Published :

Updated :

The interim government has made a move to pay at least $10 million a week to the Indian Adani Power in outstanding electricity bills, according to officials.

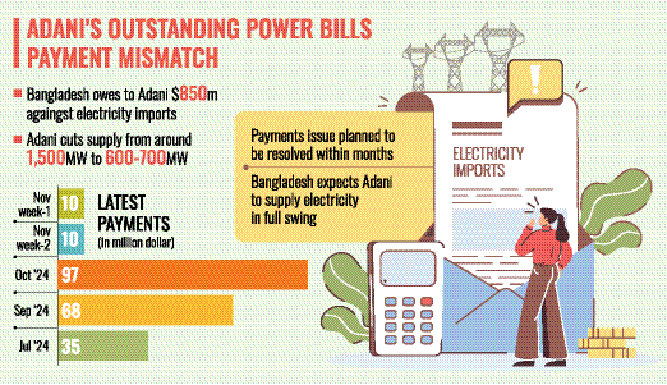

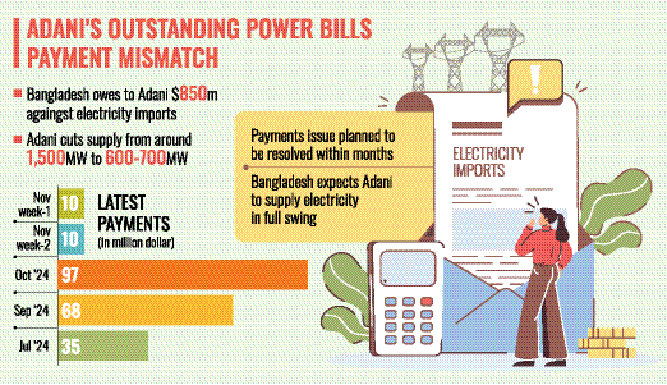

Bangladesh owes an estimated $850 million to Adani for purchasing electricity through the cross-border power grid, they say.

"We've paid $10 million in the first week of November. In the second week, we have paid another $10 million to Adani in outstanding electricity bills," comments a Bangladesh Power Development Board (BPDB) official.

"We'll be paying to the Indian conglomerate in the coming weeks too. We hope the company will supply electricity to Bangladesh in full swing."

A Power Division official said they would make payments regularly, adding that the payment crisis would be resolved within months.

The finance ministry has already asked the Bangladesh Krishi Bank to take steps for paying outstanding bills to Adani.

Meanwhile, the Indian conglomerate has cut its power supply to 600-700 megawatt (MW) a day from its earlier supply of nearly 1,500MW for the same.

Under a deal in 2015, the Adani Power supplies electricity to Bangladesh from its 1,600MW coal-fired plant in Jharkhand.

Adani's power deal was one of the many under Sheikh Hasina, which the incumbent government has called "opaque".

A national committee is now reassessing 11 previous deals, including the one with Adani, which has often been criticised as expensive.

Earlier, Adani in a letter threatened the Bangladesh government that it would not supply electricity unless the dues were not cleared by October 30.

Another official says: "We never stopped payments to any of the independent power producers (IPPs) and the rental power plants, including Adani. But it's unexpected that Adani has suddenly reduced its supply."

"We have now boosted payments and are trying to increase the amount every month to clear all dues within shorter possible time."

"You know Bangladesh is struggling with foreign-exchange reserves. We've already informed all IPPs and power suppliers of the current limitations of the country," adds the official.

According to the BPDB, it has paid some $35 million in July, $68 million in September and $97 million in October this year.

Meanwhile, Bangladesh has been suffering from increased power shortages in rural areas due to the poor power supply situation.

The country has been struggling to generate dollar revenues to pay for costly essential imports like electricity, coal and oil.

Analysts claimed foreign-currency reserves have dropped to $20 billion as a fair chunk of businessmen and public servants of the fallen Sheikh Hasina government laundered money abroad.

The Dr Yunus-led transitional government has already sought an additional $3.0-billion loan from the International Monetary Fund in addition to its existing $4.7-billion bailout package.

Again, cumulative government debts to private power producers, rented by the past regime, have ballooned as the contentious capacity charge amounted to Tk 330 billion until the second week of November.

This hefty payback on account of electricity generation under special arrangements for a quick fix to power shortages adds up to dollar crunch and to multidimensional pressures facing the problem-ridden energy and power sector of Bangladesh, officials and experts say.

The huge capacity charge-largely against installed overcapacity compared to actual electricity generation-to be paid to IPPs and rental plant owners is a big burden on the coffers reeling from depleted forex reserves and rising external debts.

Economists suggest that the interim government scrap the deals or revise the power-purchase agreements immediately in view of the present economic crisis in the country.

The government can even use the "force majeure clause" for revising the contracts with the IPPs and rental plants, they observe.

The government needs to pay the capacity charge to the IPPs under a guarantee clause in the deals on their investment and operations in Bangladesh-even if power is not generated in the plants.

Meanwhile, it has allocated some Tk 360 billion as power subsidy in the current FY2025 national budget-a third of the total subsidies this fiscal year.

Most of the allocation will be spent on paying the capacity charges.

The Hasina regime allowed many private-sector power producers to set up electricity-generation plants most of which are costly in terms of electricity pricing, resulting in rising government liabilities.

Usually, the BPDB sells electricity to consumers at rates lower than it purchases from the IPPs-and the gap needs to be made up with state subsidies.

The government had paid a total of Tk 280 billion in capacity charges in FY2023 to the favoured power producers.

Meanwhile, it has issued special bonds in recent months to clear capacity-charge payments to IPP and rental plants.

kabirhumayan10@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.