SILVER LINING NOW SHINES ON APPAREL HORIZONS

Narrow product range risks RMG sector’s sustainability

Published :

Updated :

Bangladesh long banks on few items for apparel-export earnings, risking the sector's sustainability, although diversification with high-value products suiting growing global- market trends holds great potential, trade experts say.

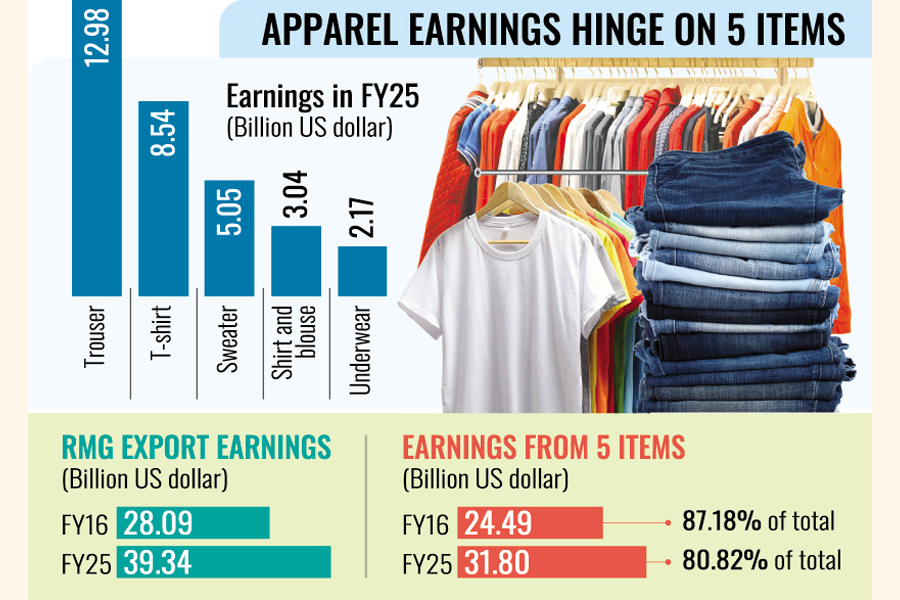

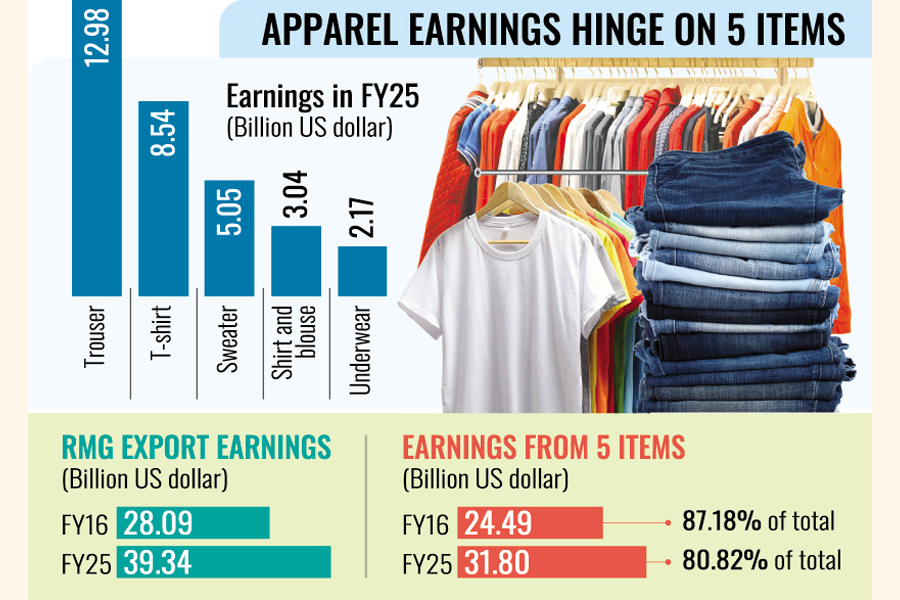

Five traditional items from the country's main export sector- trousers, T-shirt, shirt, sweater, and underwear - contributed about 80.82 per cent of the total readymade garment (RMG)-export earnings in the past financial year (FY25), according to Bangladesh Garment Manufacturers and Exporters Association (BGMEA) data.

