Published :

Updated :

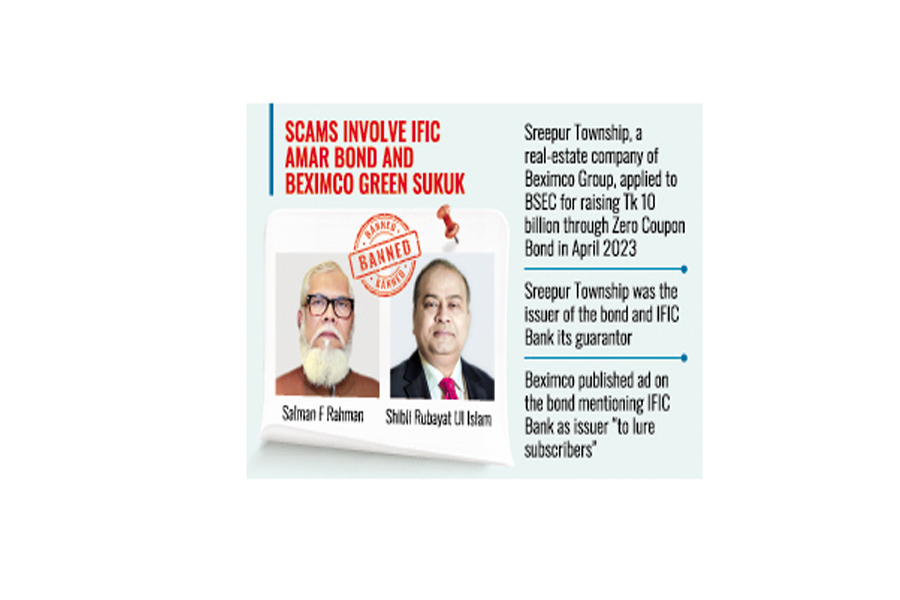

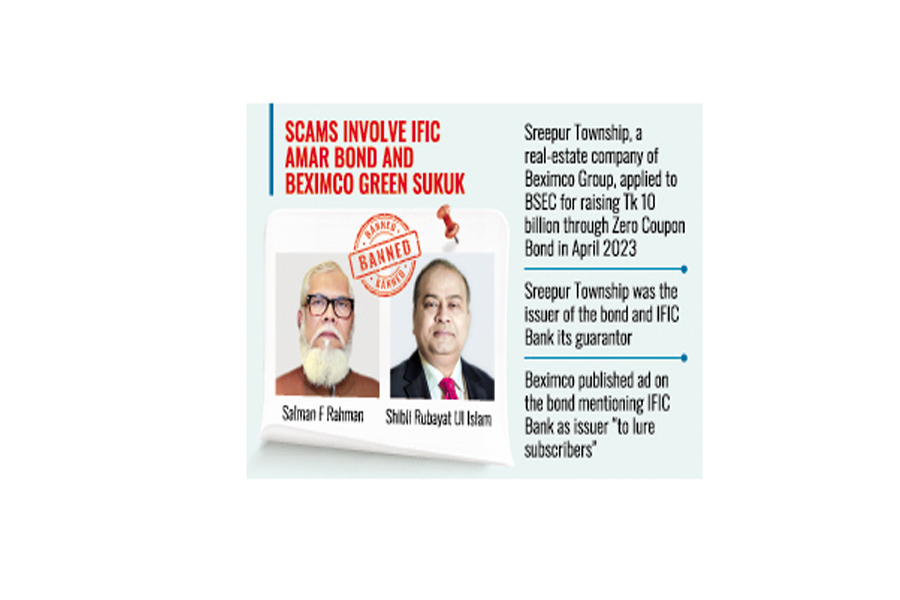

Embroiled Salman F Rahman of Beximco Group and his son and former chief of the securities regulator Shibli Rubayat Ul Islam are banned for life from bourses over bond scams.

Officials said Bangladesh Securities and Exchange Commission (BSEC) Tuesday made the decision making the trio persona non grata on the country's capital market as scams involving IFIC Amar Bond and BEXIMCO Green Sukuk-a neo-bond based on Islamic Sharia.

In a twin blow, the regulator also imposed large sums of pecuniary penalty on Rahman and his son Ahmed Shayan Fazlur Rahman. Some other punitive measures have also been against other individuals and companies having hands in the scams.

After the fall of the previous government on August 5, 2024 amid a student-mass upheaval, Rahman, former adviser to ousted Prime Minister Sheikh Hasina, was run in on August 13 of the year from the Sadarghat area of the capital, Dhaka, to stand trial.

The former chairman of BSEC, Shibli Rubayat Ul Islam, was arrested on February 4 in connection with cases filed by the Anti-Corruption Commission (ACC) on graft charges.

Both are now in jail.

Just after one month of its incorporation, Sreepur Township, a real-estate company of Beximco Group, applied to the securities regulator for raising a capital worth Tk 10 billion through Zero Coupon Bond in April 2023.

In fact, Sreepur Township was the issuer of the bond while the IFIC Bank was its guarantor.

But Beximco published an advertisement of the bond mentioning IFIC Bank as issuer "to allure subscribers", as charges read.

"Despite having gross violations, the securities regulator approved the proposal for raising the capital by Sreepur Township and investors were thus deceived," it is stated in the charges.

The paid-up capital of impugned Sreepur Township was Tk 3.35 billion and the company drew Tk 2.48 billion of such capital just after four days of deposition of the funds.

The spokesperson for the securities regulator, Md. Abul Kalam, said in fact they incorporated the company showing a paid-up capital brought from elsewhere for the time being.

"The regulator has banned Rahman and his allies for deceiving investors through unlawful activities," Kalam said.

Apart from ostracizing Salman F Rahman for life from bourses, the regulator imposed a penalty worth Tk 1.0 billion on him while his son, Shayan F Rahman, has to pay fines amounting to Tk 500 million along with banning him, too, for life.

Shibli Rubayat Ul Islam, the then BSEC chairman, has also been banned for life from the precincts of the capital market while the then commissioner Sheikh Shamsuddin Ahmed has been banned for five years.

Imran Ahmed, chief executive officer (ECO) of IFIC Investments which worked as arranger of the Sreepur Bond, is tabooed for five years, alongside taking a decision of enforcement action against Shah Alam Sarwar, the then managing director of IFIC Bank.

The BSEC also fined Emerging Credit Rating, which provided rating to the bond, Tk 1.0 million.

Furthermore, the regulator will issue warning letters to four of the then directors of the bank, namely ARM Nazmus Sakib, Md. Golam Mostafa, Md. Zafar Iqbal, Ms Qamrun Naher Ahmed and independent director Shudhangshu Shekhar Biswas.

In June 2021, the securities regulator had allowed Beximco to raise another substantial amount of capital worth Tk 30 billion through green- sukuk bond subject to some waivers from stipulated compliances in the rules.

But the commission approved the company's proposal and issued a letter of content before publishing a gazette on the waiver offered to Beximco.

The BSEC officials said the company in many cases took unfair measures to complete the subscription of the placements.

The subscription period of the IPO portion also was extension several times through September 2023 "in breach of the rules and regulations".

Of the king's ransom of Tk 30 billion, Tk 22.50 billion was raised through private placements while the remaining Tk 7.5 billion raised through IPO or initial public offering.

The regulator also will take measures against other individuals tied to the unlawful approval process for Beximco Green Sukuk Bond.

mufazzal.fe@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.