Published :

Updated :

Bangladesh's overall imports increased slightly in the first half (H1) of the current fiscal year ahead of the upcoming Ramadan, with officials saying the removal of letter of credit (LC) restrictions by the central bank has played a role in this regard.

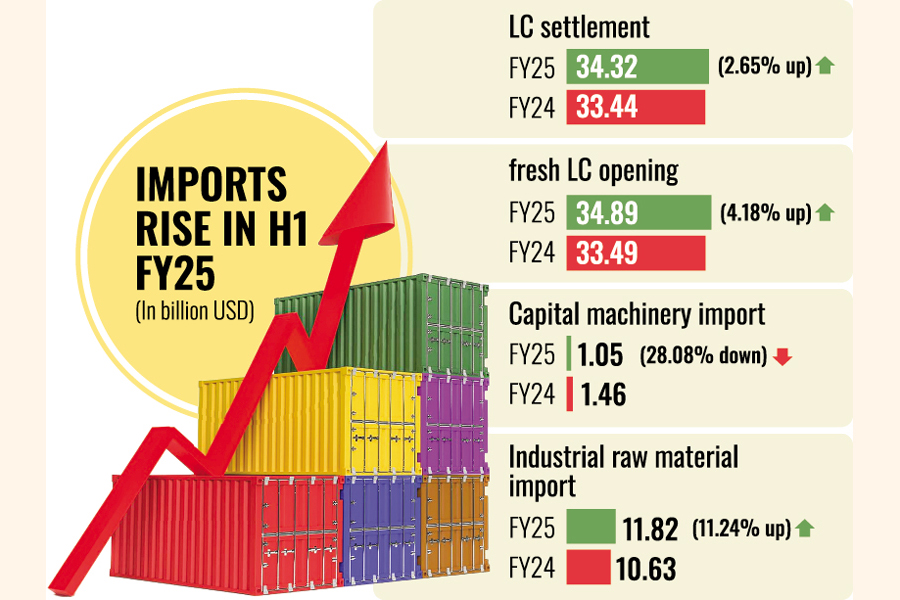

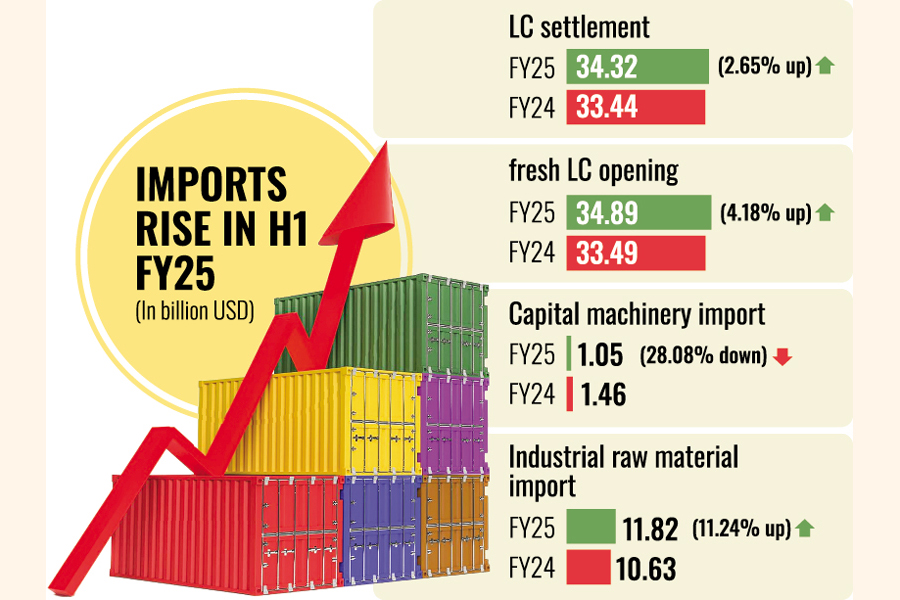

Actual imports in terms of LC settlements rose by 2.65 per cent to $34.32 billion during July-December of FY25 from $33.44 billion in the same period of the previous fiscal year, according to the central bank's latest statistics.

On the other hand, the opening of fresh LCs, generally known as import orders, increased by 4.18 per cent to $34.89 billion in the first six months of FY25 from $33.49 billion in the same period of FY24.

Senior officials of the Bangladesh Bank (BB) predict that the existing upward trend of imports will continue until March of this calendar year.

"We expect that the imports of essential items will go up further in the coming months as the central bank has withdrawn the LC margin, while the availability of US dollars has increased in the market," a central banker told The Financial Express on Thursday.

He also said the central bank has already taken measures to ensure a smooth supply of essential items to the market ahead of Ramadan.

Normally, a large quantity of essential commodities is imported to meet the additional demand during Ramadan, the month of fasting for Muslims.

The existing upward trend of imports indicates that the country's business community is trying to strengthen their activities, the central banker said, mentioning the latest Purchasing Managers' Index (PMI) report.

The economy expanded in December 2024, though at a slower pace than the previous couple of months, as reflected in the PMI report.

In December 2024, PMI stood at 61.7, 0.5 points down from November's 62.2, according to the report jointly prepared by the Metropolitan Chamber of Commerce and Industry (MCCI) and Policy Exchange Bangladesh (PEB).

A PMI reading above 50 indicates that the sector/economy is generally expanding. A value of 50 indicates no change compared to last month, while below 50 indicates a contraction.

Meanwhile, the imports of capital machinery or industrial equipment used for production dropped by more than 27 per cent to $1.05 billion during July-December of this fiscal year against $1.46 billion in the same period of FY24.

However, industrial raw material imports went up by 11.24 per cent to $11.82 billion during the period under review from $10.63 billion in the same period of FY24, the central bank data shows.

PEB Chairman and Chief Executive Officer M Masrur Reaz told The Financial Express that the data clearly indicates both new industrial unit setup and the existing units' capacity expansion have gone down during the period under review.

At the same time, the rising trend of industrial raw material imports is perhaps attributable to the increase in exports in the 2024 calendar year, when overall exports grew by 8.0 per cent, he explained.

On September 5 last year, the central bank removed the LC margin on all types of imports, except for luxury goods and products made in Bangladesh, aiming to boost local businesses as well as industrialisation.

Businessmen are currently allowed to import all types of capital machinery, consumer goods, and raw materials on the basis of bank-customer relationship without any LC margin, according to a notification issued by the central bank on that day.

However, importers will still have to pay a 100 per cent cash margin to open LCs for several luxury goods and import substitutes, the notification also said.

These include motor cars (sedans, SUVs, and MPVs), electrical and electronics, home appliances, gold and jewellery, valuable assets and pearls, ready-made garments, leather goods, jute products, toiletries, furniture, fruits and flowers, non-cereal food, processed food, alcohol, and tobacco.

siddique.islam@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.