Published :

Updated :

In recent months, Bangladesh has been visibly active in its bid to attract foreign direct investment (FDI). High-profile investment forums have been organised, numerous trade delegations from Western countries have visited Dhaka, and most recently, a large business delegation from China, led by its Commerce Minister, visited the country. These activities signal the government's awareness of the need for FDI and its willingness to project Bangladesh as an emerging destination for global investment.

However, beyond the banners, receptions, and bilateral talks, there lies a more sobering reality. Economists and entrepreneurs -- both domestic and foreign -- remain largely unconvinced about the true readiness of Bangladesh to absorb and sustain FDI on a meaningful scale. The enthusiasm generated by such events is not translating into actual investment inflows. The scepticism is rooted in several persistent and structural issues -- political instability, bureaucratic red tape, outdated visa policies, and infrastructural bottlenecks like unreliable energy supply.

Foreign investors do not merely look for profit; they look for predictability, consistency, and long-term security. In this context, political stability is paramount. If there is any lingering doubt about the continuity of policies, or if street demonstrations become a frequent feature of urban life, it raises red flags. No matter how attractive the financial incentives may be, investors will hesitate to put their capital in an environment where they fear disruption, vandalism, or shutdowns resulting from political unrest.

Indeed, political stability is not a luxury -- it is a prerequisite for economic development. Bangladesh's past growth trajectory in the garments and textile sector was bolstered during relatively stable periods when the political temperature allowed industries to function smoothly. But today, if political contestations translate into traffic gridlocks, shutdowns, or even violence, the potential of the country as an FDI destination weakens substantially.

Therefore, if Bangladesh is serious about attracting sustainable foreign investment, it must go beyond showcasing opportunities and commit to ensuring political calm. Investors do not have the time -- or appetite -- to wade through chaos.

Another major deterrent for investors is the country's cumbersome bureaucratic processes, especially concerning customs clearance. Numerous foreign investors have pinpointed this as one of the greatest challenges of doing business in Bangladesh. The customs system is often riddled with procedural delays, a lack of transparency, and arbitrary decision-making. These delays don't just inconvenience business; they cost money -- a lot of it -- and create a general atmosphere of unpredictability.

In a globalised economy where the speed of delivery can make or break a business model, time lost in clearing unnecessary hurdles is a dealbreaker. Goods stuck in customs, inconsistent assessments, and multiple layers of unofficial negotiations only dampen enthusiasm. Simplifying, digitising, and depoliticising customs procedures is not a matter of prestige -- it is a fundamental requirement to become competitive.

Another baffling policy flaw lies in the current visa regime for foreign investors. Presently, foreign businesspersons often have to renew their visas every three months. This sends a poor signal -- not only of inefficiency but also of a lack of welcome. Investors want to feel valued and secure, not scrutinised or inconvenienced at every turn. The visa process should be overhauled to issue long-term, multi-entry business visas with a straightforward renewal mechanism. Other investment hubs in the region have already moved in this direction -- and Bangladesh cannot afford to lag behind.

The structure of Bangladesh's economy, which relies heavily on protecting domestic industries through high tariffs, also needs careful reconsideration. While protectionism can be justified during the early stages of industrialisation, prolonged reliance on it discourages foreign investors who find local production costs inflated and competitiveness low. If domestic products are costlier than imports, there is little incentive for global manufacturers to establish production facilities locally.

To attract FDI, Bangladesh must signal that it is open to competition and committed to free-market principles. This does not mean abandoning all protection but striking a balance that encourages domestic industries to innovate and scale up, while making room for foreign capital and expertise.

Industrial investment is energy-intensive. Yet, factory owners and industrialists in Bangladesh continue to complain about the unreliable energy supply -- be it electricity or gas. Frequent power outages, poor grid infrastructure, and gas shortages are not just technical hiccups -- they are business risks. When factories cannot run at full capacity due to energy disruptions, the cost of production increases, deadlines are missed, and investor trust erodes.

