Published :

Updated :

The financial market experienced improved liquidity in August as major indicators pointed to stronger funding conditions across the banking sector, according to Bangladesh Bank data released on Sunday.

Lower borrowing costs, smoother settlements, and reduced volatility marked the month's money market performance.

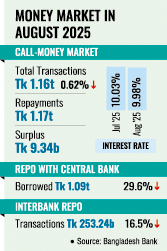

Total call-money transactions, a key gauge of liquidity, amounted to Tk 1.16 trillion during the month, while repayments by borrowing banks reached Tk 1.17 trillion. This left a surplus of Tk 9.34 billion, Bangladesh Bank data showed.

The call-money market, a short-term funding source for banks, consists of three instruments: overnight, short-notice, and term (15 days and above). Of these, overnight borrowing accounted for nearly 88 per cent of transactions.

The weighted average interest rate on overnight borrowing slipped to 9.98 per cent in August from 10.03 per cent in July, the data showed.

Repo transactions with the central bank also eased. Banks borrowed Tk 1.09 trillion in August, while repayments stood higher at Tk 1.16 trillion, meaning Tk 63.38 billion was returned to the central bank during the period.

In contrast, interbank repo activity displayed a mismatch. Transactions totalled Tk 253.24 billion, while repayments reached Tk 242.38 billion.

This activity also influenced overall treasury operations. New issuance amounted to Tk 315 billion in 90-day instruments, while maturity reached Tk 323.98 billion, indicating banks returned Tk 8.98 billion more than they borrowed.

Central bankers told The Financial Express that liquidity conditions in August 2025 showed an overall improvement, with most banks able to settle obligations without difficulty.

"As liquidity conditions strengthened, treasury yields began to ease," one official said, adding that the coefficient of variation - a key measure of money-market volatility - had declined, signalling lower risks and more predictable funding costs.

Turnover in the call-money market stood at Tk 1.16 trillion in August, down 0.62 per cent from the previous month.

Interbank repo transactions fell by 16.51 per cent to Tk 253.24 billion, while central bank repo turnover declined by 29.6 per cent to Tk 1.09 trillion compared with July 2025.

jasimharoon@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.