Published :

Updated :

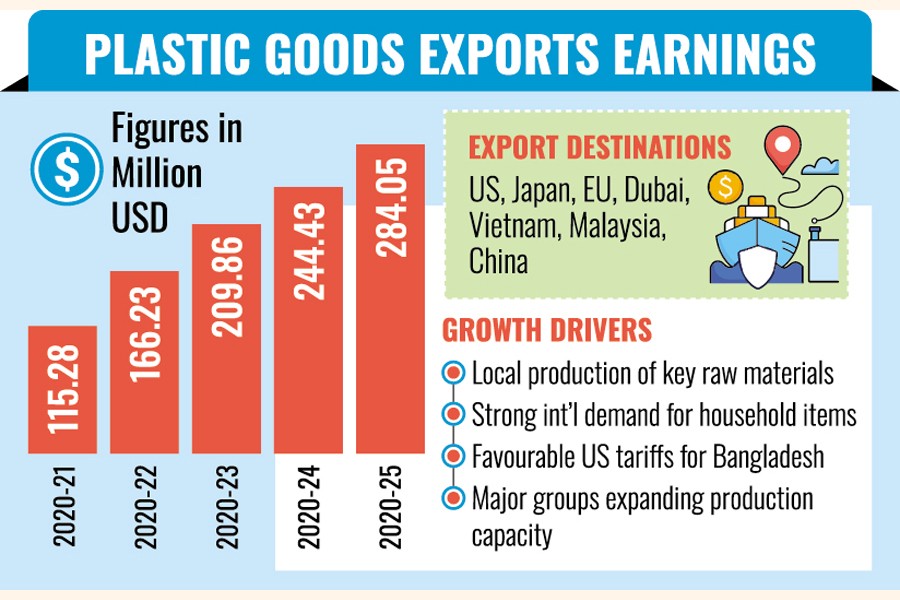

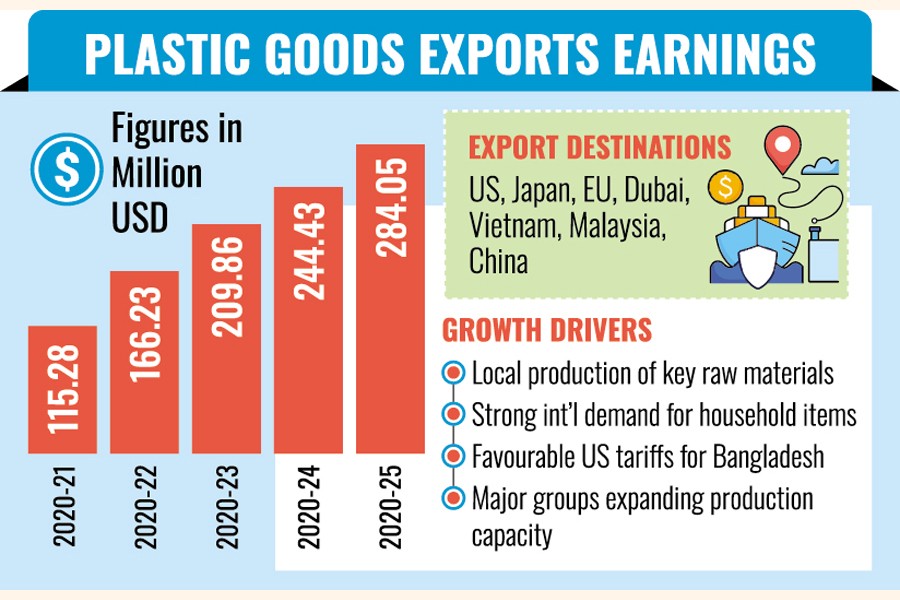

Local production of key raw materials, combined with a growing flow of international orders, had driven Bangladesh's plastic-goods exports to US$284.05 million in FY2024-25, up from $115.28 million in FY2020-21, marking nearly 147-percent increase over a period of five years, according to Export Promotion Bureau (EPB) data.

Industry insiders said the rise is supported by new US tariffs favouring Bangladesh, investments by major groups in domestic raw material manufacturing, and strong demand for household items such as PVC bags, kitchenware and tableware in global markets.

A few large groups are investing in expanding their capacity to produce plastic raw materials, which exporters believe will enhance the country's price competitiveness and reduce lead times, they added.

Data analysis showed that shipments of PVC bags, kitchenware and tableware rebounded strongly last fiscal year, spurring an overall plastic-product export growth of 16.21 per cent over the previous year.

PVC bags fetched $51.53 million, marking a 33.46 per cent rise, while kitchenware and tableware brought in $43.12 million, posting 47.47 per cent growth.

However, export earnings from plastic waste fell 15.50 per cent to $14 million in FY25. Waste exporters attributed this to rising local consumption in the plastic recycling industry.

Speaking to The Financial Express, Gias Uddin, a plastic waste exporter and director of Bangladesh PET Flakes Manufacturers and Exporters' Association (BPFMEA), said demand had declined globally while local consumption was on the rise.

"We export to the US, Dubai, Vietnam, EU, and Malaysia, while China imports only high-grade, white-washed waste materials," he noted.

Shamim Ahmed, president of Bangladesh Plastic Goods Manufacturers and Exporters Association (BPGMEA), said exports are set to rise further as more orders are being diverted to Bangladesh. Without disclosing names, he added that a major group has bagged large orders and is expanding capacity.

"Exports of household items, particularly kitchenware, tableware and toys, are also increasing steadily to markets in Japan, the US and the EU," he said.

Mr Ahmed credited the local manufacturing of some basic raw materials, previously imported, for improving competitiveness. Meghna Group has already begun producing such inputs, while two more groups are investing in the sector.

"Once they come on stream, we will be more price competitive and our lead time will reduce further," he said.

He, however, argued that plastic-product exports are higher than EPB figures suggest, as a large portion of production goes to export-oriented garment, food-processing, pharmaceutical and other industries under back-to-back letters of credit.

According to him, plastic accessories worth about $1.5 billion are supplied to the garment sector alone, accounting for around 3.0 per cent of total accessories use.

"This statistical gap is not misinformation but disinformation," he claimed, adding that deemed exporters receive all types of government support, including cash incentives.

Shahedul Islam Helal, managing director of Bengal Pacific, said his factory supplies polybags, hangers and gum tape to the garment industry. Orders are growing, he noted, as global buyers prefer compliant factories.

"New factories are compliant ones, and buyers place orders accordingly," he added.

Echoing the BPGMEA president, he stressed that plastic accessories supplied to export industries must be included in EPB data to better capture the sector's performance and shape appropriate policies.

Industry insiders said Bangladesh has yet to capture a notable share of the global toy market, despite duty-free access, competitive prices and quality goods. They blamed the lack of policy support for this underperformance.

BPGMEA leaders pointed out that China, the world's dominant toy exporter, is shifting to high-tech industries due to rising labour costs, creating opportunities for Bangladesh to strengthen its foothold.

However, they cautioned that the local plastic industry remains heavily dependent on imported moulds, mainly from China, while certification costs in India and Singapore remain high.

Mr Ahmed urged the government to support local mould manufacturing and address financing bottlenecks to enable sustainable growth of the sector.

munni_fe@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.