Published :

Updated :

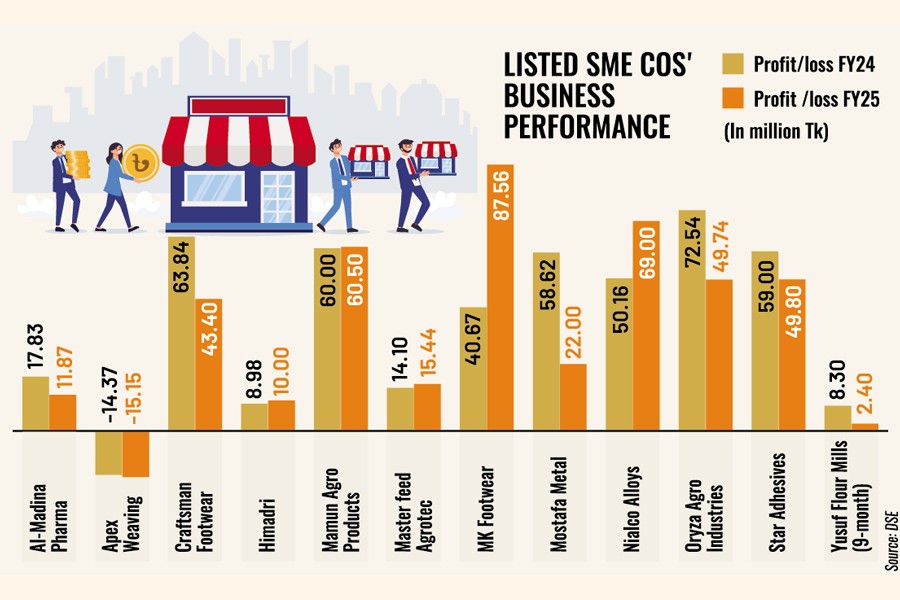

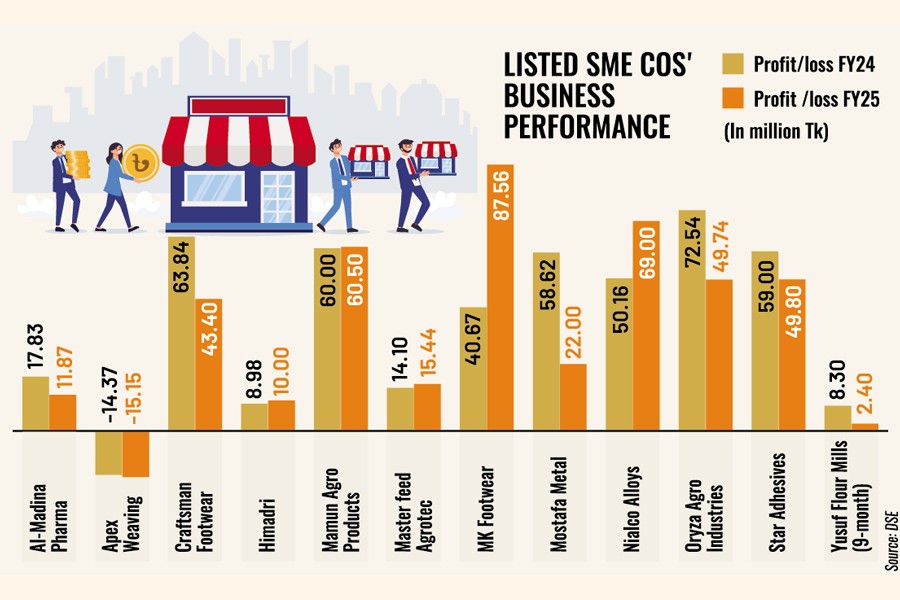

Most of the listed small and medium enterprises (SMEs) witnessed a year-on-year decline in profit in FY25, driven by higher business costs amidmacroeconomic challenges.

According to market analysts, overall economic activities remained subdued after the political shift last year that squeezed demand and impacted profitability of companies, including that of SMEs.

Apart from economic slowdown, factors such as high interest rate and political uncertainty led to shrinking corporate profitability.

"Business activities are yet to reach pre-July 2024 levels due to a cautious stance among businesspeople," said Md Akramul Alam, head of research at Royal Capital.

As the SME firms operate in diverse sectors, factors behind profit erosion vary significantly from one company to another. The firms in the businesses of poultry & fish feed, pharmaceuticals and PVC wood plastic doors experienced weak demand in the year, thanks to inflationary pressure and other macroeconomic challenges.

On the other hand, the firms in copper alloy business, footwear manufacturing and in cold storage business achieved an income growth in FY25 due to higher demand for their products.

