Growing digital adoption drives up internet banking

39pc growth coincides with 9.42pc fall in paper-based transactions

Published :

Updated :

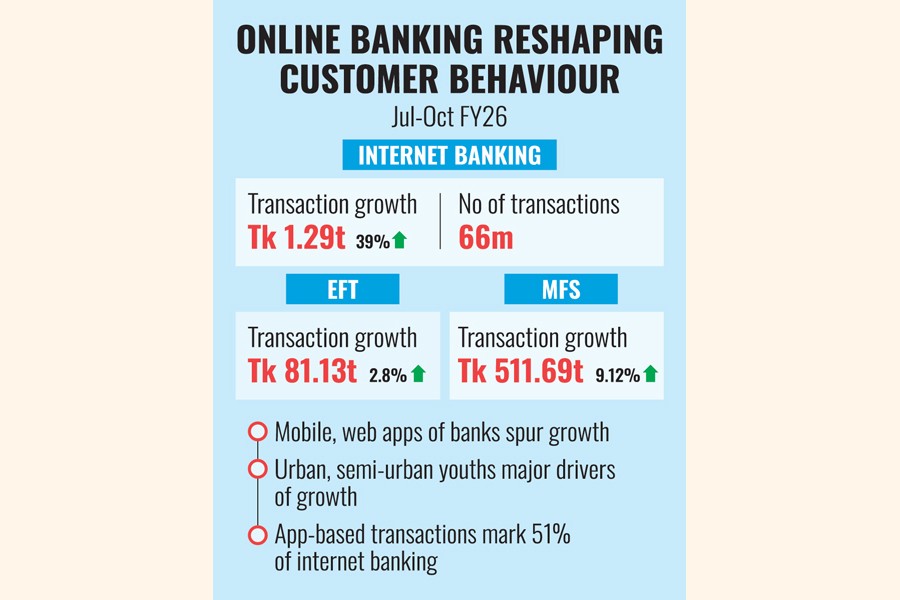

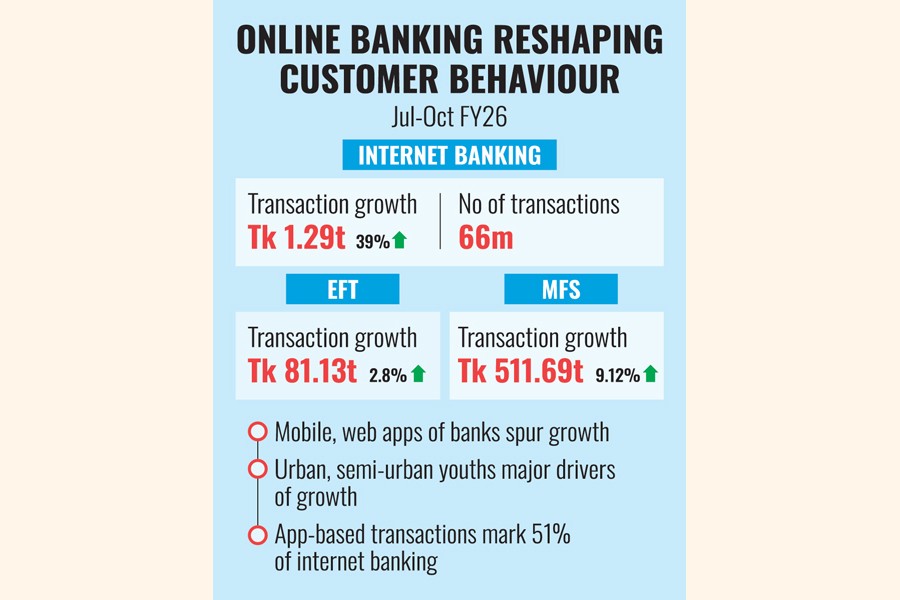

Internet-banking transactions surged by more than 39.0 per cent to Tk 1.29 trillion during the first four months of the current fiscal year, signifying a steady shift away from cheques and other paper-based conventional payment methods.

Roughly 66.0 million transactions were carried out through internet banking platforms between July and October, according to the latest Bangladesh Bank data.

People familiar with the data tell The Financial Express this reflects growing consumer comfort with digital channels as banks expand app-based services.

The surge highlights how bank-developed mobile and web applications are increasingly driving the country's digital payment ecosystem, particularly among youths in both urban and semi-urban areas.

Senior bankers say the trend still has room to grow, as a large segment of older customers continues to rely on cheques and traditional branch-based transactions.

They also say the convenience of real-time transfers, bill payments, and account monitoring is gradually reshaping customer behaviour.

"To my mind, this growth in internet banking transactions is largely due to the adoption of apps developed by banks," says Mr Syed Mahbubur Rahman, managing director and chief executive officer of Mutual Trust Bank.

"Interoperability has accelerated it sharply, allowing customers to transfer funds seamlessly from one bank account to another using a single app."

He further adds that security concerns - long cited as a barrier to digital adoption - have eased as customers become more familiar with safeguards.

"Security is strong, provided users do not share their passwords with others," he says.

Industry data suggests app-based transactions now account for nearly 51 per cent of the total internet banking activities, with the remainder conducted through other online platforms, such as web portals.

The rise of internet banking has coincided with a marked decline in paper-based cheque usage.

Cheque clearing - including magnetic ink character recognition (MICR) and non-MICR instruments - fell by 9.42 per cent, or Tk 597.27 billion, between July and October, compared with the same period a year earlier.

Other electronic payment channels also gained momentum during the period.

Electronic fund transfer (EFT) transactions rose by Tk 81.13 billion, or 2.8 per cent, year on year in the same period, while transactions through mobile financial services (MFS) increased by Tk 511.69 billion, or 9.12 per cent.

Internet banking gained momentum during the Covid-19 period, when physical movements were restricted to contain the spread of the virus and curb the pandemic.

jasimharoon@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.