Published :

Updated :

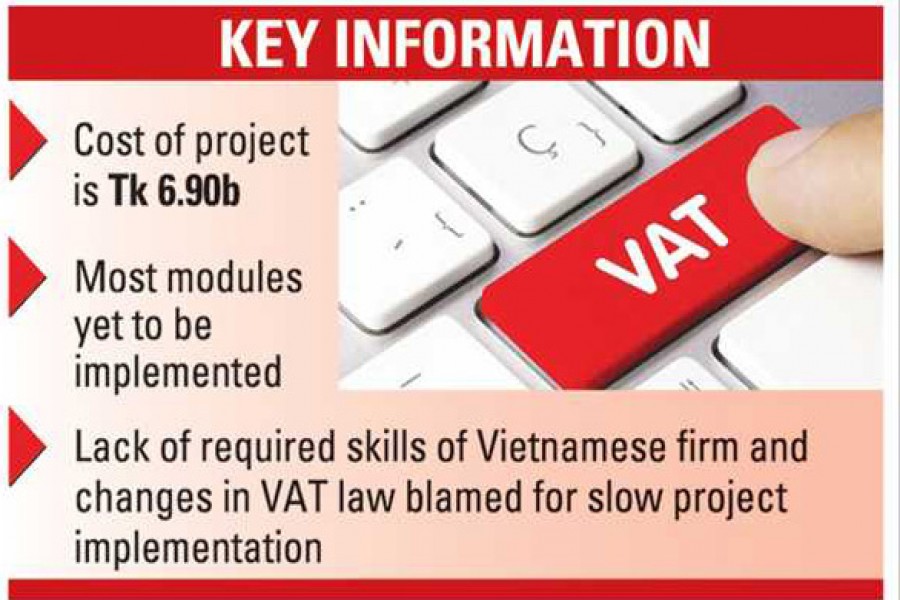

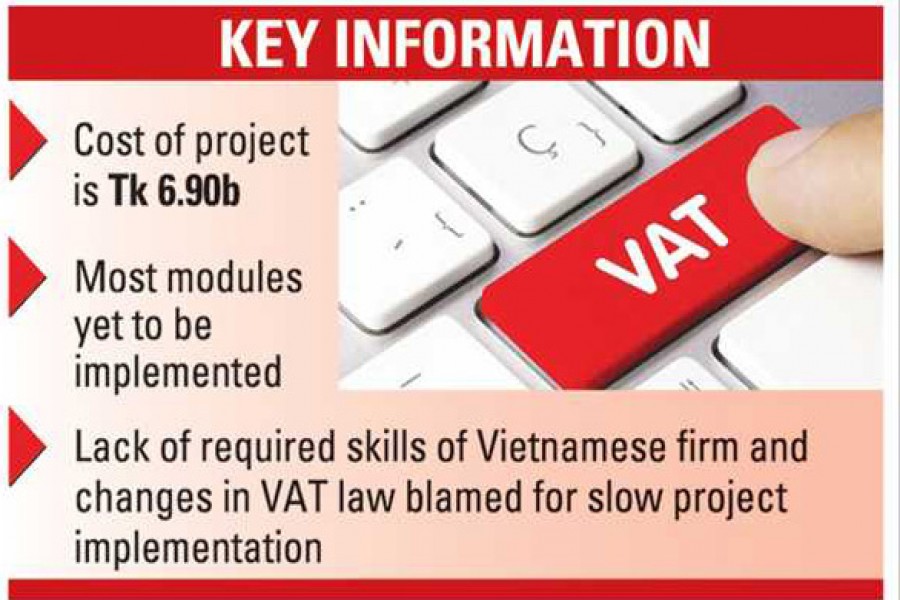

Around 63 per cent of the total cost of the VAT Online Project (VOP) has remained unspent though the deadline for its execution is set to end on December 31 next.

The cost of the project is Tk. 6.90 billion.

Most modules necessary to automate the VAT system are yet to be implemented.

Officials concerned have ruled out the possibility of any further extension of the project life. Only four modules could be developed until now out of the total of 16 modules.

However, project director (PD) Kazi Mustafizur Rahman is optimistic about implementing the remaining modules, including document management, non-filers information and litigation in the next three-month period. He said the five modules under the VOP would be launched by the next month.

He said they were now working on refund, risk management and debt management modules. Mr. Rahman, however, said some Tk 2.0 billion of the project cost may remain unspent by end of the project tenure.

Officials said the work of the VOP got pace in the recent times, but not enough to meet the deadline.

They blamed the lack of required skills of the Vietnamese firm FPT and massive changes in the VAT law from the original one, framed in 2012, also for the reduced pace of project implementation.

The VOP has paid Tk 1.09 billion to the FPT for developing the IVAS system and purchasing hardware to automate the VAT administration.

Officials said the NBR may not pay the full amount of Tk 2.38 billion to the firm as per contract as the firm will not be able to complete its work by the deadline.

The VOP has so far introduced online VAT registration, online VAT return, taxpayers account and e-payment system.

However, the field-level VAT officials were sceptical about the online VAT return system while businesses raised allegation about unusual delay in getting online VAT registration.

VOP officials said the process of resolving the problems of VAT online return submission is taking time as they have to address problems of each of the businesses individually.

The NBR launched the VOP project on May 9, 2014 with the fund support from the World Bank and the government.

The NBR is set to take up the VOP after expiry of the project. The VOP is currently imparting training to the NBR's IT officials on the VOP's software in this regard.

A former official of the NBR said the project would remain half done by end of its tenure.

He said the pace of the project was slower at the beginning due to lack of proper monitoring of the government high-ups and major changes brought by the revenue board to the original VAT and Supplementary Duty Act-2012 amid demand from the business community.

The VAT online system was initially designed as per the original law, he added.

The revenue board is not getting the benefits of the new VAT law as the implementation of the law requires automation of the system.

In the first five years, the VOP completed only two modules - VAT registration and online return submission.

The World Bank is providing US$60 million for the project under 'programme for result' initiative and it evaluates the project regularly.

Sources said the WB's consultant Deloitte is currently assessing the performance of the VOP and will submit its report soon.

In its earlier evaluation, the WB found 35 per cent progress in overall online VAT collection system and 75 per cent in VAT registration module.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.