One for Summit, another for US co

Govt to build two more re-gasification units

Deals on bay LNG import ports sans tender

Published :

Updated :

One goes to local cynosure Summit Group and another to US firm Excelerate Energy's share under deals sans tender as the Bangladesh government decides to build two more LNG-import terminals on the bay.

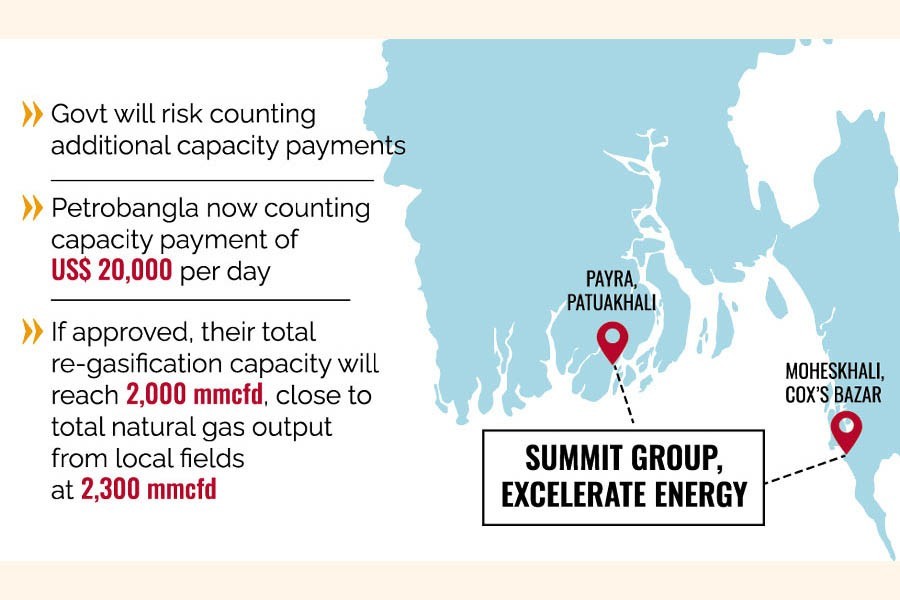

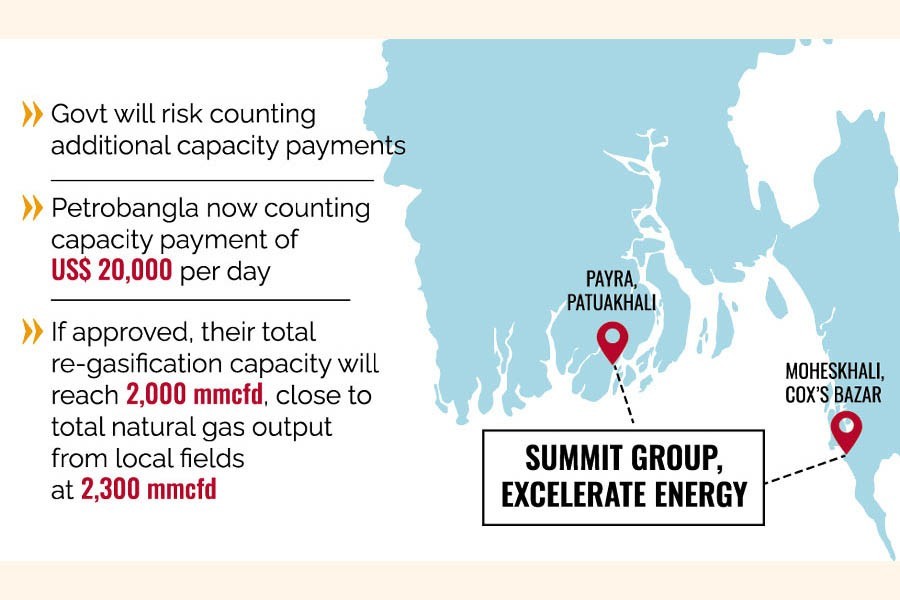

Sources say one of the floating liquefied natural gas (LNG) import terminals will be built at Moheskhali island in Cox's Bazar and the other at Payra in Patuakhali, as the country now heavily banks on LNG import to cater growing gas needs against slowing local production.

