Calm comes after the forex storm

Dollar little cheaper for importers

Market-driven exchange regime also revamps interbank transactions

Published :

Updated :

A relative calm appears after the storm on Bangladesh's forex market as exchange rate for importers fell slightly Tuesday while interbank transactions also saw a revamp, bankers said.

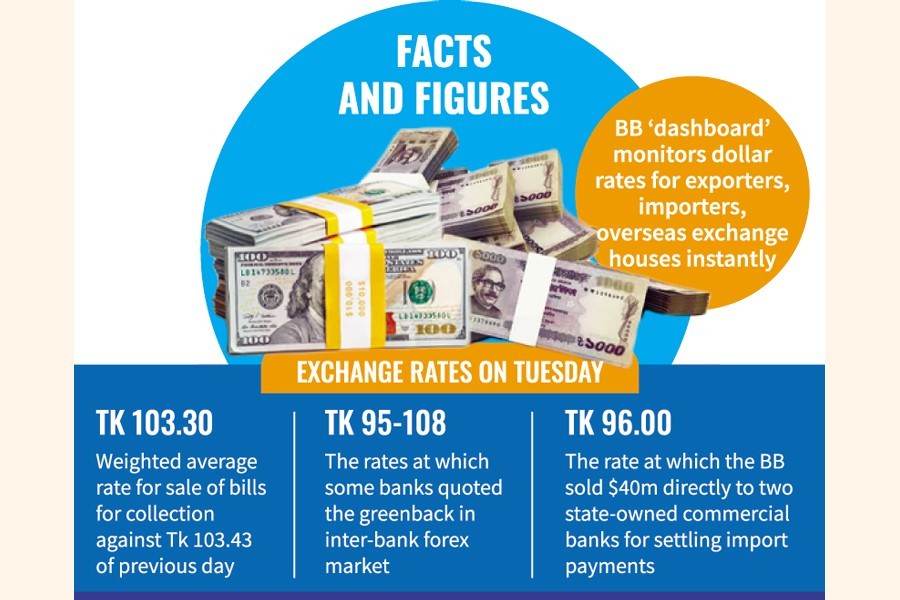

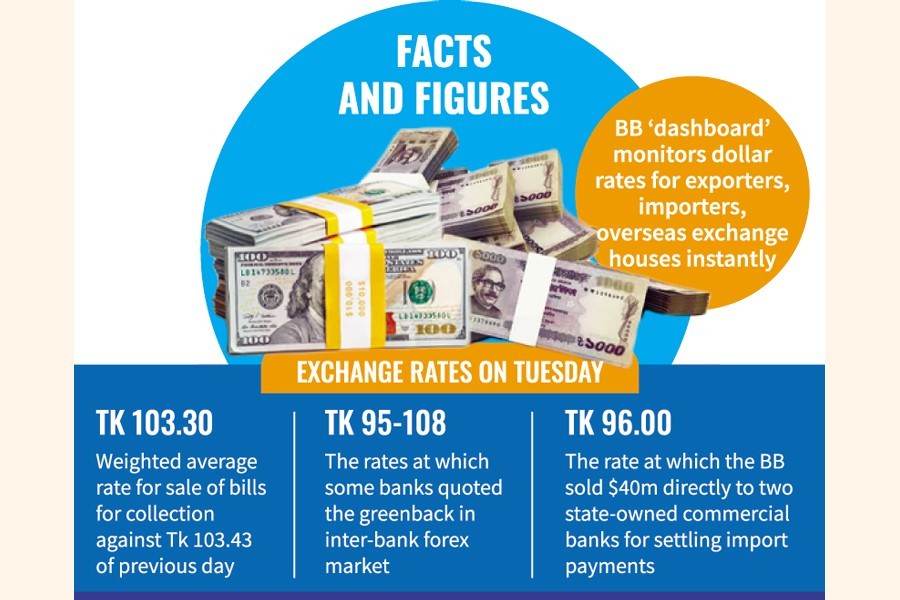

The central bank has already intensified monitoring on the foreign-exchange (forex) market using its 'dashboard' to known about the rates for exporters, importers and the overseas exchange houses instantly.

"We'll act considering the market's latest situation," a senior official of the Bangladesh Bank (BB) told the FE about the market-driven exchange regime broached by bankers as a panacea for treating forex volatility.

He wouldn't elaborate.

Earlier on February12, 2013, the central bank launched an electronic system-generally known as 'dashboard'-for monitoring all kinds of foreign-exchange transactions to check fraud and forgery in the country's banking sector.

The dashboard provides information on different modes of foreign-exchange transactions, including on summary of exports, imports and inland back-to-back letters of credit (LCs) separately.

The weighted average rate for the sale of bills for collection, better known as BC, for settling import payments stood at Tk 103.30 on the day against Tk 103.43 of the previous working day, according to the Bangladesh Foreign Exchange Dealers' Association (BAFEDA)'s latest monitoring report.

The BEFEDA calculated the weighted-average rate considering the exchange houses and the exporters' rates offered by 51 banks out of its 55 member-banks until 4:00 pm on the day (Tuesday).

"Lower weighted-average rate for BC selling indicates that the ongoing situation on the foreign-exchange market has improved slightly," a senior member of the BAFEDA told the FE while explaining the latest situation on the market.

He also predicts that such downturn in the weighted average rate for BC selling might continue in the days ahead following adjustment of the previous rates.

The weighted-average rate is being calculated on a five-day rolling-average basis by each bank based on its actual cost of inflow of the greenback, the BAFEDA member explains.

He also found transactions on the inter-bank forex market improving gradually as some banks quoted rates for the greenback ranging between Tk 102.37 and Tk 106.90 on Tuesday.

The inter-bank rate for the US dollar was ranging between Tk 101.6721 and Tk 106.1500 on Monday, according to the BAFEDA.

The rates were released by the central bank on its website, saying that exchange rates of the taka for inter-bank and customer transactions are set by the dealer banks, based on demand-supply interaction and indicative rates suggested by the BAFEDA.

"Bangladesh Bank (BB) is not in the market on a day-to-day basis, and undertakes USD purchase or sale transactions with dealer banks only as and when needed to maintain orderly market conditions," the central bank explains.

When contacted, a top central banker said the BB published the interbank rates on its website on the basis BAFEDA report.

Talking to the FE, the head of treasury at a lending private commercial bank (PCB) said: "We expect that dealing in the US dollar through the interbank will increase further in the coming days."

On Monday, US$2.26 million was traded through the interbank transactions, according to the BAFEDA report, and on Tuesday the volume surged to $11.80 million.

On the other hand, the central bank kept unchanged its selling rate for the US dollar to the scheduled banks on Tuesday.

Like on the previous day, the Bangladesh Bank (BB) sold $40 million more directly to two state-owned commercial banks (SoCBs) on the day at Tk 96.00 to help them for settling import payment obligations.

On Monday, the central bank provided $65 million to four banks on the same ground.

The central bank has so far funneled $2.86 billion from the reserves directly into commercial banks as liquidity support for import payments in the current fiscal year (FY), 2022-23.

In FY22, the central bank sold$7.62 billion from the reserves to the banks for the same purpose.

Bangladesh's forex reserves rose to $37.20 billion on Tuesday from $37.12 billion of the previous day despite higher sales of the greenback to feed the market.

siddique.islam@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.