Published :

Updated :

The slow pace in the formation of One Person Companies (OPCs) is emerging as a bottleneck for Foreign Direct Investment (FDI) in Bangladesh despite regulatory reforms aimed at encouraging business-friendly structures.

The concept introduced to streamline business registration and attract individual investors, including foreigners, has yet to gain significant traction.

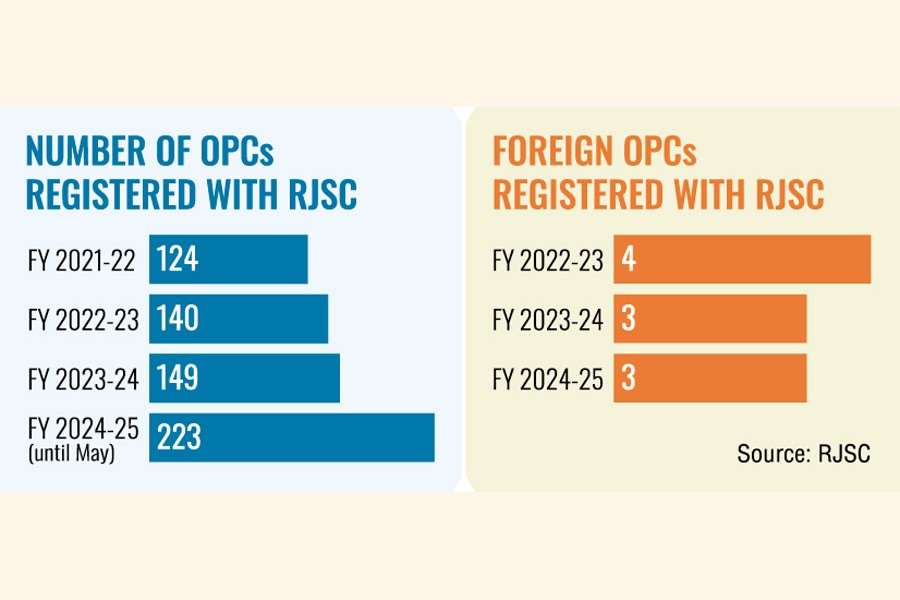

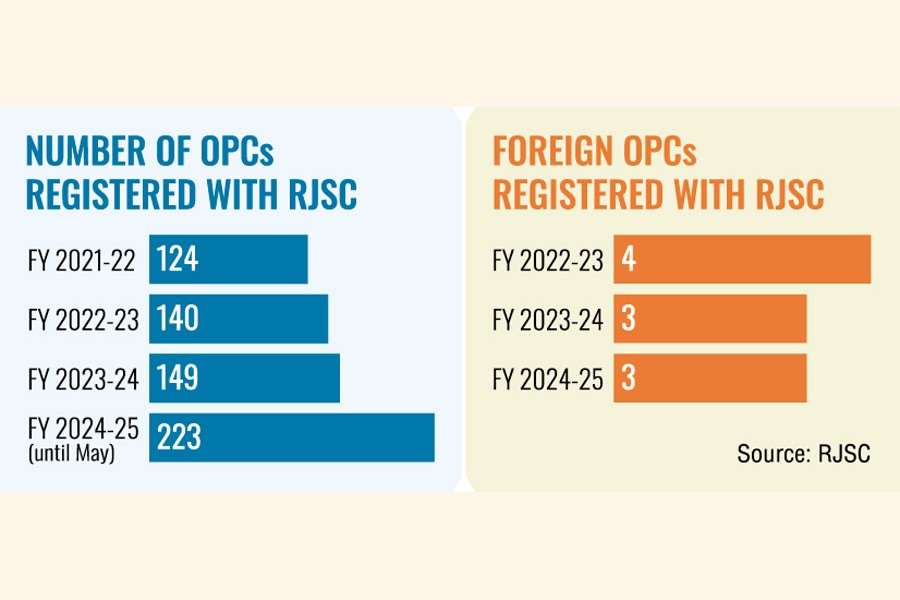

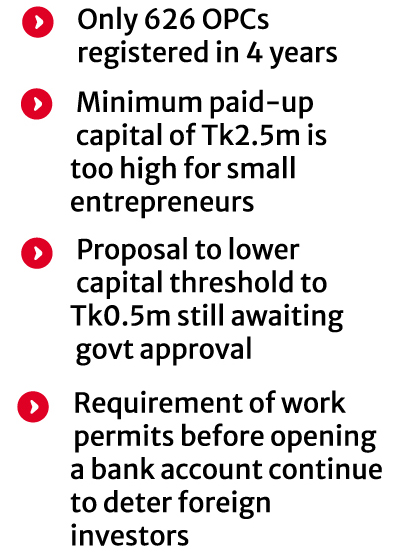

According to official data from the Office of the Registrar of Joint Stock Companies and Firms (RJSC), only 626 OPCs have been registered over the past four years. In FY 2021-22, just 124 OPCs were formed. The number inched up slightly in subsequent years-140 in FY 2022-23 and 139 in FY 2023-24-reflecting a sluggish adoption rate.

