Taka devaluation decelerates for policy buttress against dive

Tightened monetary policy, steady dollar inflow against subdued demand deter exchange-rate slides

Published :

Updated :

Local-currency taka depreciated marginally in the just-past calendar year as policy buttress and steady dollar flow deterred steep devaluation suffered in 2024, sources say.

This is due to tighter monetary policy, strong dollar inflow and subdued demand for the greenback, according to central bankers.

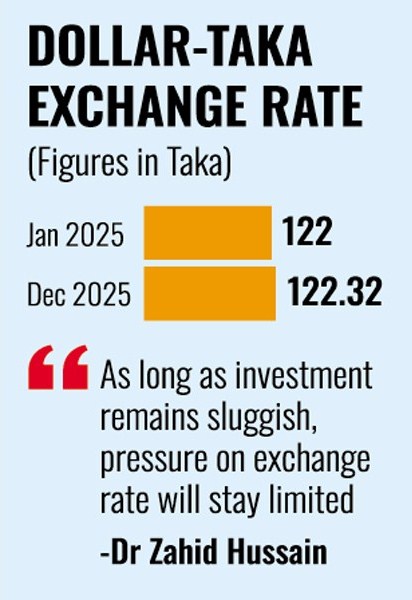

In early weeks of January in 2025 the dollar-taka exchange rate was recorded at Tk 122 and at the end of December 2025 it stood at Tk 122.32 or 0.27-percent depreciation, according to Bangladesh Bank statistics.

The taka had weakened more than 9.0 per cent in the calendar year 2024.

However, the local currency had lost its value by as much as more than 40 per cent between 2021 and 2024.

Senior central bankers say the sharply lower depreciation of the local currency against the US dollar in 2025 was a result of a combination of monetary measures aimed at restoring stability to the currency market.

"Our monetary-policy objective was to stabilise the currency market and make the local-currency taka attractive," one senior central banker, wishing anonymity, tells The Financial Express.

He says a stable policy rate and disciplined liquidity management helped strengthen the taka, which has not been seen in many years.

The official also mentions a decline in capital flight following the political transitions triggered in August 2024.

"A section of traders were accused of siphoning off dollars through imports," he says.

Consequently, the foreign-exchange reserve strengthened and volatility on the forex market eased.

Bangladesh received loan disbursement from the International Monetary Fund or IMF during the year under review, providing additional support to the balance-of-payments situation.

While the stronger currency helped contain inflation and reduced cost for essential commodities, it did not translate into rise in import volume.

Economists say weak domestic demand and poor credits to the private sector were main factors for poor demand for the dollar.

"As long as investment remains sluggish, pressure on the exchange rate will stay limited," says Dr Zahid Hussain, an independent economist.

He feels the taka's stability can be tested if import demand picks up sharply or global commodity prices rise.

jasimharoon@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.