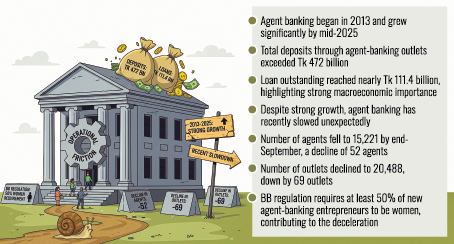

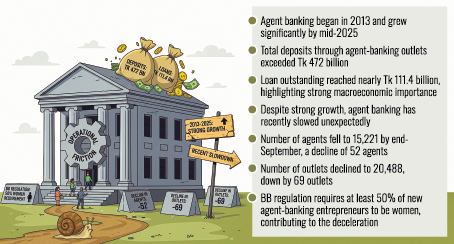

Agent banking expansion slows down amid regulatory intervention

High-street bankers feel difficult to meet 50-percent women entrepreneurship

Published :

Updated :

Agent banking has woven one of Bangladesh's quiet financial success stories. The pivot aims at extending high-street banking services to underserved, mostly women and geographically remote populations, as the model rapidly became a critical conduit for rural savings mobilisation, remittance inflow, and grassroots-level liquidity.

Beginning in 2013, by mid-2025, agent-banking outlets had total deposits balance exceeding Tk 472 billion and loan outstanding worth nearly Tk 111.4 billion-figures that underscore their growing financial and macroeconomic relevance.

Yet, despite these impressive aggregates, the growing agent banking has recently got into an unexpected slowdown.

The number of agents squeezed to 15,221 at the end of September last-down by 52, instead of expanding. Similarly, the number of outlets also shrank during the period to 20488 or down by 69 outlets, official data showed.

The number of agent-banking agents and outlets had declined on both a year-on-year and quarter-on-quarter bases, reversing a long trend of steady expansion.

At the centre of this deceleration lies a new regulatory intervention: the Bangladesh Bank-set requirement that at least 50 per cent of new agent-banking entrepreneurs be women.

The policy, aimed at boosting female participation in financial intermediation and entrepreneurship, reflects broader national and global sustainable commitments to gender inclusion.

However, early evidence suggests that its implementation has introduced frictions that may be constraining growth in a sector that plays a vital role in the country's' financial inclusion.

As of September 2025, some 30 commercial banks operating through agent-banking channels had mobilised Tk 472 billion in deposits, a substantial share of which originated in rural and semi-urban areas.

Net remittance inflows through agent outlets only in July-September quarter stood at Tk 81.513 billion, underscoring the model's importance in connecting migrant income with local economies.

The agent model's success lies in its hybrid structure: regulated banks leverage third-party entrepreneurs to deliver services such as deposits, small loans, remittance payments, utility bill collection, and social safety-net transfers. This arrangement allows banks to expand reach without the heavy fixed costs of brick-and-mortar branches.

In March 2025, Bangladesh Bank governor Dr Ahsan H. Mansur announced that going forward, at least half of new agent-banking representatives must be women. The central bank formalised this requirement through a circular issued in May.

From a policy perspective, the rationale is compelling. Women remain underrepresented in formal financial intermediation, both as service providers and as entrepreneurs.

By mandating female participation at the agent level, regulators hope to create role models, generate employment, and improve women's access to and trust in banking services-particularly in conservative rural settings where women often feel more comfortable transacting with female agents as many pious Muslim avoid male-dominated branches.

However, the timing and design of the mandate have sparked debate within the banking industry.

Several bankers point to the announcement of the gender mandate itself as a turning point, noting that expansion momentum weakened soon after March.

Executives involved in agent-banking operations highlight a gap between regulatory intent and rural realities. Agent banking is a technology-driven business, requiring digital literacy, familiarity with core banking systems, compliance protocols, and customer-service standards.

In many rural areas, especially outside peri-urban growth centres, the pool of women with the requisite skills and entrepreneurial readiness remains limited.

"This is a technology-driven business, and most rural women have yet to acquire the necessary skills," says a senior executive of a private commercial bank engaged in agent banking. Another banker notes that while women are increasingly active in microfinance and small trade, running an agent outlet involves operational complexities that differ significantly from traditional informal businesses.

Banks also report unintended behavioural responses. In some cases, male entrepreneurs have sought licences in their wives' names to scale regulatory criteria even though the day-to-day operations are handled by men.

Regulators have tightened scrutiny to prevent such proxy arrangements, but the heightened compliance burden has further slowed onboarding.

The agent bankers warn that a sustained contraction in this digital mode of banking could undermine progress in formalising rural finance. Agent outlets often serve as the first-and sometimes only-point of contact between rural households and the formal banking system. A reduction in outlets may increase travel costs, discourage small depositors, and push some transactions back into cash-based or informal channels.

Moreover, agent banking has become a critical delivery mechanism for government social safety-net programmes. Any disruption to coverage risks affecting beneficiaries who depend on timely payments for subsistence.

Few in the banking industry dispute the importance of increasing women's participation. The debate centres on sequencing and support mechanisms. Many bankers argue that a rigid quota, applied without parallel investments in training, digital literacy, and financing support for women entrepreneurs, risks slowing sectoral growth.

A more phased approach-such as gradually increasing female- participation targets, offering regulatory incentives, or co-investing in capacity-building programmes-could yield more sustainable results.

Others suggest leveraging the large pool of educated rural youth, including women, through targeted training partnerships involving banks, NGOs, and fintech providers.

Agent banking stands at a critical juncture. Its rapid expansion has delivered measurable benefits in deposit mobilisation, remittance flow, and rural liquidity. At the same time, the push for gender inclusion reflects a necessary and overdue policy priority.

The challenge for regulators is to balance these objectives without sacrificing momentum. If supported by skills development, access to finance, and realistic transition timelines, the 50-percent women-entrepreneur mandate could ultimately strengthen the sector.

Without such support on the cusp of transition, however, there is a risk that a well-intentioned reform may temporarily blunt one of Bangladesh's most effective tools for financial inclusion. How policymakers navigate this trade-off will shape not only the future of agent banking but also the broader trajectory of inclusive growth in the rural economy.

jasimharoon@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.