Eleven companies listed on the SME board of the Dhaka bourse published annual financial results as of Tuesday. Six out of them saw their income erode between 16 per cent and 63 per cent year-on-year in FY25, including one remaining in the red.

Five other companies, however, secured profit growth by 1 per cent to 115 per cent.

The SME companies' combined profitsfell around 9 per cent year-on-year to Tk 404 million in FY25, according to financial disclosures.

Among them, Mostafa Metal Industries had the highest profit decline of 63 per cent year-on-year, as, according to the company, business was tougher in FY25 than before; production expenses had shot up in the year for rising input costs.

Mostafa Metal is a manufacturer of all kinds of Polyvinyl Chloride (PVC) and wood plastic composite (WPC) doors.

Company secretary Md Nazmul Islam said sluggish real estate sector coupled with lower public spending and demand had impacted bottom-line growth.

Due to the sharp profit erosion, Mostafa Metaldeclared only 1.5 per cent cash dividends for shareholders for the year.

Profit of Al-Madina Pharmaceuticals plunged 33 per cent year-on-year to Tk 11.83 million in FY25, as its sales dropped 25 per cent in the year amid higher borrowing costs.

The drug manufacturer's finance cost grew 8 per cent year-on-year as short-term loans jumped 18 per cent in FY25 compared to FY24.

Despite the profit drop, Al-Madina declared a 12 percent cash dividend for general shareholders and 1 percent cash dividend for sponsor-directors for FY25. It had paid 12 per cent cash dividends only to general shareholders for the year before.

Oryza Agro Industries, which manufactures and markets fish and poultry feed, also witnessed a 31 per cent year-on-year profit erosion in FY25. It had reported the highest annual profit among SME companies for the year before.

Company secretary Bayazied Hossain attributed the income de-growth to lower sales and higher costs, which compelled the company to cut its dividend to 1 per cent cash only to general shareholders for FY25 from 5 per cent cash dividends paid for FY24.

Another SME company --- Yusuf Flour Mills-is yet to disclose annual financial results for FY25. Its nine-month data has been taken into account to see how it has performed this year while its stock is the most expensive on the SME platform.

Yusuf Flour Mills' profit plunged 88 per cent year-on-year to Tk 2.4 million in the nine months through March due to lower sales.

The little-known company witnessed an abnormal stock price surge, reaching Tk 6,352 per share on June 30 last year. The stock has since plunged 65 per cent to Tk 2,200 per share on Tuesday.

On the other hand, MK Footwear posted the highest profit growth of 115 per cent year-on-year to Tk 87.66 million in FY25, driven by non-operating income and lower forex loss.

Its revenue grew only 1.05 per cent year-on-year to Tk 788 million while its non-operating income [realized gain from share sale] was Tk 64 million, leading to the profit hike.

MK Footwear is a 100 percent export-oriented company, producing all types of leather and synthetic footwear.

Profit of Nialco Alloys, a manufacturer of copper alloy products, jumped 38 per cent year-on-year to Tk 69 million in FY25, backed by higher sales and lower finance costs.

Nialco Alloys is also an export oriented company, sending products to Europe, Africa, and Japan.

"Notable increase in profitability was driven by improved revenue growth and reduced finance expenses," said the company, in its earnings note.

Its export revenue jumped 43 per cent year-on-year to Tk 1.04 billion in FY25, riding on high dollar-taka exchange rate while finance expenses were cut by 64 per cent to Tk 3 million.

The higher profit allowed Nialco to increase dividends to 10 per cent cash for FY25 from 6 percent cash paid for the previous year.

Himadri, which operates six potato cold storages in northern Bangladesh, posted a 5 per cent profit growth to Tk 10 million in FY25.

The company declared a 5 per cent cash dividend and 100 per cent stock dividends for the year, aiming to increase paid-up capital. Currently, its paid-up capital is Tk 26.25 million.

Himadri stock had skyrocketed to Tk 10,000 per share in November 2023, becoming the most expensive stock on the bourses, surpassing stocks of many fundamentally strong firms.

The stock of Himadrithen started falling in July last year after the regulator had penalized one individual investor and three firms for manipulating Himadri shares.

The stock closed at Tk 772 each share on Tuesday, losing 6.6 per cent over the previous day.

Amid the not-so-promising financial results of the SME firms, the board has been enduring a steady decline in the index.

Launched in September 2021with six companies and a base index of 1,000 points,it peaked at 2,244 points in August 2022 during a wave of speculative trading. The index has since been falling and closed at 939 points on Tuesday, losing 19 points from the day before.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.