"The government has decided in principle to ink deals with Summit and Excelerate to build these new LNG-import terminals," Petrobangla chairman Nazmul Ahsan told the FE Sunday.

He wouldn't disclose details of the deals to be signed with the firms to build the new floating storage and re-gasification units (FSRUs) on the waters of the Bay of Bengal.

If awarded, Summit and Excelerate both will win two 3.75-million-tonne-per-year (MTPA)-capacity FSRUs each, doubling the number of their such units in the country through unsolicited deals under the Speedy Supply of Power and Energy (Special Provision) Act 2010 that allows bypassing the tendering process.

The law has a provision of immunity for those involved with a quick fix.

Energy experts and rights groups fear establishing a monopolistic situation in LNG re-gasification by the private sector if both the private firms are awarded these new FSRUs without competitive bidding again.

The government will be at risk of counting additional capacity payments for not utilizing in full the new FSRUs, they say.

State-run Petrobangla is now counting payments worth around US$ 20,000 per day as it is currently re-gasifying a lower amount of around 580 million cubic feet per day (mmcfd) of LNG from two FSRUs.

Currently Summit and Excelerate own 3.75 MTPA-capacity FSRUs each at Moheshkhali with the capacity to re-gasify around 500 million cubic feet per day (mmcfd) equivalent of LNG each.

Once the new units are awarded, their total re-gasification capacity will reach around 2,000mmcfd, almost as much the country's overall natural gas output from local fields, which is around 2,300mmcfd, according to Petrobangla.

Both the local firm and US multinational are also lobbying government high-ups for inking deals with Petrobangla to supply LNG under long-term deals sans biddings, sources say, though this special measure was stipulated to meet energy emergencies.

Summit has quoted LNG price at around US$20 per million British thermal unit (MMBTU) based on Henry Hub index, which is similar to that on volatile spot-market rates.

The government has ceased importing LNG from the spot market since July 2022 amid a global price hike, Petrobangla sources say.

Excelerate has offered to supply LNG following JKM (Japan, Korea, Marker) index--meaning the price will reflect the spot market value of LNG cargoes delivered into Japan, South Korea, China and Taiwan, for 2022.

For 2023 and onwards, Excelerate has proposed to supply LNG at around 11.70 per cent of the three-month average price of Brent crude oil plus US$ 0.35 constant per MMBtu.

"It will ensure syndicated business of a certain quarter," says energy adviser of the Consumers Association of Bangladesh (CAB) Prof M Shamsul Alam.

It is pre-planned and an outcome of intentional non-exploration of local energy resources, he told the FE.

The special law has given shield to this 'misdeed' to create a monopolistic situation in the energy sector, Dr Alam deplores.

It contradicts the creation of Bangladesh Competition Commission and Bangladesh Energy Regulatory Commission (BERC), the CAB leader opines.

Petrobangla should build in future FSRUs or such types of infrastructures of its own.

It should select engineering, procurement and construction (EPC) contractors, instead of awarding private sectors to build more FSRUs bypassing tenders, Mr Alam suggests.

The government will become hostage to only to these two private firms if it awards FRSUs and further LNG-supply deals to them, energy expert Professor Badrul Imam also fears.

"The whole country will become captive to them as a consequence," says the energy expert, Mr Imam, a professor of Geology at Dhaka University.

"It will be risky if the government continues relying on only two private firms for future FSRUs," says another energy expert, Prof Ijaz Hossain.

The time has come to enact new law to limit operations of any private firm in energy-sector business to avoid monopoly by private firms in the sector, Mr Hossain of Bangladesh University of Engineering and Technology (BUET) suggests as a measure to avert getting trapped in 'captive market'.

Officials said both the private firms earlier had attained permission to build their first FSRUs and supply re-gasified LNG under the special law as Petrobangla did not float any international tender to select contractors to do the job.

Bangladesh initiated importing LNG in August 2018, in the wake of a stalemate in prospective gas exploration in the country's onshore and offshore hydrocarbon turfs.

Bangladesh has a 15-year contract with Qatargas to import around 2.5- million-tonne-per-year LNG, at a 12.65-per cent slope of the three-month average Brent price plus a 50-cent constant.

A similar contract also stands with Oman's Oman Trading International (OTI) for 10 years at an 11.9-per cent Brent slope plus 40 cents.

azizjst@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.