Published :

Updated :

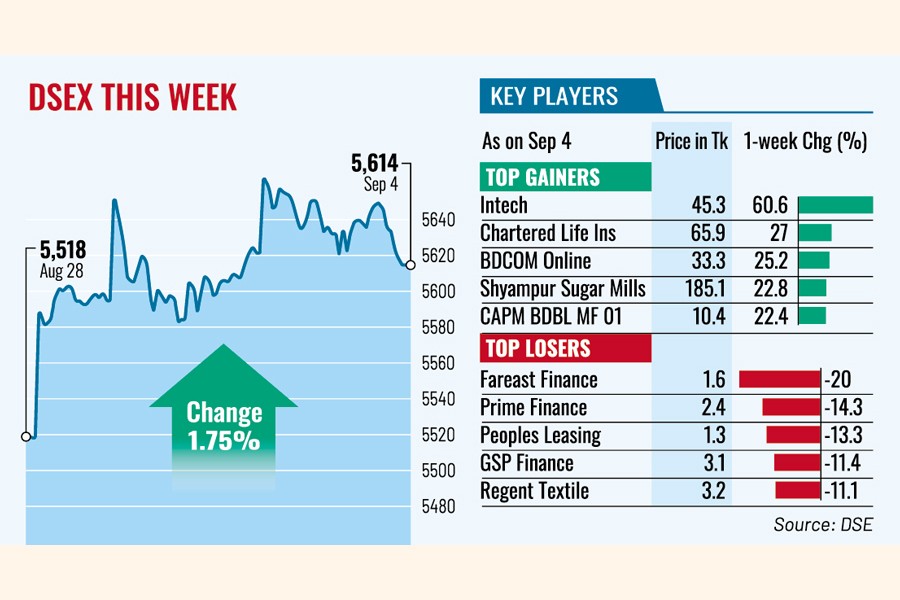

The benchmark index of Dhaka Stock Exchange (DSE) climbed past the 5,600-point mark this week for the first time in over a year, as investors' buying binge buoyed the equity market despite worries over political uncertainties.

The index rallied for the third straight week as investors, particularly high-net-worth individuals, intensified their buying in selective stocks, mainly blue chips seen as undervalued and promising amid improving economic indicators.

Market analysts attributed the rally to renewed investor optimism, bolstered by greater clarity on the upcoming election roadmap and stabilising macroeconomic conditions.

Declining interest rates on government securities also prompted a shift of funds toward the stock market, further fuelling the bullish sentiment, they said.

Currently, the current price-to-earnings (P/E) ratio of the market hovers around 10, which experts consider a sign of undervaluation, making equities an appealing option for both institutional and retail investors.

Meanwhile, the yield rates on government securities continued to decline over the past three months, signalling potential easing of interest rates in the money market.

Mohammad Rehan Kabir, head of Research at EBL Securities, in a statement this week, said Bangladesh's capital market is on the verge of a potential bull run, backed by improving macroeconomic indicators and growing investor confidence.

He drew comparisons with regional peers, noting how easing inflation and falling treasury yields in Pakistan and Sri Lanka had sparked strong rallies in their respective markets.

"The capital market of Bangladesh is well positioned to mirror the trends experienced in Pakistan and Sri Lanka, where easing inflation and declining treasury yields triggered strong market rallies," he added.

As a result, the opportunistic investors capitalised on the current rallies by reshuffling portfolios toward potential quick-gain opportunities.

This week, the market closed three sessions higher while two others ended marginally lower due to moderate profit-taking.

The DSEX, the benchmark index of the prime bourse, finally settled the week more than 96 points or 1.75 per cent higher at 5,614 points.

The prime index added 264 points in the past three consecutive weeks while the market-cap surged by Tk 162 billion during the time under review as heavyweight stocks saw prices soaring.

EBL Securities, in its weekly analysis, said that although the market began the week with bullish dominance, with strong buying interest witnessed in selective large-cap June-closing and bank stocks, market momentum oscillated between selective buying interest and profit-taking sentiment during the week.

The blue-chip DS30 index, a group of 30 prominent companies, also gained 26 points to close at 2,183 while the DSES index, which represents Shariah-based companies, rose 23 points to 1,230.

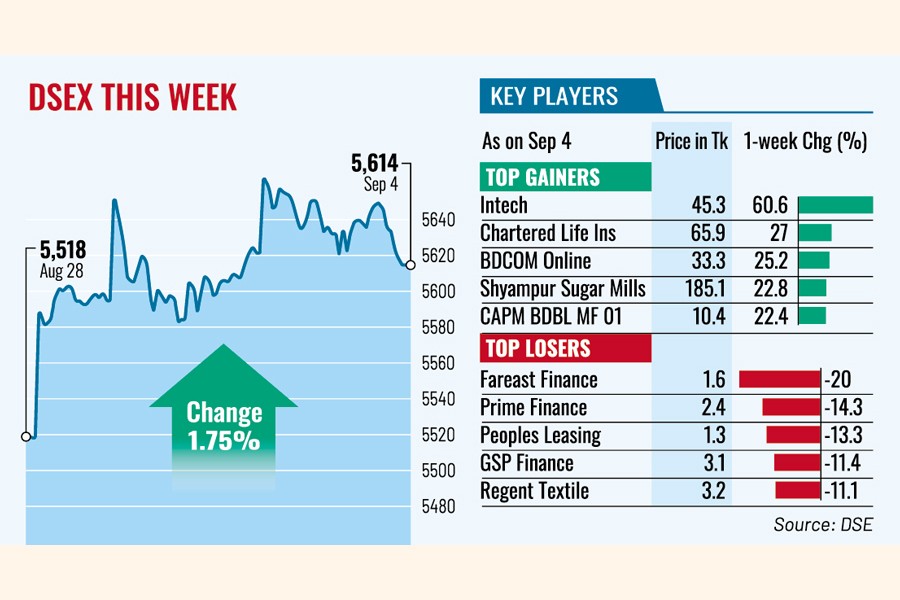

Price hike of selective well-performing stocks such as Walton, BRAC Bank, City Bank, Khan Brothers, and Prime Bank largely contributed to the index gain, as they jointly accounted for almost 38-point rise in the DSEX.

However, there is also a cause for concern, as shares of some low-performing companies also continued to surge, signalling potential market manipulation.

Four junk stocks -- Shyampur Sugar Mills, Generation Next Fashion, Bay Leasing and Aamra Technologies -- featured in the weeks' top 10 gainers' list, soaring between 20 and 23 per cent during the week.

Market participation remained robust as the total turnover reached Tk 64.92 billion as against Tk 57.30 billion in the week before.

Accordingly, the average daily turnover soared to Tk 12.98 billion, up more than 13 per cent from the previous week's average turnover of Tk 11.50 billion.

Investors were mostly active in the pharma sector, which accounted for 13 per cent of the week's total turnover, followed by banking (12 per cent) and textile sector (11 per cent).

Gainers took a strong lead over losers, as out of the 391 issues traded, 243 ended higher, 126 closed lower and 22 remained unchanged on the Dhaka bourse.

Major sectors posted gains, with the IT sector booking the highest gain of 11.7 per cent, followed by life insurance, power engineering, NBFI, banking, and telecom.

City Bank became the most-traded stocks, with shares worth Tk 2.07 billion changing hands, closely followed by Orion Infusion, Lovello Ice-cream, Khan Brothers PP Woven Bag Industries and BRAC Bank.

The Chittagong Stock Exchange also ended higher, with its All Shares Price Index (CASPI) rising 345 points to 15,702, while the Selective Categories Index (CSCX) gained 205 points to 9,650.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.