Published :

Updated :

The Interim government presented its annual budget on June 2, with a total outlay of TK7.9 trillion which is 0.88 per cent lower than the outgoing budget, and a revenue target of TK5.64 trillion resulting in a budget deficit of TK 2.26 trillion. It is a trimmed budget relative to budgets presented in previous years reflecting stark economic reality facing the country. The economy is facing a combination of slow growth, high inflation, and rising unemployment notwithstanding the impending political changeover.

Even after almost ten months in power, there remains a sense of unease about the future as to whether the interim government under the leadership Nobel Laureate Professor Mohammad Yunus can get the economy back on track while spearheading political reforms needed to rebuild a durable democratic system and prevent another dictator from emerging. The economic factor will ultimately be the key issue in determining the interim government's success. It is a monumental challenge.

The finance Advisor in defending his austere budget said the budget "is realistic, pragmatic and implementable' in the current economic context. Such a scaled down "responsible" budget most likely will receive positive nod from the IMF and the World Bank if not from the economically disadvantaged section of the population.

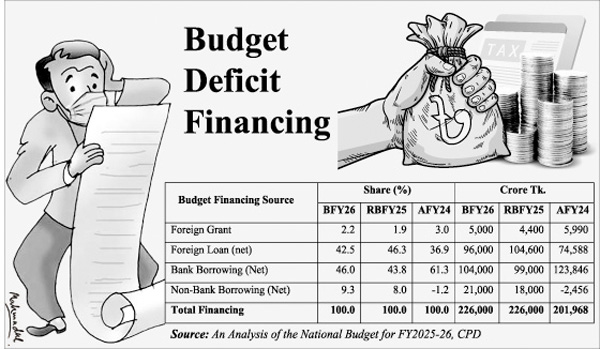

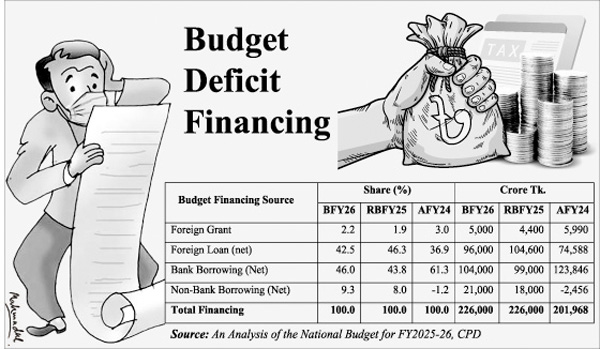

The measures to reduce the budget deficit have resulted in a decrease in annual development expenditure, set at Tk 2.3 trillion, which is a 13.2 per cent decline from the original allocation in the previous budget. The proposed fiscal deficit of TK1.25 trillion will further balloon the already accumulated public debt despite the austerity measures.

In 2024, Bangladesh's public debt was $181,008 million. This amount represented 40.13 per cent of Bangladesh's GDP. Bangladesh's debt per capita in 2024 was $1,056. The public debt is composed of domestic debt (56 per cent of total debt) and external debt (44 per cent). Bangladesh's Private debt and household debt debts stand at 36.92 per cent and 6.69 per cent respectively of GDP in 2025.

Now the debt/GDP ratio is also expected to rise further at the end of fiscal 2025-26. Because debt is a stock rather than a flow, it is measured as of a given date, usually the last day of the fiscal year. Interest payment will account for 22 per cent of total revenue budget or 15.5 per cent of total spending. Between 1979-80 and 2024-25, Bangladesh always ran budget deficits except for four years. It indicates the budget has a structural deficit problem rather than cyclical.

The debt/GDP ratio for Bangladesh is notably lower when compared to the United States at 125 per cent, the United Kingdom at 105 per cent, and Japan at 270 per cent. If output falls sharply and the deficit grows, the debt/GDP ratio for Bangladesh will further climb up. Only budget surplus or high economic growth can help reduce the debt/GDP ratio.

The government also increased subsidy spendings to deal with rising oil, gas and fertiliser prices amounting to 11.3 per cent of budget expenditure. In the present situation, continuous dependence on existing energy and food subsidies will restrict adjustments in domestic prices and hinder fiscal measures from promptly addressing any significant economic challenges that may emerge in the coming months or years. Therefore, it is imperative that the emergency economic support does not become deeply ingrained.

