International IFN Roadshow Bangladesh-2021

Brave new world: Islamic finance in BD

Published :

Updated :

International IFN Roadshow Bangladesh-2021 was held recently organised by REDMoney Group. The IFN Roadshow-2021 series opens with Bangladesh, a country that has a promising future in Islamic finance, especially as it launched its first corporate Sukuk in 2020. Bangladesh is on a sprint to aggressive development as the public demand for Islamic finance is rising, which has spurred the robust Islamic banking sector in the nation.

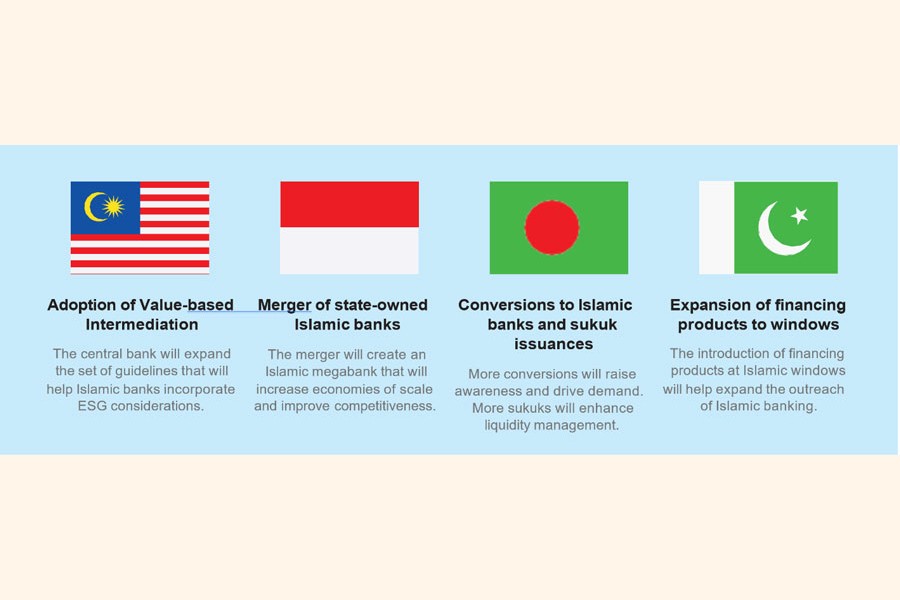

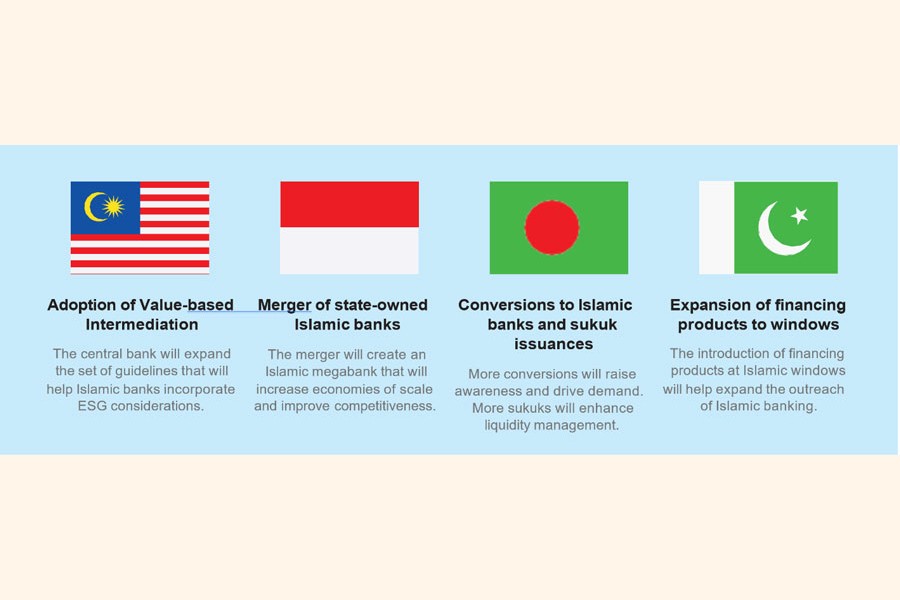

Moody's Investors Service forecasts a growth of more than 25 per cent in Islamic banking penetration in the country, backed by strong government support due to the high demand. Besides, Bangladesh is looking forward to greater conversion to Islamic banking, as access to finance due to digitalisation comes into play. Overall, the future looks bright for Bangladesh as the government looks toward an enhancement of liquidity management through more regulatory frameworks and the establishment of an independent Shariah committee. This can be seen as a platform to enable a conducive ecosystem for more Sukuk issuances and further developments in the country. There is also a stronger emphasis on the advocacy of Islamic finance literacy among the public to further catalyze growth opportunities of other sectors such as the Halal industry and much more. REDmoney group, Malaysia arranged this influential international roadshow the second time for Bangladesh on a virtual platform. The theme of the Roadshow was "Brave new world: Islamic finance in Bangladesh".

