Published :

Updated :

For the last three years, the country has been experiencing high inflation, eroding the real income of fixed-income people as money loses its value and becomes a melting asset. So, the key question now is whether inflation will continue to rise in the new year. Though inflation witnessed a modest downward trend in the last half of the past year, it has not subsided significantly, giving people adequate respite.

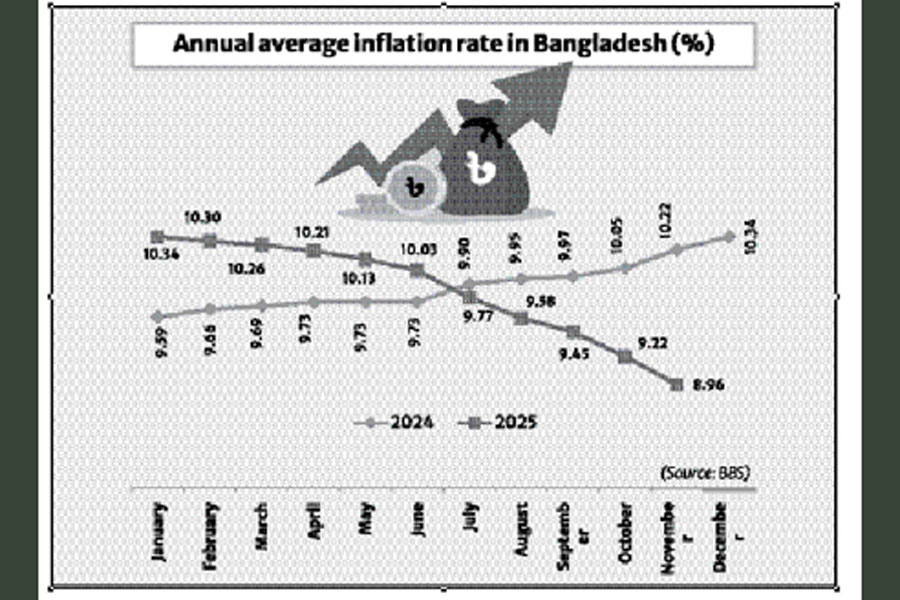

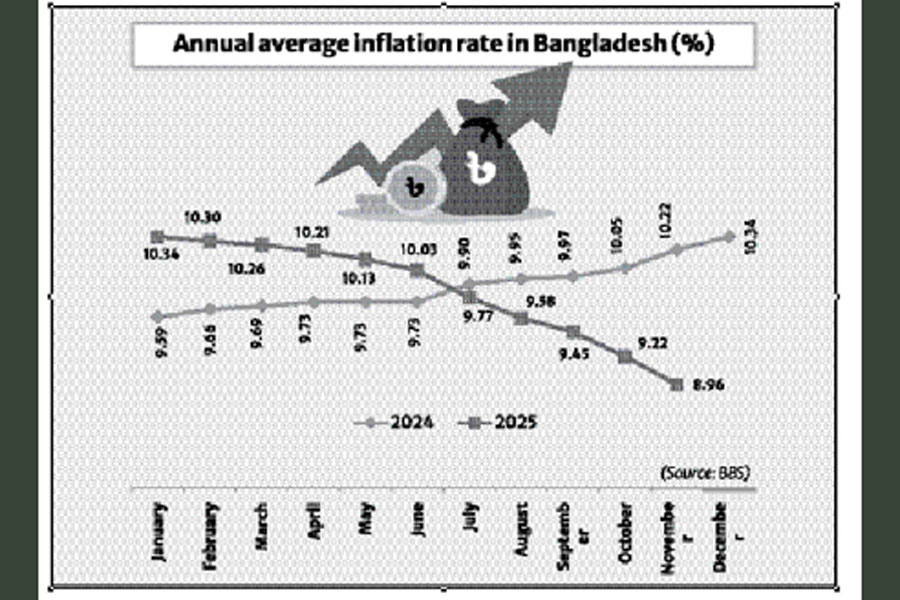

Official statistics showed that the annual average rate of inflation was 9.48 per cent in December 2023, which increased to 10.34 per cent at the end of 2024. The rate, however, modestly came down to 8.96 per cent in November 2025. It also showed that the inflation rate fell below 10 per cent in July and remained below 8.50 per cent until November last year. The December figure is yet to be available, and it can be presumed that the rate would remain above 8 per cent.

