Published :

Updated :

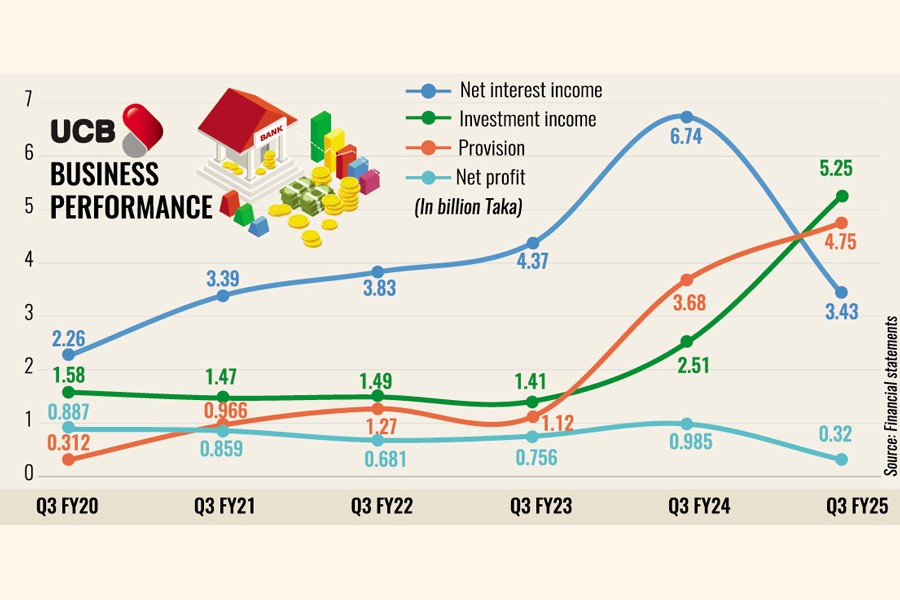

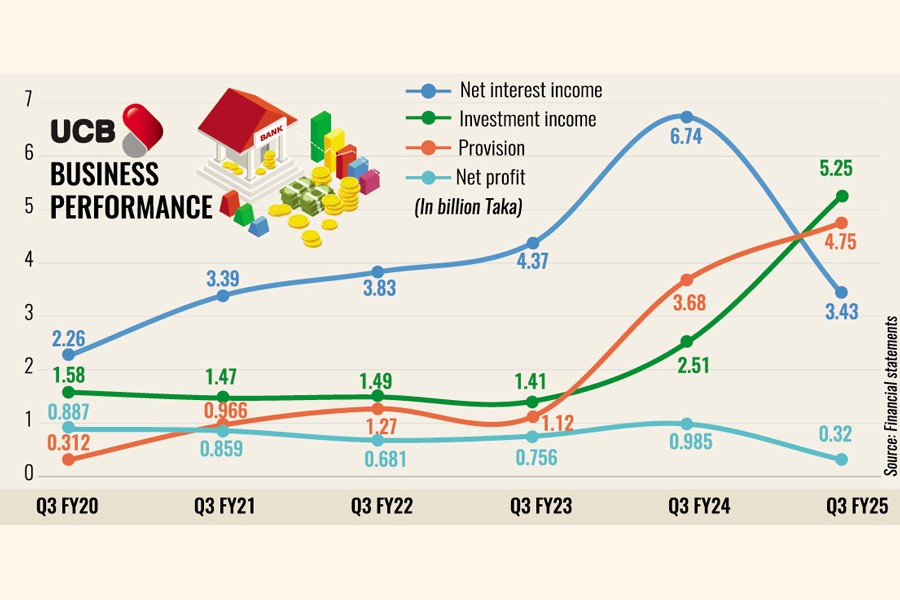

United Commercial Bank's profit plunged 68 per cent year-on-year to Tk 320 million in the third quarter to September this year as provision on default loans escalated.

Bad loans that the bank had tucked away until the political changeover in August last year and the subsequent restructuring of the bank board had to be disclosed in regulatory actions to discipline the financial sector. That led to provisions soaring on loans and advances by 29 per cent year-on-year to Tk 4.75 billion in the July-September quarter this year.

The previous board was heavily influenced by the family of Awami League lawmaker and former land minister Saifuzzaman Chowdhury.

As the previous government fell, the central bank under new leadership took a stringent policy on non-performing loans, forcing banks to reveal their actual position in terms of bad loans, which increased provision requirements.

The bank's interest income grew less than 2 per cent year-on-year, while interest payment on deposits and borrowing jumped 38 per cent year-on-year in the quarter. Hence, net interest income fell drastically - by 49 per cent to Tk 3.43 billion - in the quarter.

Only investment income, particularly from government securities, surged 104 per cent to Tk 5.25 billion, which helped keep earnings in the green zone. But higher provisioning stemmed the growth of profits.

The bank's nine-month profit also tumbled nearly 98 per cent year-on-year, mainly due to increased interest payment on deposits and borrowing.

The net operating cash flow per share, a measure of a company's ability to generate cash from its operations, however, turned positive - Tk 11.89 for January-September this year - from Tk 6.55 in the negative for the same period last year.

The bank's deposits grew 18 per cent year-on-year to Tk 653 billion, while the loan portfolio increased nearly 9 per cent year-on-year to Tk 630 billion in the nine months through September this year.

Its NPL ratio to outstanding loans is 14 per cent as of June this year.

UCB looks to return to sustainable profitability as it takes steps to improve governance, recover loans, and enhance asset quality under the new leadership, said Mohammad Mamdudur Rashid, managing director and CEO of the bank, in a recent interview with the FE.

Annual performance

The gloomy third-quarter results follow an already turbulent 2024 for the bank, when its annual profit plunged 96 per cent year-on-year to only Tk 80 million. The bank could not recommend any dividend for 2024 due to a significant provision shortfall.

The bank had paid 5 per cent cash and 5 per cent stock dividends for 2023.

A sharp decline in annual profit and the failure to meet the required provision under Bangladesh Bank's latest policy were the main reasons behind zero dividends for 2024.

As per the central bank's latest guidelines, banks are barred from declaring dividends for 2024 onwards if they fail to maintain adequate provisions for loans or have taken deferral facilities.

According to the auditor's report, the bank disbursed loans and advances worth Tk 527.82 billion as of 2024. Of the amount, loans amounting to Tk 85.34 billion turned sour. The bank made Tk 27 billion provision against the required provision of Tk 60.55 billion, leading to a shortfall of Tk 33.49 billion in 2024.

Loans disbursed during the tenure of the Awami League government are increasingly becoming defaulted, particularly those linked to influential businessmen who were close to the ousted regime.

At the same time, the overall economic slowdown and changes in loan classification policies after the political changeover have added to the sharp rise in bad loans.

The total volume of defaulted loans in the banking sector soared to Tk 5.30 trillion up until June this year, which is 27 per cent of total loans disbursed in the sector.

NRB Bank sinks into the red

NRB Bank sank into the red, with losses amounting to Tk 535 million in the July-September quarter this year, while it had reported a profit of Tk 86 million for the same quarter last year.

Its net interest margin turned negative due to higher interest payment on deposits and borrowing.

The lender also had to keep huge amounts of provisions for bad loans that were not maintained properly previously.

The bank's interest income stood at Tk 1.84 billion in July-September, while interest payment was Tk 1.92 billion, leading to a net interest income of Tk 75 million in the negative.

Meanwhile, total provision on loans and advances skyrocketed more than threefold year-on-year to Tk 890 million in the quarter to September.

babulfexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.