Published :

Updated :

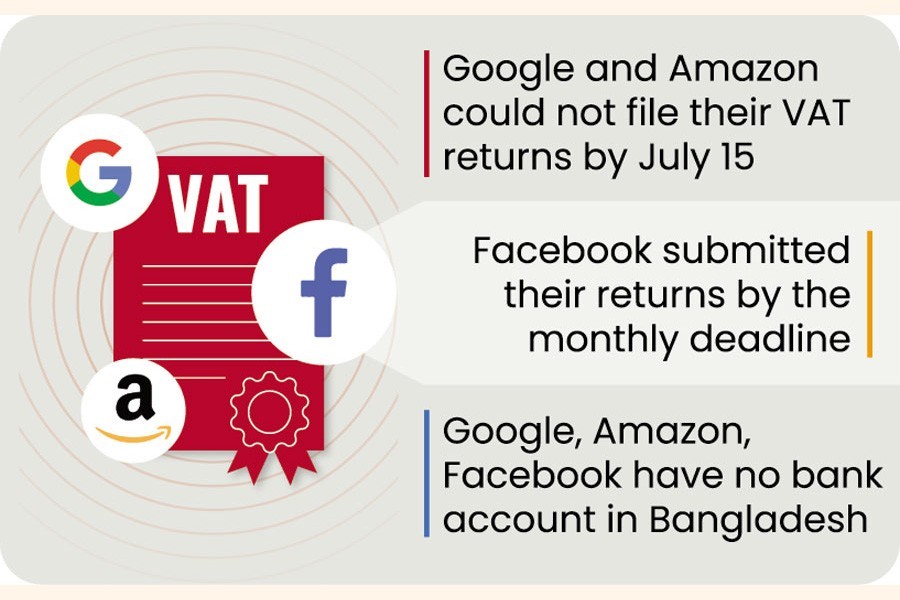

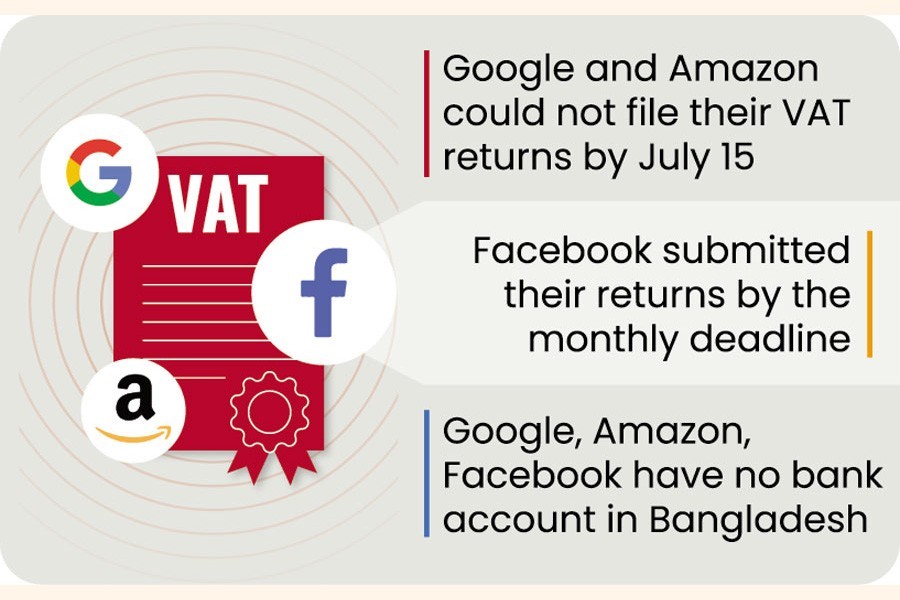

Several non-resident companies (NRCs) could not submit their VAT returns on time because of the complexities involving VAT law compliance, officials said.

They said two global technology giants - Google and Amazon - failed to file their VAT returns within the due date---July 15 last--- due to the complexities in sending remittance to Bangladesh.

Three non-resident tech companies including Facebook, which had earlier obtained the VAT registration in Bangladesh, however, submitted their returns within the deadline.

According to the VAT and Supplementary Duty Act-2012, all the VAT-registered companies or Business Identification Number (BIN) holders have to submit VAT returns by the 15th of every month.

Local representatives of the technology Google and Amazon said that the non-resident companies missed the deadline due to complexities involving sending their remittance to Bangladesh.

NRCs such as Google, Amazon and Facebook have no bank account in Bangladesh. So, they need an easy process of sending remittances.

According to the Foreign Exchange Policy Regulations of Bangladesh Bank BB, submission of a declaration form (Form-C) with documentary evidences in banks by beneficiary of inward remittances is necessary if the amount exceeds US$ 10,000.

In this case, the government or the NBR is the beneficiary of inward remittance to be paid by the NRCs as they have Permanent Establishment in Bangladesh.

However, there is no requirement to make the declaration in case of receiving higher amount of loan or project financing from abroad.

The NRCs are also worried about double taxation as commercial banks deduct VAT at a rate of 15 per cent on the amount repatriated by the former.

Taking into cognizance the concerns of the NRCs, the VAT policy wing of the National Board of Revenue (NBR) recently held a meeting with the stakeholders to find a way out.

Representatives from the PricewaterhouseCoopers, Ernest & Young Advisory Services, City Bank NA, Standard Chartered Bank, Sonali Bank, Bangladesh Bank and NBR attended the meeting.

Chaired by VAT policy member Md Masud Sadiq, the meeting has taken five decisions to resolve the problems and facilitate the global companies to submit VAT returns.

According to the decision, the commercial banks may have to furnish details on the Value Added Tax (VAT) deducted at source (VDS) to the revenue board and VAT agents of non-resident companies to avoid double taxation.

They have to provide the details of VDS within a week of every month. The BB will issue necessary directives to the commercial banks in this connection.

It also decided to request BB to ease the process of inward remittance above US$ 10,000 by amending the rules of mandatory declaration in Form-C.

Talking to the FE on Sunday, a senior VAT official said they have already sent letters to the central bank to implement the decisions.

He said that although the submission of VAT returns by the tech giants was due by July 15, they could not submit it due to the complicated process.

The NBR would allow them to submit returns by August 15 next without penalty as the problems remain at the government's end.

Officials of the Dhaka South VAT zone said Facebook Technologies Ireland Ltd, Facebook Ireland Ltd and Facebook Payments International Ltd have submitted their VAT returns within July 15 under an interim arrangement made by the NBR.

According to the decision of the meeting, the non-resident foreign companies would deposit the VAT amount to the 'government revenue collection account' maintained at Gulshan branch of the Sonali Bank.

The Sonali Bank will deposit the VAT amount received from the NRCs under the relevant economic code through treasury challan as soon as possible.

It will have to inform the NBR and the VAT agent of the company concerned about it.

In the meeting, representatives of Standard Chartered Bank and Citi Bank NA expressed concern over the double taxation issue on earnings of the foreign companies and sought NBR directives in this regard.

They said that foreign companies now would be able to issue VAT challan against the charges for the services.

They hinted the possibility of double taxation if the banks deduct VAT while remitting the amount.

The VAT wing of NBR, however, did not take any decision on the issue, saying that the existing VAT deduction process will continue until decided otherwise.

Sonali Bank chief financial officer Subhash Chandra Das, PwC representative Md Shahadat Hossain, Ernst & Young Advisory Services partner Rakesh Shaha, Bangladesh Bank joint director Farhana Marium and NBR first secretary Kazi Farid Uddin Ahmed, among others, attended the meeting.

doulot_akter@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.