The country exports more than 30 types of garment products, according to industry people.

Knit-and woven-apparel exports together fetched $39.34 billion in FY25. Of the earnings, the five items contributed $31.80 billion.

Back in FY16, the aforesaid items of common use brought in $24.49 billion, while total RMG export earnings were $28.09 billion, data showed.

During the last decade, underwear exports more than doubled while trousers fetched the highest earnings. On the other hand, shirt earnings remained almost static.

Of the $31.80 billion earnings in the just-past fiscal year, $12.98 billion came from trousers, $8.54 billion from T-shirt, $5.05 billion from sweater, $3.04 billion from shirt and blouse, and $2.17 billion from underwear.

The country's total export earnings stood at $48.28 billion during the last fiscal year, with apparel accounting for an overwhelming 81.49 per cent, data showed.

Exporters and experts opine that Bangladesh largely produces basic items mostly based on cotton. "Though the global market is switching to man-made fibre (MMF)-based garments from the natural fibre of cotton, the situation of Bangladesh looks opposite," they note by one voice, stressing the need for the RMG sector's diversification.

They have, however, said diversification is happening gradually, especially in denim, dyeing, and washing segments.

Besides, the critics blame the absence of effective steps for product diversification according to market demands and exploration, poor infrastructure, and entrepreneurs' unwillingness to take risks.

"Such dependency on a single sector and a few items might put the overall export earnings at risk," says one trade expert, recommending effective measures and government policy support to increase the competitiveness of local products, including non-apparel items, and exploring the untapped markets across the world.

Fazlee Shamim Ehsan, executive president of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), told The Financial Express that diversification is taking place gradually and items on the top-five list also changed during the last decade, with underwear/lingerie entering the basket.

He explains that there are three types of value addition - country base, inside products, and profit.

"The first two are rising as they source local raw materials mostly for knit items and necessary accessories, though value addition in terms of profit has declined," he notes.

Explaining the risk of confining to a few items, Mr Ehsan added that as most of them produce basic items, it has developed higher capacity compared to the global demand, which resulted in price pressure.

Inamul Haq Khan, senior vice-president of the BGMEA, says 70 per cent of the global demand is for MMF-based garments, while Bangladesh produces 70-75 per cent of its exportable based on cotton, which runs counter to the global trend of the day.

To raise export earnings from RMG products, he says, exporters need to go for MMF-based garments to sustain in the competition and get better prices like Vietnam.

His factory's export earnings are growing, though the number of factories or their capacity has not increased, says the leading exporter, adding that it is because they produce high-value-added items.

Bangladesh mostly makes items for which the free on board (FOB) is $6-8 per piece on average, while it gets $12-15 for cut and make (CM) - which means stitching for a garment - and there are products that bring CM of $30 per piece.

Both leaders have said the country needs investment in the backward-linkage textile sector to produce raw materials needed for MMF-based garments as Bangladesh has to meet the requirements for such materials imported from China and India.

Textile millers also stressed diversification in the textile sector to manufacture blended, as well as MMF- and non-cotton-based, yarns and fabrics to sustain business in the long run and face the emerging challenges stemming from tariffs and post-graduation market access.

According to industry-insiders, Bangladesh's synthetic yarn industry is small and cannot meet the domestic demand for MMF yarns.

That is why the country imports most of the manmade yarns and fibres used in apparel exports, they said. Till 2023, Bangladesh had 19 synthetic spinning mills, including eight acrylic ones, they added.

A new diagnostic report by the World Bank, the International Finance Corporation (IFC), and the Multilateral Investment Guarantee Agency (MIGA) says Bangladesh's RMG sector could be on the cusp of a transformative leap, with the potential to earn up to $94 billion in annual export earnings by 2029 if it expands into non-traditional markets and embraces MMF-based garment production.

This ambitious earning amount is expected to be achieved at an average annual growth rate of 15 per cent, which would require coordinated reforms across trade, industry, and finance, it adds.

Munni_fe@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.