Streamlining Bangladesh development financing: WB, ADB unite under new framework

Published :

Updated :

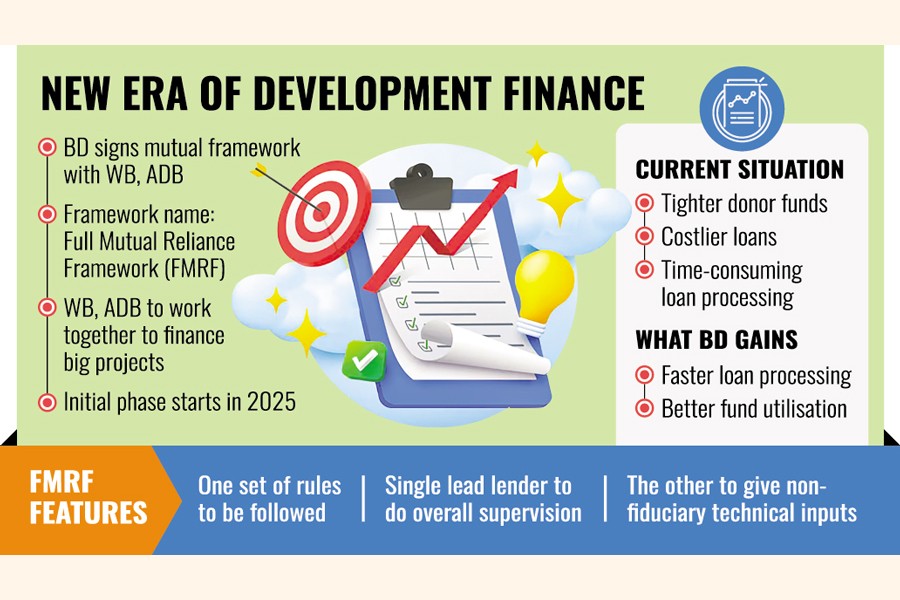

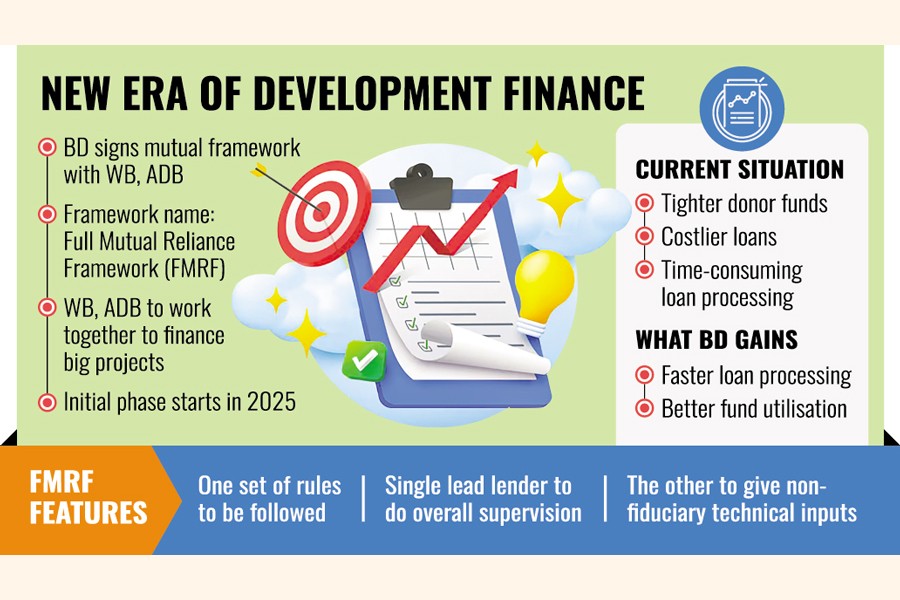

The World Bank (WB) and the Asian Development Bank (ADB) would work together to finance Bangladesh's big projects as the country signed a mutual framework for streamlining their loans and ensuring the best utilisation of the money, officials said on Thursday.

From now on, both the key multilateral development partners would work together, apply a single set of operational policy requirements, and engage with a single lender in charge of appraising, supervising, and monitoring co-financed projects, they said.

"Since project financing in recent days became tougher due to squeezed donor funds, resulting in the mobilisation of money from the open market, lending to borrowers is becoming costlier. So, both development partners want to join hands for streamlining financing," said a senior Economic Relations Division (ERD) official.

After its potential graduation from the status of the Least Developed Country (LDC) in 2026, Bangladesh might not enjoy the concessional loan facilities much, he said.

The mutual framework would facilitate reducing time losses in loan processing and ensuring the best utilisation of the funds, said another ERD official.

The Full Mutual Reliance Framework (FMRF) between the two lenders would be available for investment project financing and lending, result-based lending, policy-based lending, and any other modality and instrument that apply the same operational policy requirements of the lead lender, officials said.

The WB and the ADB will jointly identify and agree with their borrowers on the projects to be processed under the FMRF.

It is expected that this initiative will increase efficiency, streamline project processing, and enhance collaboration between the two institutions by allowing them to rely on each other's due diligence, as well as technical and environmental and social reviews, according to Ministry of Finance officials.

One of the two institutions that would be designated as the lead lender would be responsible for all aspects of project preparation, implementation, and completion, while the other would provide non-fiduciary technical inputs, they said.

The FMRF, the first-ever arrangement between the multilateral development banks, aims to streamline project processing and implementation, as well as deliver faster and more efficient results to borrowing clients, a WB statement recently said.

In line with the FMRF, borrowers under WB-ADB co-financing can rely on one set of rules - using the policies and procedures of either the WB or the ADB - for all aspects of project design, preparation, appraisal, supervision, completion, and evaluation.

"The FMRF is a significant step in our collaboration with the World Bank and will deliver lasting benefits to communities and economies across Asia and the Pacific," ADB President Masatsugu Asakawa said recently.

"By leveraging our respective strengths, we can enhance efficiency, scale impact, and provide a strong platform for sustainable and inclusive growth," he said.

"This partnership between the World Bank Group and the Asian Development Bank is a testament to the deep trust and abiding confidence between our institutions," World Bank Group President Ajay Banga was quoted as saying.

"It reflects a broader shift in development finance - where collaboration, not competition, delivers greater impact. By combining our strengths, we are making it faster, easier, and more cost-effective for countries to access the support they need.

"More than just an agreement, this is a model for how development banks can work together to drive better outcomes for the people we serve," he added.

The framework would initially apply to selected public sector projects during a four-year initial phase, starting in 2025, to refine operational approaches and assess outcomes, WB and ADB sources said.

Every year, the Washington-based WB, the largest development partner of Bangladesh, and the Manila-based ADB, the second largest one, provide Bangladesh with nearly $1.50 billion in loans and grants each.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.