Published :

Updated :

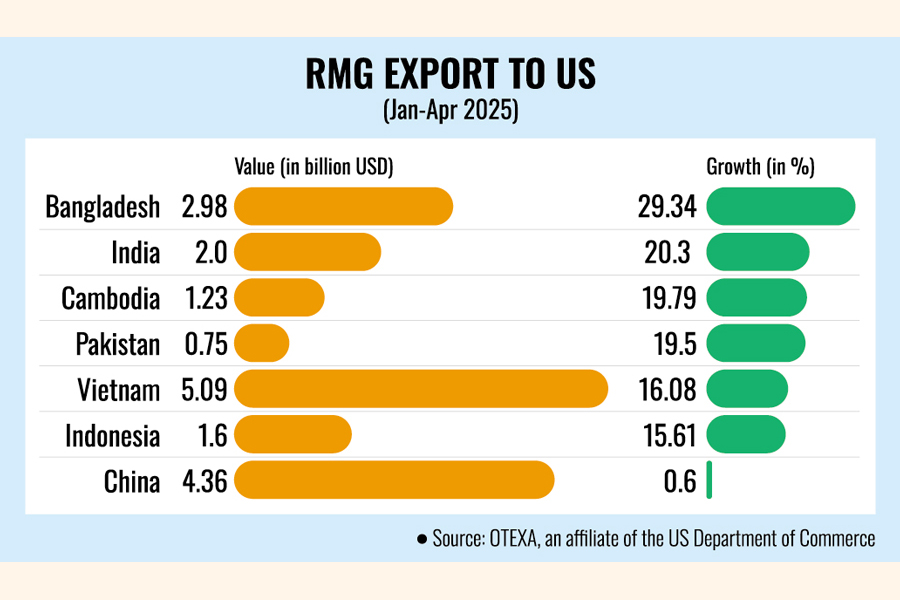

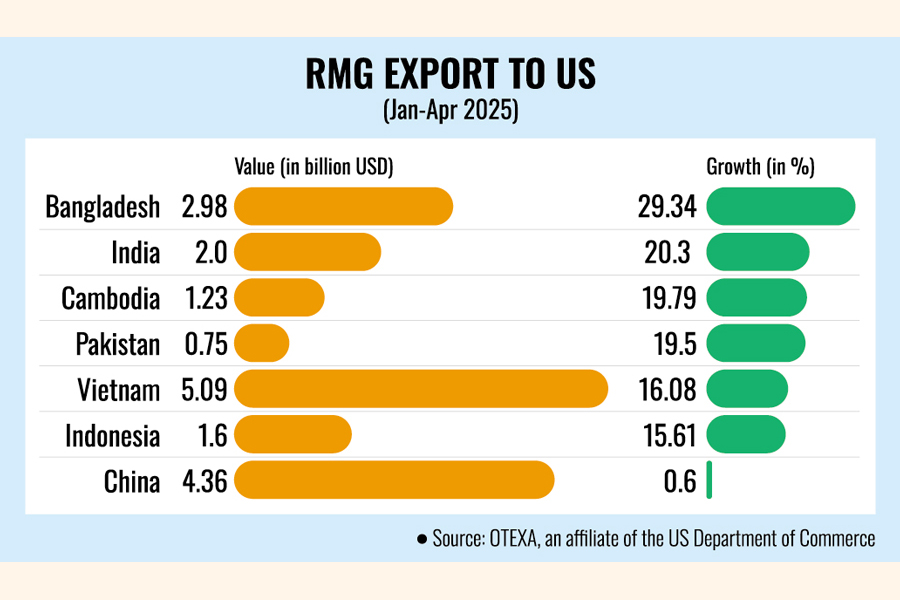

Bangladesh emerged as the fastest-growing apparel exporter to the United States with the highest 29.34-percent year-on-year growth among its major peers during the first four months of 2025.

The export of readymade garments from Bangladesh during the January- April period fetched US$2.98 billion, against US$2.31 billion in the same period of 2024, according to the data released on June 05 by OTEXA, an affiliate of the US Department of Commerce.

The growth rate also surpassed the global average growth of 10.67 per cent, placing Bangladesh ahead of main competitors like Vietnam, India and Cambodia on the US market.

US's overall apparel imports during January to April 2025 stood at US$26.22 billion, up from $23.69 billion in the corresponding period the last year.

The rise reflects improved consumer demand and the ongoing recalibration of supply chains, particularly in response to trade and tariff shifts involving China.

Vietnam, which overtook China in March 2025 to become leading apparel exporter to the US, kept its position in April as US imports from China during the period fell sharply.

Vietnam shipped RMG items worth US$5.09 billion, accounting for a 16.08- percent growth.

China remained in the second position with US$4.36 billion worth of RMG shipments with a meagre 0.6-percent year-on-year growth highlighting the effects of renewed tariff barriers and ongoing geopolitical tensions.

Talking to the FE, Fazlul Hoque, former president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), termed the growth good.

Responding to a question, he said it would take some more months or August onwards to understand the US new tariff regime's impact, saying that there is on average a 50:50 arrangement between most US buyers and local exporters that each of them would share half of the additional 10-percent duty burden for the interim period.

Exporters opine that the overall work-order situation is good despite some disruption in backward-linkage suppliers due to gas crisis.

According to the OTEXA data, China started the year with strong export performance as in January US imports of Chinese apparel reached US$1.60 billion in a 13.6-percent increase compared to the same month in 2024 while February recorded 3.0-percent growth.

In March, however, the momentum reversed with US imports falling 8.9 per cent year on year to US$826.7 million. The decline deepened in April, when imports dropped by a further 13.3 per cent to US$760.7 million.

In contrast, Vietnam demonstrated consistent and accelerating growth throughout the first four months of the year.

Vietnam's apparel exports to the US in January rose 19.8 per cent, February with modest at 2.2 per cent but in March and April recorded 20.2-percent and 23.3-percent growth respectively.

India's apparel exports rose by 20.3 per cent to US$2 billion during the January-to-April period.

Indonesia recorded a 15.61-percent increase in apparel shipments to US$1.6 billion, continuing its steady growth as a supplier to the US market.

Cambodia witnessed 19.79-percent rise in exports, reaching US$1.23 billion, during the period under consideration.

Pakistan also recorded a growth of 19.5 per cent to bag US $750 million from the US market.

Munni_fe@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.