While the current fiscal year has shown an uptick, with 223 OPCs registered in the last eleven months until May, the overall trend still falls short of expectations given the policy intent.

The OPC framework was introduced to simplify business entry, promote formalisation of informal enterprises, and improve Bangladesh's standing in global ease-of-doing-business indices. It was also seen as a vehicle to attract FDI by enabling foreign individuals to establish a company on their own. However, legal and procedural bottlenecks-such as the requirement for work permits before opening a bank account or remitting paid-up capital-continue to deter foreign investors.

Experts argue that unless these barriers are eased, the OPC model will not be able to fully serve its purpose as a catalyst for foreign investment. They told the FE that the minimum paid-up capital of an OPC (Tk 2.5 million) is too high for the small entrepreneurs. It should be open in order to formalise the informal entities.

An official at the RJSC told the FE that the country's company registrar had submitted a draft proposal to the Ministry of Commerce around one and a half years ago, seeking to amend the minimum paid-up capital requirement from Tk 2.5 million to Tk 0.5 million. However, the amendment has not yet been approved, he added. The Companies (2nd Amendment) Bill 2020 was passed in parliament in November 2020 making legal provision for the formation of OPCs in the country, which are available in India, Pakistan and other economies.

A "natural person" can start an OPC by registering at the RJSC online. According to the bill, a single-person company has to have a minimum paid-up capital of Tk 2.5 million to a maximum of Tk 50 million. The minimum turnover of that company in the immediate past year must be between Tk 10 million to Tk 500 million. If the paid-up capital and turnover exceed the amount, the OPC can be transformed into a private limited company or in some cases into a public limited company.

An OPC has to hold at least one meeting of the board of directors every year. If director and the main person of such firms is one person, it will get relief from holding board meetings and decision-making processes. If that one person dies, as per the bill, the nominated person will get all the shares. However, the shares of an OPC may be transferred to another natural person only.

Talking to the FE, Policy Exchange Bangladesh Chairman M Masrur Reaz said only 626 OPCs formed since FY 22 reflect serious bottlenecks. The OPCs could also help attract foreign direct investment from smaller international firms, he said.

He slammed the Tk 2.5 million minimum paid-up capital requirement, saying it defeats the goal of easing business entry and formalising entrepreneurship. Reaz, who was involved in drafting the OPC-related reform in the Companies Act on behalf of the World Bank team, noted the original intent was to support start-ups and formalisation of ventures, not restrict them.

"It's unfair that a giant like a global multinational can start a company with Tk 500,000, but a new entrepreneur must invest Tk 2.5 million," he said, urging capital flexibility for non-public money ventures.

The concept of OPC has been legally recognised in the UK, the USA, China, Singapore, Turkey, the UAE, Pakistan, Nepal and Sri Lanka over the years. In most countries, there is no minimum paid-up capital requirement. Countries like India, Pakistan and Nepal have 100,000 rupee requirement of minimum capital for OPC in their respective currencies.

Barrister Md. Hafizur Rahaman Khan said FDI is being hampered by excessive restrictions on smaller foreign investors. The Supreme Court lawyer noted that foreigners often want to invest and operate businesses alone but face hurdles such as needing a work permit just to open a bank account-even before registering an OPC. "Why would a foreign investor be interested if they need a work permit to open a bank account?" he asked.

He added that investors are also required to have an office before registering an OPC, which discourages investment. "No other country has such legal bottlenecks. Even in India, the paid-up capital requirement for OPCs is nominal," he said.

He also criticised the Tk 2.5 million paid-up capital requirement, saying startups cannot afford it. Additionally, he pointed out that disputes between spouses make it difficult to manage jointly owned companies, which is why many prefer OPCs for smoother operations.

He recommended amending the Companies Act 1994 to remove these restrictions and better attract foreign investment.

A total of 10 foreign OPCs were registered with the RJSC over the last three fiscal years, from FY 2022-23 to FY 2024-25.

sajibur@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.