Bangladesh Bank, in its half-yearly monetary policy statement (MPS) for July-December 2025, asserted to bring down the inflation rate to 7 per cent by the end of the year. To achieve the target, the central bank continued the tight monetary stance. "BB is likely to maintain its tight monetary policy in H1FY26 to contain inflation below 7.0 per cent, while still supporting productive economic activities," said the statement announced in July last year. It now appears that monetary tightening does not work entirely, and in the MPS for the January-June period in the current year, the central bank may maintain the tight monetary stance.

Monetary tightening is a contractionary policy conducted by the central bank that raises interest rates to increase the cost of borrowing from banks and attract people to park money in banks. In this process, the supply of money in the market is gradually reduced, leading to a cut in aggregate demand and finally pulling down the inflation.

Inflation is the rate of increase in prices over a given period of time, and it is generally a broad measure, such as the overall increase in prices or the increase in the cost of living in a country. Inflation ultimately 'represents how much more expensive the relevant set of goods or services has become over a certain period, most commonly a year.'

Macroeconomic theory links the money supply and inflation conversely, meaning a rise in money supply pushes inflation, and a decline in money supply reduces inflation. So, it is necessary for the central bank to contain the growth of the money supply.

By reducing the money supply or the growth of the money supply, Bangladesh Bank has been trying to contain the inflationary pressure for the last two years. The money supply is usually measured by M2, or broad money. It includes: currency outside banks, demand deposits, time deposits and deposits with the central bank other than deposit money banks (DMB). If time deposits are excluded, the combination of the three others becomes the M1 or narrow money. Around three-fourths of M2 is time deposits or fixed deposits in banks having various maturity periods.

At the end of FY23, money supply stood at Tk 2.27 trillion, which was more than 10 per cent of the amount in the same period of FY22. In FY24, the growth of the money supply moderated to 7.50 per cent, reaching Tk 2.40 trillion. It increased to Tk 2.55 trillion in FY25, up 7 per cent. On a monthly basis, M2 dropped by only 0.23 per cent in October last from September. The figure for November and December is still not available.

The central bank has also kept the policy rate, repo rate to be precise, unchanged at 10 per cent since the announcement of the H1MPS in July last. It is because the rate of inflation has yet to fall to the desired level of 7 per cent, despite a downward trend. The downward trend also supports the central bank to not enhance the policy rate, which again helps the commercial banks to offer credit without hiking the interest rates significantly. Nevertheless, the growth of private credit is still modest, only 6.23 per cent in October last year compared to the previous year, reflecting sluggish demand by businesses.

Two decades ago, when Bangladesh Bank started to announce the monetary policy publicly by issuing written statements, it also declared the policy framework. Under the framework, to achieve the goal of price stability coupled with economic growth, a number of policy tools were designed, including repo and reverse repo auctions, bank rate, and SLR and CRR. Reserve money was set as the operating target, and M2 as the intermediate target. Two decades later, Bangladesh Bank has shifted from a monetary targeting approach to an Interest Rate Corridor (IRC) framework to fight inflation. Nevertheless, the ultimate objective to contain inflationary pressures and support economic growth remains unchanged.

Curbing excessive inflation, however, is not the sole responsibility of the Bangladesh Bank, and the central bank cannot achieve the goal without support from the government. Though the central bank can adjust its tools to fight demand-pull inflation, those tools are less effective against cost-push or supply-driven inflation. Again, due to growing complexity, it becomes challenging to determine the nature of inflation precisely, as cost-push inflation may overlap with a demand-pull inflation.

To contain the cost push inflation, forms of inflation caused by an increase in the cost of inputs, it is necessary to take measure like cut in taxes or relax the imports to increase the supply of the products. The finance ministry has the authority to cut or hike up tax, while import relaxation is the commerce ministry's job. For the central bank, it is difficult to intervene as higher inflation requires rate hike although in regards to cost push inflation, doing so may bounce back. That's why persistent coordination between fiscal and monetary policies is necessary to check the inflation under control.

As Bangladesh is going to witness the 13th general election on February 12 this year, the economy has already entered the election-centric political business cycle. Whether inflation will stay at the current level or rise during the cycle is difficult to say. It is widely believed that inflation is unlikely to decline by a notable extend before the election.

asjadulk @gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.