SLOW PUBLIC-SECTOR DEV PROJECTS, BUSINESS SLUGGISHNESS

Building-material makers seem in tailspin

Steelmakers say 40pc mills suspend operations for demand slump

Published :

Updated :

Building-material manufacturers continue to struggle amid lower demand from public-sector development projects and private-sector business sluggishness, insiders say.

They have said demands for key construction materials like rod, cement, brick and the like have plummeted in the recent times both in public and private sectors.

They attribute the demand drops principally to dull economic condition, political uncertainty, limited adoption of development projects, and delay in already-taken projects' implementation.

As a result, manufacturers are now walking tightrope as they operate with limited or barely any profit margin to cope with the situation and wait better luck to come.

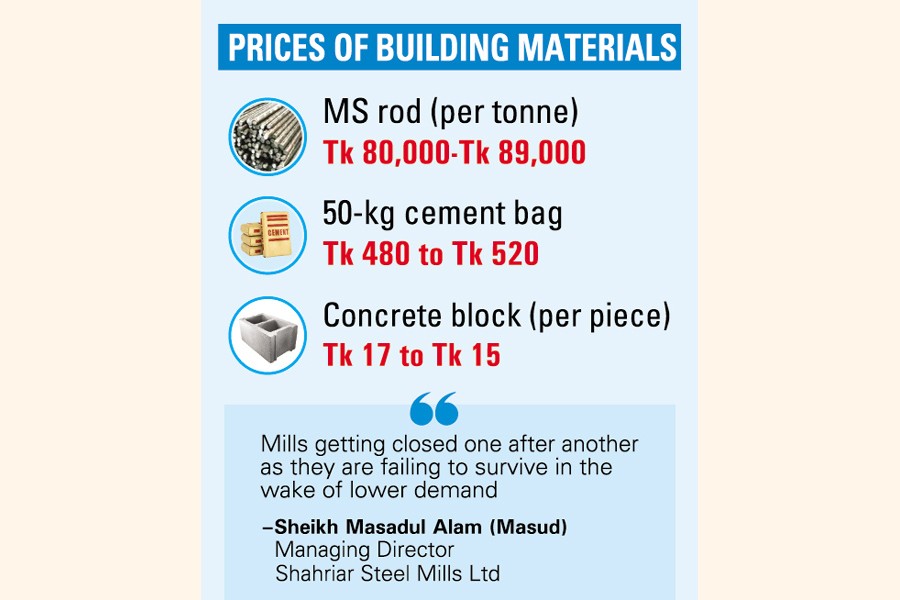

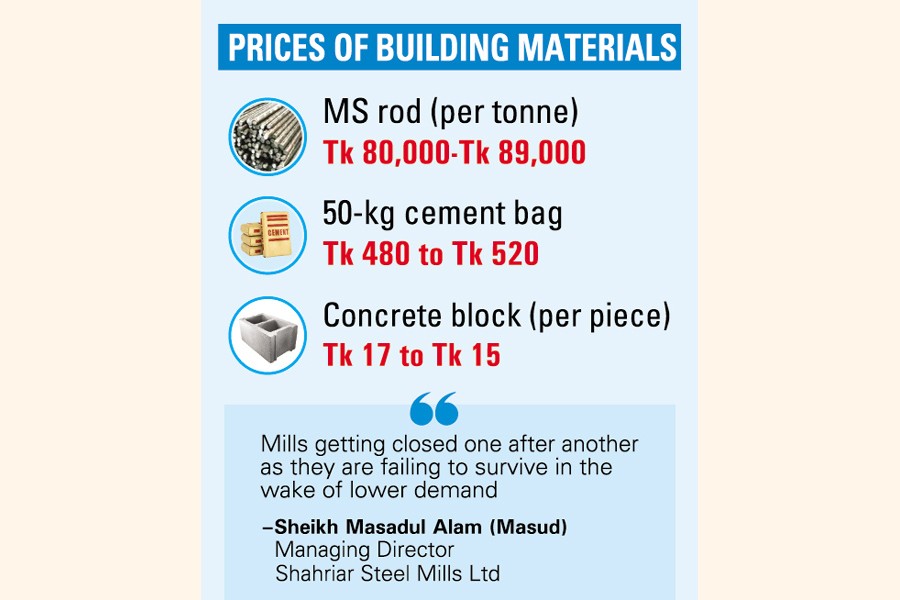

According to data available with the retail market, price of per-tonne mild steel (MS) rod was fluctuating between Tk 80,000 and Tk 89,000 based on brands in different trade houses in the recent days.

The price is a bit lower by Tk 1,000 to Tk 2,000 per tonne than that reported in March this year.

According to data available with the Trading Corporation of Bangladesh (TCB), per-tonne 60-grade ms rod was selling between Tk 83,500 and Tk 87,000 Wednesday. The price was 3.4- percent lower than what was a month ago and 13.45-percent lower than that a year ago.

Contacted, Managing Director of Shahriar Steel Mills Ltd (SSRM) Sheikh Masadul Alam (Masud) said mills were closing one after another as they are failing to survive in the wake of lower demand.

"There has been a slowdown for the last four years as number of development projects gradually got lowered down during the last regime," he said, adding that such trend is continuing.

Not only rod manufacturers--many other industries are now going through tough times as a sense of political uncertainty prevails in the country, he notes.

"Banks have become conservative in dealing with the manufacturers to provide cash as they are struggling," he said, adding that lower trend in investment is also hurting all the other allied industries.

Mr Masud, also former chairman of Bangladesh Steel Manufacturers Association (BSMA), estimates that nearly 40 per cent of the mills have suspended operations.

According to sources, Bangladesh is largely dependent on import of raw materials like scrap metal. Per-tonne scrap metal sells between $380 and $400.

Similar to ms rod, the price of another key building material, cement, also declined slightly by Tk 10 to Tk 30 per bag of different brands from rates in March this year.

According to retail-market data, per-bag 50-kg cement has been selling at Tk 480 to Tk 520 in the recent times.

As per information available with the Bangladesh Cement Manufacturers Association (BCMA), the sector, comprising 40 companies, has witnessed de-growth since 2022.

Chief Business Officer of Metrocem Cement Asadul Haque Sufyani says cement production has come down to lower than half of the country's total capacity of around 88 million tonnes, indicating a tough situation.

"Cement-makers can neither increase the price in tune with rational level nor can they suspend operations as they have made huge investment considering the potential," he told The Financial Express, adding that many companies are now struggling to maintain their working capital.

The growth of construction-material-manufacturing sector is directly linked to the country's economy or GDP growth, he said, highlighting the importance.

Despite the cement-makers' plea, he rues, the government has raised some taxes for the sector in the budget for the running fiscal year. He thinks the current government is also less-focused on undertaking development projects.

Sources have said the main consumers of the building materials are government-funded infrastructure-development projects and housing sector-and they are going dull.

President of Bangladesh Concrete Blocks Prostutkarak Malik Somite Shakhawat Hossain says due to lower demand a number of operators have to halve their production, leading to higher operational cost and lower profit margin.

"We also have to lower the rational price of a concrete block from Tk 17 to Tk 15 to survive until the good days come back."

saif.febd@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.