A structural deficit problem implies that even allowing cyclical fluctuations in the economy, current government spending is being financed by borrowing. With structural deficit, therefore, a deficit will be posted regardless of the strength of the economy. A structural deficit problem implies that borrowing will become increasingly unsustainable or more expensive. A structural deficit problem can lead to a rise in interest payments as a percentage of GDP which means increasing amount of tax revenue would be needed to make debt interest payments.

Only spending cuts or raising revenue or both are methods that can get rid of structural deficits. But neither of these methods are appealing to any government and that is why structural deficits continue to linger. More importantly, spending cuts and tax concessions combined can also create a challenge more existential than fiscal. Therefore, the government could reform the taxation regime to solve the structural deficit problem. The current budget does not address that issue significantly.

This budget further demonstrates that Bangladesh is trapped in highly bureaucratised budgetary system with deep structural impediments. A notable example is the longstanding budgetary practice that still provides opportunities to legalise laundered money. This budget is no different in this regard. There also appears to be an inability to reform the taxation system which remains a critical issue for a long time.

10.2 per cent of budget allocation went for the public administration up by 1 percentage point along with increased special benefits for public servants who are set to receive a "special benefit" of up to 15 per cent on their basic salary. It remains unclear what productivity gains were achieved by public servants that justified an increased allocation. Also, the public service in Bangladesh is not known for efficiency. In fact, the public service in Bangladesh is highly bloated, inefficient and also known to be corrupt.

The Budget has allocated Tk 89.2 trillion for subsidies. While energy remains the primary focus, subsidies allocated for fertiliser, mechanisation, and food assistance remain in place as before. Continued reliance on existing energy and food subsidies will constrain adjustments in domestic prices, subsequently limiting the effectiveness of fiscal measures in addressing potential economic challenges that may occur in the coming months or years. Emergency economic support should not become permanent.

The budget has set a GDP growth rate target of 5.5 per cent for the fiscal year 2025-26 against a realised GDP growth rate of 3.97 per cent for the current fiscal year and an inflation target of 6.5 per cent. However, such a growth projection comes at a time when all major economies are facing a downturn, the US is set to suffer the sharpest drop. The OECD predicts US growth will slow from 2.8 per cent in 2024 to 1.6 per cent in 2025 and 1.5 per cent in 2026. The OECD further said, "This reflects the substantial increase in the effective tariff rate on imports and retaliation from some trading partners, high economic policy uncertainty, a significant slowdown in net immigration, and a sizeable reduction in the federal workforce." The inflation target appears challenging based on the experience of the past few years as well as the current economic and political climate.

An economic slowdown in developed countries is concerning for developing countries like Bangladesh, which depend on exports to wealthy regions such as the US, UK, and EU. Economic slowdown in these countries will hit Bangladesh hard. It is also to be noted that all developing countries including Bangladesh are at the receiving end of the advanced economies macroeconomic policy consequences. The budget document does not indicate that the Bangladesh economy may experience a significant slowdown, recession, or stagflation. Rather the picture painted is just the opposite.

According to the World Bank during the interim government's tenure, more than 2.7 million people have become new-poor. Of these, 1.8 million are women. Wages have not kept up with inflation, reducing real incomes. High inflation and increasing unemployment are indicators of an economy potentially experiencing stagflation. Domestic and foreign investment are stagnant, and income inequality is increasing, further worsening economic turmoil.

For a trade dependent country like Bangladesh, budget deficits can boost inflation considerably. Also, fiscal deficits can widen the current account deficit and push up interest rates. An appreciating US dollar as reflected in the BDT/USD exchange rate will make debt repayment or buying commodities even more expensive.

The budget includes measures designed to prepare the economy for becoming a lower-middle income country by November of next year. With that objective in mind, the tariff structure has been simplified by reducing tariffs and removing supplementary and regulatory duties on a very large number of goods rather than introducing a simplified tariff rate across the board. Despite design limitations, this is a positive step towards creating a more competitive environment in the country which is the key to productivity growth.

The principal fiscal challenge facing Bangladesh needs to be viewed in the context of high inflation, rising unemployment, poverty and income inequality and falling to stagnant investment both domestic and foreign. This fiscal year's budget prioritises debt servicing over public welfare. Structural reforms are necessary and have been recognised for a long time as crucial. But the budget appears to be business-as-usual type without any attempt to undertake structural reforms needed to revamp the economy.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.