Published :

Updated :

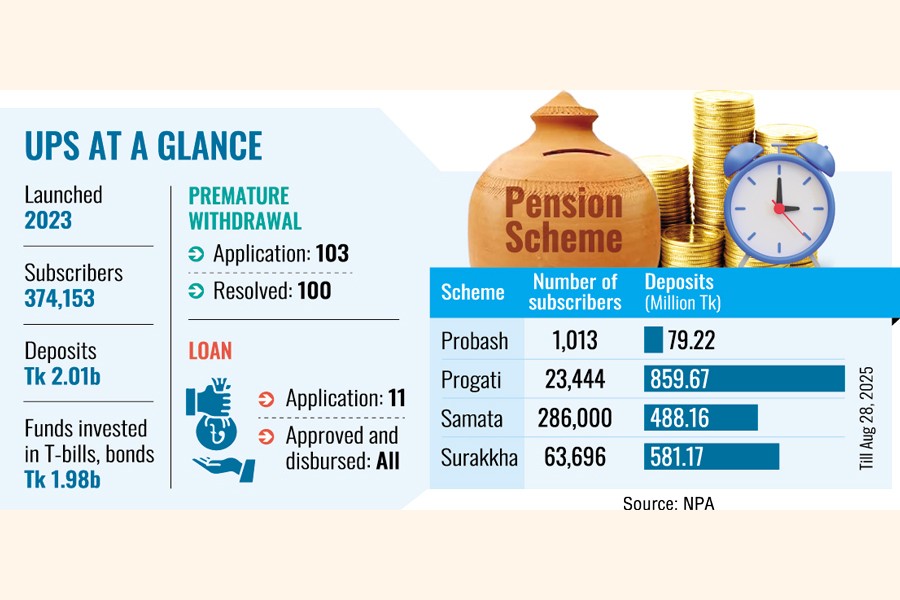

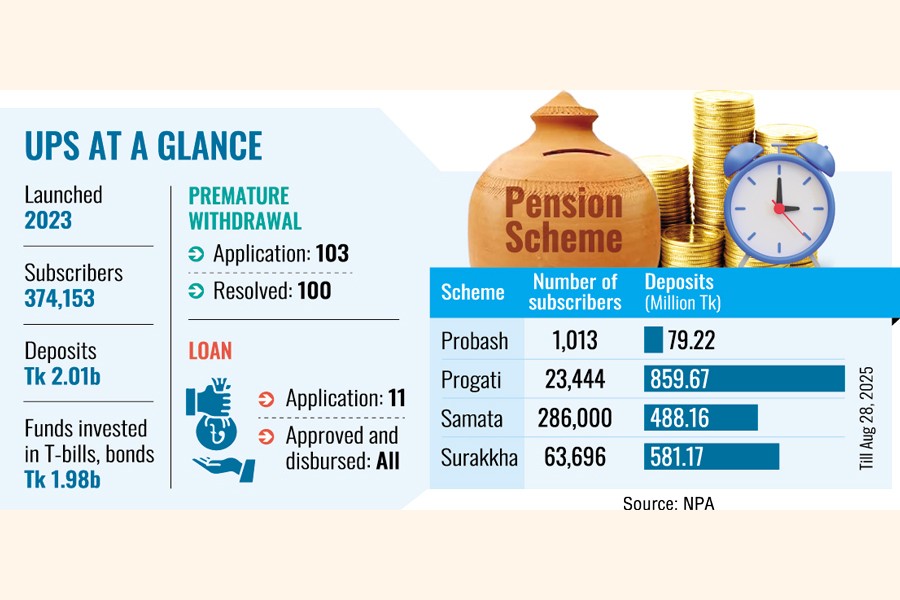

The subscribers of the much-vaunted Universal Pension Scheme (UPS) have so far deposited over Tk 2.01 billion, according to the National Pension Authority (NPA), which is planning to introduce a Shariah-aligned pension scheme to attract more participants.

A total of 374,153 citizens enrolled in the scheme under four categories till Thursday, NPA data shows.

Of the contributions, more than Tk 1.987 billion has already been invested in government treasury bills and bonds, NPA says.

So far, 103 premature withdrawal applications have been submitted, and 100 of those have already been resolved, it says.

In addition, NPA has received 11 loan applications, all of which have been approved and the loans have been disbursed.

The universal pension system was rolled out through NPA, which was formed under the provisions of the Universal Pension Management Act 2023.

Md Mahiuddin Khan, executive chairman of NPA, said, "Recognising Bangladesh's Muslim-majority population, NPA is considering the introduction of Shariah-compliant alternatives to ensure inclusiveness and broader participation."

"A feasibility study is currently underway to explore viable Shariah-aligned pension options," he said.

He further noted, "There are many people in society who are disinterested in conventional interest-based systems. Considering their demand, we are conducting a feasibility study with technical support from the Asian Development Bank (ADB) to launch Islamic products under the scheme."

"We are also planning to expand the scheme in the coming days. As part of it, we aim to include at least one member from each family under the UPS," added Mahiuddin.

The NPA has so far launched four pension products - Probash, Progati, Samata, and Surakkha.

In the national budget for the financial year 2022-23, a specific announcement was made to introduce a universal pension system.

Following that, the Universal Pension Management Act 2023 was passed in parliament, paving the way for the scheme's formal launch.

The UPS was introduced in 2023 to cover the country's growing elderly population under a sustainable and well-organised social security net.

The initiative also took into account the increase in life expectancy and the rising dependency ratio as the working-age population was projected to decline in the future.

The then government inaugurated the UPS on August 17, 2023, as one of its flagship social protection programmes.

Following the inauguration, NPA introduced online registration - along with payment facilities through mobile financial services, debit/credit cards, and banks - for participation in the four schemes.

Asked about progress, Md Golam Mostofa, a member of NPA, said the entire UPS system had been fully digitised.

"Even after the maturity of their contributions, participants receive their payments directly through electronic funds transfer (EFT), ensuring transparency and efficiency."

He added that the schemes were becoming increasingly popular as people were gaining confidence in their reliability.

"As a result, both the number of contributors and the overall fund size are growing rapidly," he told The Financial Express.

Dr M Masrur Reaz, chairman of Policy Exchange of Bangladesh, said the UPS marked a significant step toward building a sustainable social security system in the country.

With more than 374,000 citizens already enrolled and over Tk 2.0 billion mobilised, the scheme reflected growing public trust in government-backed long-term savings products, he said.

He also said that the investment of pension contributions in treasury bills and bonds was not only ensuring secure returns for contributors but also channelling funds into the domestic economy.

The upcoming plan to introduce Shariah-compliant schemes, the economist added, would further broaden participation by addressing the needs of those hesitant about conventional financial products.

However, Dr Reaz suggested that beyond mobilising funds, NPA should gradually diversify investment avenues to include infrastructure and green financing.

"This will allow pension savings to generate higher returns for contributors, while also contributing to the country's long-term development priorities," he added.

sajibur@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.