Published :

Updated :

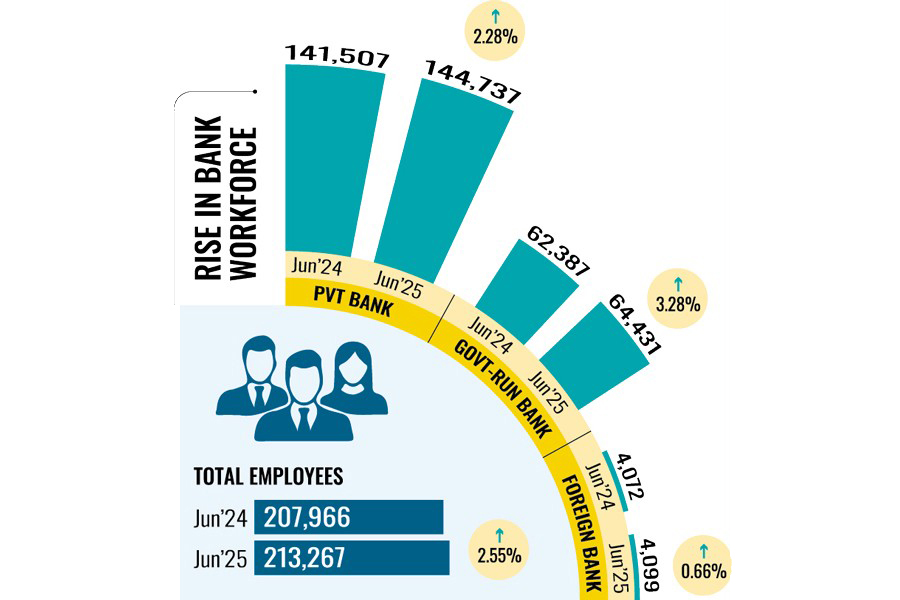

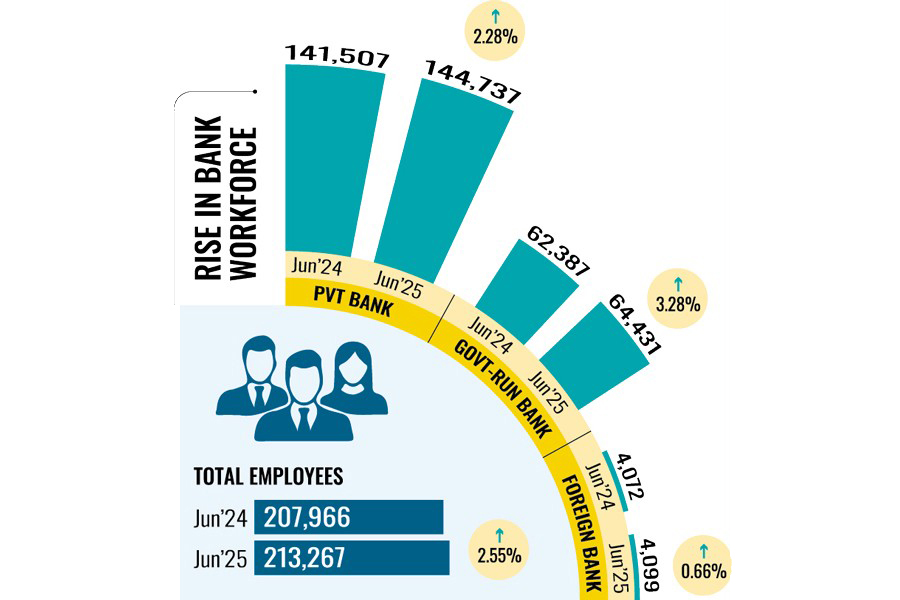

The number of bank employees rose by 2.55 per cent year on year in June 2025, according to a latest Bangladesh Bank report, reflecting continued expansion of the key financial sector.

The total workforce across the country's 61 high-street banks stood at 213,267 in June 2025, up by 5,301 from the same month a year earlier.

Of them, men accounted for more than 83.0 per cent or 177,485, while women represented just over 16.0 per cent, highlighting the persistent gender gap in the industry despite growing calls for greater female participation in formal jobs.

A total of 43 private commercial banks remained the dominant employers, hiring 144,737 workers or nearly 68 per cent of the total workforce.

The six state-owned commercial banks employed 52,438, while the three specialised ones collectively had 11,993 staff members.

Nine foreign banks operating in the country accounted for a modest share of the workforce, employing 4,099 people.

In contrast, formerly the non-bank financial institution (NBFI) sector - comprising 35 finance companies - saw a decline in staffing levels.

The number of employees in such companies fell by 4.0 per cent year-on-year, dropping to 6,362 in June 2025, down by 272 from the same month last year.

Bankers familiar with the development say this reflects tighter margins and consolidation in the sector, which has been facing mounting stress due to liquidity shortages and weak investor confidence.

They say the steady growth in bank employment comes at a time when agent banking and mobile financial services are expanding rapidly.

"While technology is changing the way banks operate, the demand for skilled professionals in compliance, IT security, and customer services is keeping the overall employment growth positive," a senior official working at a reputed private commercial bank tells The Financial Express.

He says there may be a push after the establishment of digital banks, which is in the process, although they will all be technical employees.

The impacts of the recent retrenchment at an Islamic bank will be reflected later, he adds.

jasimharoon@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.