As the country moves towards attracting investments beyond the garments sector -- particularly in high-tech manufacturing, electronics, and heavy industries -- it must prioritise a reliable and expanded energy supply. This includes both conventional sources and renewable alternatives, with strategic investment in power infrastructure.

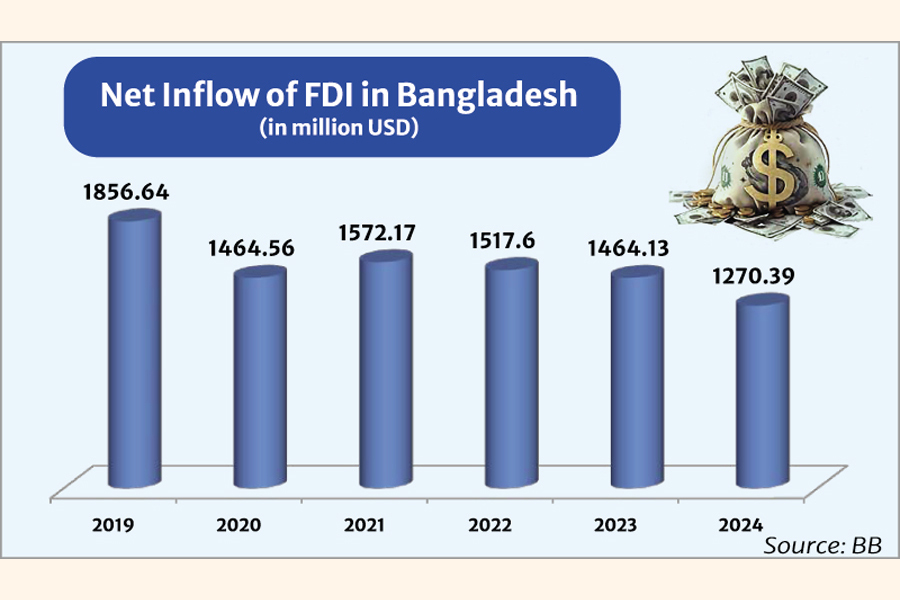

A quick glance at regional comparisons further illustrates the challenge. Bangladesh's FDI-to-GDP ratio is a mere 0.75 per cent, significantly lower than India's 1.7 per cent and Vietnam's impressive 4.7 per cent. This is not just a statistic -- it is a symptom of missed opportunities. Vietnam, in particular, has emerged as a global case study in successfully attracting FDI through structural reforms, political stability, and a welcoming business climate.

There is, however, an emerging window of opportunity for Bangladesh. With the U.S. imposing tariffs on Chinese exports and many Western firms looking to diversify their supply chains away from China, Bangladesh stands to gain. But capital will not shift to Bangladesh merely on the basis of geography or labor cost. The country must prove that it is a reliable, efficient, and politically stable destination.

The frequent high-level visits, conferences, and investment summits are useful in showcasing Bangladesh's potential. But potential alone does not attract investment -- performance does. Foreign investors are smart, pragmatic, and well-informed. They don't make decisions based on ceremonial handshakes or promotional brochures. They conduct due diligence, observe the socio-political dynamics, and analyse systemic bottlenecks before committing their money.

Thus, while the optics of engagement are encouraging, they must be accompanied by real, visible reforms. A stable political environment, streamlined customs process, investor-friendly visa policy, open trade structure, and reliable energy infrastructure are not optional -- they are essential.

The government, if it truly seeks to make Bangladesh a serious player in the global investment arena, must realise that sound bites and symbolic gestures are not enough. Structural reforms, political maturity, and administrative efficiency are the only real currencies in this highly competitive global race for capital.

Bangladesh stands at a crossroads. With its demographic dividend, strategic location, and proven industrial base in garments, it has the right ingredients to become a South Asian investment hub. But unless the climate of uncertainty is replaced with stability and reform, the opportunities ahead will remain untapped, and foreign investors will continue to look elsewhere. The time to act is now.

mirmostafiz@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.