Nazrul Islam, deputy general manager of Bangladesh Bank, presented the keynote paper and Tengfu Li, analyst, Financial Institutions Group, Moody's Investors Services, gave a presentation on overall Islamic finance and banking in Asia. Saliba Sassine, managing director, Bluemount Capital, Scott Levy CEO, Bedford Row Capital, Ikbal Daredia, adviser to CEO, Acting Director - Global Markets and Fixed Income (GMFI) and Acting Director - Treasury, The Islamic Corporation for the Development of the Private Sector (ICD), Professor Dr M Kabir Hassan, Professor of Finance, Department of Economics and Finance, University of New Orleans and Dr Natalie Schoon, Consultant, Formabb were the panellists in this event. Md. Touhidul Alam Khan, FCMA (writer of this column), additional managing director of Standard Bank Limited, moderated the event.

In the keynote paper, Nazrul Islam said, Bangladesh is the second-largest Muslim- majority nation and has the ninth-largest population in the world. Since 2005/2006, it has been keeping its growth rate around 7.0 per cent. Though the unemployment and poverty rates are still high, and it is poorly ranked in the Global Innovation Index, Bangladesh is a nation of high potential due to its demographics with more than 60 per cent consisting of the younger generations who can bring changes in the economy. At the end of the October-December 2020 period, deposits and investment grew by 2.28 per cent and 3.55 per cent respectively while remittances and excess liquidity of the Islamic banking sector increased by 19.24 per cent and 60 per cent respectively compared with that of the last quarter. Islamic banks accounted for a 40.51 per cent share of remittances mobilised by the entire banking sector during the same period. It would be worth sharing that the most challenging parts not only in this sector but also in the overall banking system are the lack of skilled human resources, product diversification, the use of technology and a strong legal framework for Islamic banking in Bangladesh.

COVID-19 Pandemic has really changed the global economic perspectives, besides all the advances in monetary and macro-prudential policies to strengthen financial stability and growth. Almost all countries have suffered from this ongoing pandemic and projected global growth rate has been reduced and Bangladesh is not out of that effect. To boost the economic activities and to achieve sustainable growth, Bangladesh Govt and Bangladesh Bank jointly have taken so many measures which are under implementation. Some of the historic steps have been taken like; (a) Financial Stimulus Package including refinance Scheme; (b) Credit Guarantee Scheme for Cottage, Micro, Small Enterprises; (c) Issuance of Sukuk for the first time in Bangladesh and (d) Introduction of Start Up Fund and Directives to build Banks Own Fund.

Dr Natalie Schoon, Consultant, Formabb said the Islamic finance market in Bangladesh is approximately 30 per cent of the overall financial services market, yet the service offerings are not yet very well developed. However, the issuance of Sukuk by Bangladesh Bank in December 2020 is certainly a step in the right direction. A number of possible future developments were highlighted such as a centralised Shariah board, and the development of both regulations and product development in line with international best practice. This will assist with (international) trade-related financial services and in growing the Islamic financial services industry. There are potentially strong opportunities for Islamic finance in Bangladesh going forward, with innovation, as well as creativity in meeting customer demand, being key.

Tengfu Li, an analyst in the Financial Institutions Group of Moody's Investors Service, has shown in his presentation that firstly, the country's robust economic growth and favourable demographics provide a strong foundation for growth in Bangladesh. Secondly, the momentum for Sukuk issuances has picked up pace with the recent maiden government and corporate Sukuk issuances with more expected to come this year. In addition to bridging the long-term financing gap in Bangladesh, these Sukuk will help banks, which currently lack liquid Islamic instruments to invest in, to smoothen their liquidity management. Last but not the least, more can be done in terms of the regulatory framework to support a sustainable growth in Sukuk.

As one of the panellists, Dr Scott Levy, CEO of Bedford Row Capital, has mentioned that Bangladesh is probably the most interesting emerging economy. Bangladesh and a few Bangladeshi corporates have only recently entered the international capital market stage and done so with some innovative and forward-thinking initiatives. Islamic finance (Sukuk in particular) has enormous growth potential both for the domestic market and as a destination for global Sukuk investors in search of better returns. However, some work needs to be done to take advantage of the strong start to 2021. The domestic capital markets have little experience of secondary markets (too heavily reliant on Murabahah) for Sukuk and the governance around Islamic finance is in its infancy.

