Capital-machinery import rebounding from slump

Overall import orders also see upswing on forex stability

Published :

Updated :

Capital-machinery import rebounds into positive trajectory from a slump, indicating some acceleration in the economy after months of sluggishness Bangladesh had witnessed following disruptions.

In sync with the upturn in import of capital machinery, the country sees a sharp growth in the overall import orders in recent times on the back of some pivots.

The import is spurred basically by a positive vibe on availability of foreign currencies, persisting stability in the exchange rate and the rollout of national budget after the monsoon, according to officials and money-market experts.

Businesses, however, think a bit different. They say the sluggishness in the economic activities still persists, hurting business expansion and employment badly.

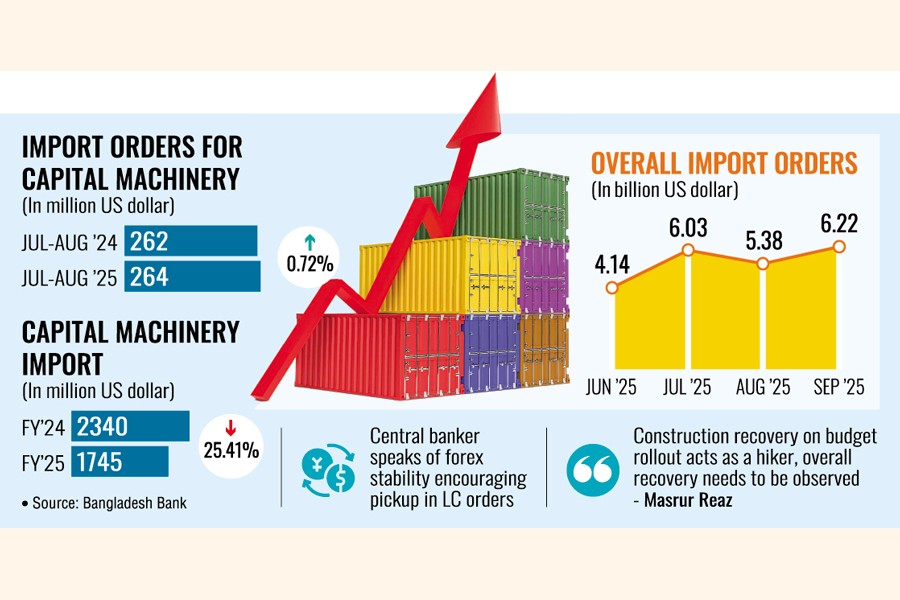

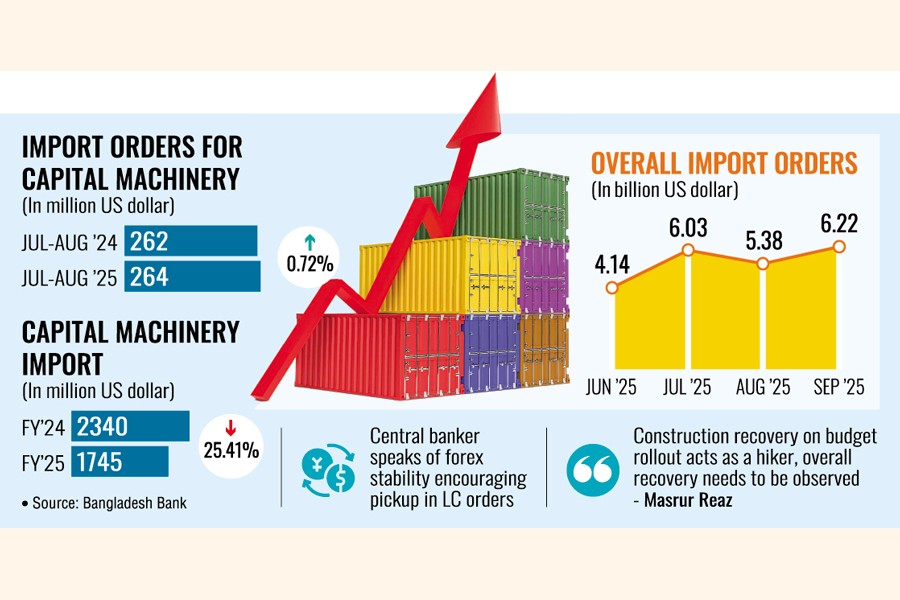

According to the data with Bangladesh Bank (BB), the import of capital machinery grew by 0.72 per cent in the first two months (July-August) of the current fiscal year (FY'26). Orders for the import of capital machinery amounted to US$264 million during July-August. But the value was recorded $262 million in the same period of time a year ago.

In fact, the capital-machinery import plummeted by 25.41 per cent in the FY'25 to $1745 million (1.745 billion) from FY'24 ($2340 million), according to the central bank data.

Executive director at the BB Dr Md Ezazul Islam has said the country sees a significant rise in import orders, in what is seen as an early indication of economic rebound after months of recession.

"The inflow of foreign currencies continues rising in recent months mainly because of significant growth in remittance. This upturn bolsters the country's foreign-exchange reserves," he told The Financial Express about the improvements in macroeconomic parameters.

Because of the steady rise in forex reserves, the central banker says, the commercial banks are not showing any reluctance to open LCs for the import of all goods on demand.

"It clearly indicates that the economic activities rebound slowly," says Dr Ezazul, who leads the monetary policy department of the banking regulator.

The BB data also showed that the opening of fresh LCs, generally known as import orders, increased over 13 per cent to US$6.22 billion in September from the August count of $5.38 billion.

The value of import orders was $6.03 billion in July and $4.14 billion in June of this year, according to the official data.

President of Bangladesh Chamber of Industries Anwar-ul Alam Chowdhury says the import of capital machinery normally ranges in- between $2.50 billion and $3.0 billion per year.

"Now, it drops to less than $1.0 billion. It means the industrial growth is not happening. Just industrial servicing is going on," the private-sector leader told the FE.

He also mentions that the private-sector-credit growth dropped to 6.35 per cent in August last--the lowest in the country's history. "The reality is industries are going out of business because of the prevailing anti-business climate."

Managing director and chief executive officer of Mutual Trust bank (MTB) PLC Syed Mahbubur Rahman says there is no problem regarding the availability of the US dollar in particular because of growing inflow of foreign currencies.

On the other hand, the taka-dollar exchange remains stable in recent months. "These factors have basically fuelled up the imports in very recent months. It may go up further after the upcoming general election," the seasoned banker says.

Chairman of Policy Exchange Bangladesh Dr M Masrur Reaz sees the economy activities accelerating slightly because of a bit of vibrancy in the construction sector as the national budget for FY'26 has started rolling out.

Simultaneously, he says, major portion of the FDI or foreign direct investment reinvested into the economy to expand their capacity, which might be reflected in the scenario.

"It's too early to say economic rebound because intermediate goods and exports took a dip in recent months. I think we need to wait couple of months more to see the trend," the economist says, on a cautious note.

jubairfe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.