Published :

Updated :

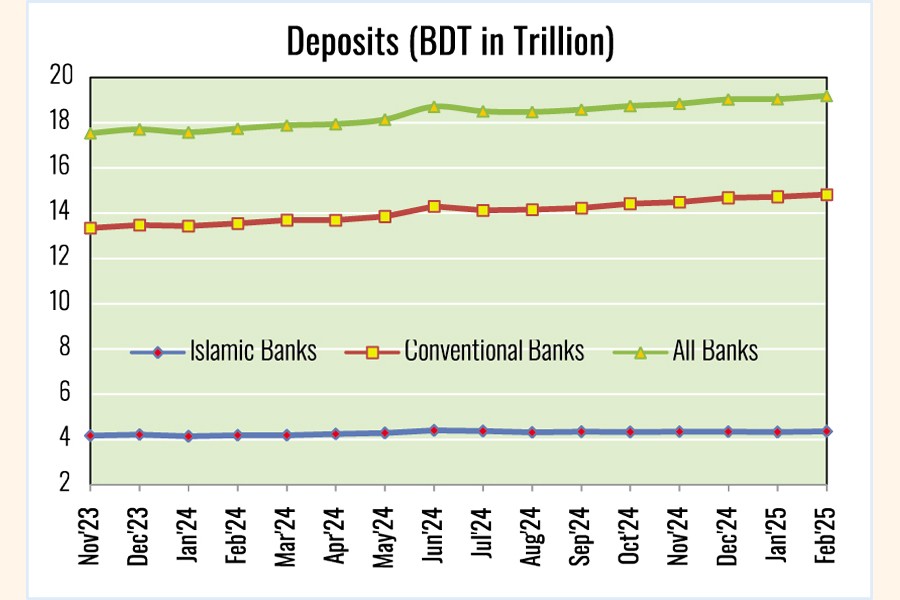

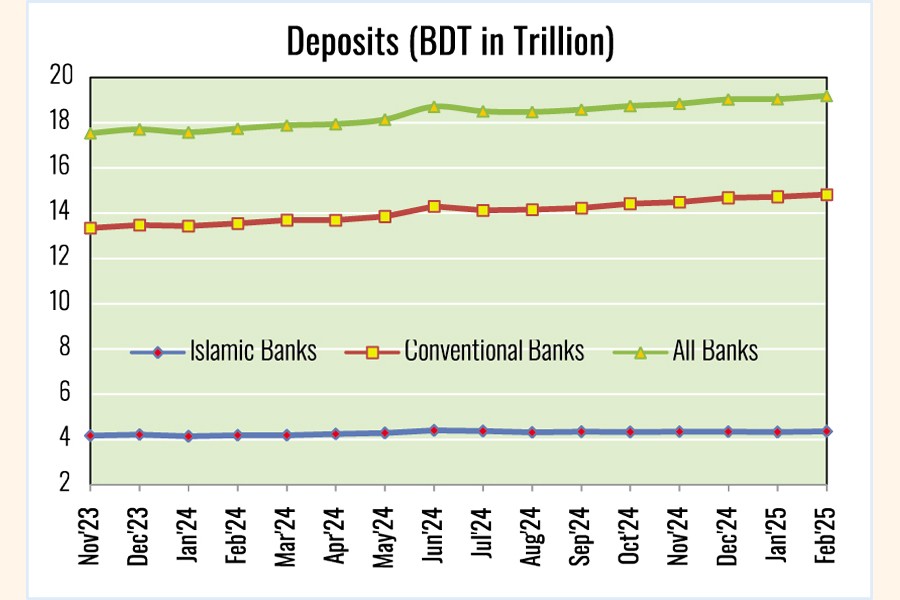

Islamic banks maintained consistent deposit growth, with figures increasing from Tk 4.19 trillion in February 2024 to Tk 4.36 trillion in February 2025 - a 4.0-percent rise.

This came amid an 8.17 per cent overall rise in total banking deposits, which stood at Tk 19.19 trillion by the end of the review period.

The total banking system deposits were Tk 17.74 trillion in February 2024, according to a Bangladesh Bank report.

While conventional banks experienced higher growth, Islamic banks held firm, continuing to attract a loyal customer base due to Shariah-compliant services.

Between February 2024 and February 2025, Islamic banks in Bangladesh demonstrated steady and resilient performance across key indicators, despite conventional ones showing relatively faster growth in some areas.

The central bank report provides a detailed analysis of both Islamic and conventional banking sectors, focusing on deposits, investments, assets, exports, imports, remittances, and agent banking.

In terms of investments, Islamic banks posted an 8.02 per cent increase - from Tk 4.89 trillion to Tk 5.28 trillion in this period.

Though conventional banks grew by a stronger 12.05 per cent, Islamic ones showed disciplined and controlled investment expansion, reflecting their cautious risk management approach.

The asset base of Islamic banks rose by 10.11 per cent, reaching Tk 8.53 trillion by February 2025.

This growth, while lower than the 15.13 per cent recorded by conventional banks, indicates consistent asset accumulation by Islamic banks despite market competition, according to the report.

Their performance remained stable, particularly at a time when conventional banks reached peak asset levels in November 2024 before slowing.

They also contributed significantly to Bangladesh's external trade, especially in export receipts. They showed a year-on-year growth of nearly 14 per cent in export proceeds, collecting $713 million in February 2025, up from $628 million in the same month a year earlier.

The report revealed that the export receipt growth trajectory remained stable, with the highest amount recorded in September 2024 at $837 million.

This consistency contrasts with more fluctuations in conventional banks' export earnings.

In import payments, Islamic banks made notable progress, increasing their payment volume from $900 million to $1.10 billion, reflecting a 22.18 per cent growth.

Their share constituted around 20 per cent of the total import payments in the economy. In contrast, conventional banks faced more volatility in import financing due to the recent dollar liquidity pressure affecting many of them.

One area of concern was remittance inflows, according to the report.

Islamic banks saw a decline in remittance share - from $897 million in February 2024 to $502 million in February 2025.

This reduced their share from 41 per cent to below 20 per cent in this period.

The drop may reflect temporary trust issues stemming from governance concerns, and restoring confidence will be crucial, the report said.

Despite this, Islamic banks continued to dominate agent banking deposits, holding 55.23 per cent of the total such deposits in February 2024.

This grew steadily by 5.0 per cent to reach Tk 211 billion in February 2025.

While conventional banks posted faster growth of 25 per cent, Islamic ones maintained leadership in this inclusive banking channel.

sajibur@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.