon said. However, how much of the deposits would be recovered remains unclear, he added.

Many listed companies and individuals placed deposits in these institutions long before their financial condition deteriorated. Some listed firms also invested in the scam-hit companies, creating a cumulative impact on the market.

For instance, the Investment Corporation of Bangladesh (ICB) invested in fixed deposit receipts (FDRs) with eight of the nine troubled NBFIs that are now under liquidation.

The move could deal another blow to the state-run investment bank, which is already struggling with deep losses from unyielding investments.

ICB invested around Tk 8 billion in the eight NBFIs.

ICB Managing Director Niranjan Chandra Debnath recently said the institution has not received any payments on FDRs from these troubled NBFIs since 2021.

The investments were made using taxpayers' money, and general investors of the investment bank are now set to bear the cost of those failed decisions.

In many cases, the failed NBFIs had deposited funds with one another, which were later lost to scams and fraud. For example, International Leasing holds FDRs worth Tk 1.33 billion in FAS Finance, Tk 1.40 billion in People's Leasing and Tk 528 million in Premier Leasing.

babulfexpress@gmail.com

mufazzal.fe@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.