"We have seen a lot of recent interest in Bangladesh for Sukuk investment, but challenges remain around central bank policy and local governance to bring Bangladesh to the forefront of Islamic capital markets. IFN's first Bangladesh forum demonstrated just how much knowledge and international experience there is to help support the development of Islamic finance in Bangladesh - the future is bright", Dr Scott also commented.

Dr M Kabir Hassan, professor of finance in the Department of Economics and Finance at the University of New Orleans, focussed on the following challenges facing the Islamic finance industry in Bangladesh:

(a) Communication gap: Misconceptions, misunderstandings and misplaced notions about Islamic finance must be removed through awareness and advocacy programmes.

(b) Trust gap: Social business and impact investing should be emphasized to remove tension among the stakeholders of the Islamic finance industry.

(c) Innovation gap: Balance between macro and micro Maqasid should be maintained - the so-called form versus substance (financial engineering).

(d) Talent gap: A new brand of scholars who are well versed in Islamic jurisprudence and secular financing techniques and mechanisms must be nurtured.

(e) Regulatory gap: A proper and efficient regulatory framework and law should be enacted to provide a level playing field and guidelines and standards for Islamic finance industry stakeholders.

The esteemed panellists and the presenter discussed several areas particularly on how Islamic banking can be developed across the globe. Sufficient evidence was there to arrive at a conclusion that the Islamic banking industry in the South Asian region has access to adequate capital required for sustainable growth. In Bangladesh, it bears a long-term potential as well. They also suggested that the country should put more emphasis on the governance and development of Sukuk that can fulfil the objectives of Shariah rather than on the budgetary deficit of the government. Should a secondary capital market be developed, Sukuk could be more popular and outperform conventional bonds in the market at some point. They view green Sukuk as this region's newfound potential to strengthen sustainable banking. Market penetration for this industry is also being accelerated through the country's agent banking networks.

The potential of the Sukuk market is obvious here in Bangladesh where the government has due interest as to some mega infrastructure projects. According to the experts, the playing field has to be level and the approaches from banks, non-banking institutions and other key market players need to be comprehensive for which a guideline and roadmap should be prepared if the bottleneck is to be reached under the scope of social finance. The government should look into the tax structure to gain a bigger share in Islamic banking. Bangladesh Bank needs to conduct fit and proper tests besides selecting members of the Shariah boards in Islamic financial institutions, so that Shariah governance can be ensured properly.

As agent banking has been employed with the adoption of technology to penetrate the country's unbanked population, Bangladesh easily qualifies as a fine example of financial inclusion. The experts also opined that the existing technologies should be upgraded, including those used in fintech to ensure greater transparency. They observed that the pool of trained professionals and human resources is not adequate when it comes to the delivery of Islamic banking services and products. Because of that shortage, they emphasized the development of skilled human capital to support the industry's goal to add values and advance while envisioning a state where it is based on Shariah itself, not just compliant with Shariah laws.

Bangladesh's Islamic banking and finance industry has ample growth potential that would enable it to hold its own with its neighbours, Sri Lanka and Pakistan, and especially with strong support from a government that is pushing for more Islamic finance transactions in the country. A promising Sukuk pipeline and more banks/FIs offering innovative Islamic products towards getting better outcome with a more comprehensive legal and regulatory infrastructure as now Islamic finance is one of the fastest growing financial sectors in Bangladesh.

In global ranking conducted by Islamic Finance Country Index, Bangladesh is positioned 8th in the globe and the country showed its comprehensive development than Saudi Arabia, Iran and many other GCC countries. In fact, Bangladesh Islamic Banking Industry, being more than one-fourth of Banking asset and liability, have gained its popularity due to, obviously, its intrinsic value of Islamic finance, not for only the business motive.

Despite the challenges that Islamic banking sector is facing due to the pandemic, the overall growth of the Islamic finance market in Bangladesh has been possible with inclusive investments in infrastructure and the possibilities brought by Sukuk, particularly through the digitalisation of products and services. Even amid the global pandemic, the year-2020 had been remarkable for Islamic Banking industry in Bangladesh because of the landscape being both bullish and competitive against the conventional counterparts.

Md. Touhidul Alam Khan is Additional Managing Director of Standard Bank Limited, Bangladesh. He was also the member of advisory board of IFN Roadshow Bangladesh-2021. touhid1969@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.