Published :

Updated :

Though the services sector has become a leading source of growth and employment in the least developed countries (LDCs), it has yet to provide adequate, productive, and formal jobs. Instead, service-centric jobs in these countries are clustered in low-productivity and informal sectors, leading to limited income gains.

These are some of the key findings of the Least Developed Countries Report 2025, released by UN Trade and Development (UNCTAD) last week. The report seeks to answer the central question: 'Are services the new path to structural transformation?' To do so, it explored various aspects of service-related economic activities in LDCs and their impacts on the development journey of these countries.

The United Nations (UN), in its System of National Accounts, defined services as "the result of a production activity that changes the conditions of the consuming units or facilitates the exchange of products or financial assets." Simply put, services are intangible economic activities provided by one party to another. The activity usually involves an act or experience and is consumed at delivery. It cannot be owned, kept, or carried like physical products. Services require human work, knowledge, and engagement to address specific needs. Because services span a wide range of activities across the economy, they are sometimes difficult to define precisely.

The report focuses on five core areas. First, despite the growing role of services, average per capita growth in least developed countries remained weak. The report showed that average per capita growth in LDCs was just one per cent in 2024, leaving them further behind other developing economies.

Second, though services have absorbed a major share of the growing workforce in these countries, earnings remain low. There are 44 LDCs, including Bangladesh, and services account for nearly half of these countries' average gross domestic product (GDP). Nevertheless, agriculture remains the largest employer in LDCs, accounting for around half of total jobs in 2023. Low productivity has limited the potential of the services sector. Labour productivity is the amount of output produced per unit of labour, typically measured as output per worker or per hour worked. The report calculated the median real labour productivity in constant prices using purchasing power parities (PPPs). It showed that productivity in LDCs increased from $5,430 in 1991 to $8,579 in 2024, with a compound annual growth rate of 1.4 per cent during the period under review.

Fourth, despite tourism becoming the leading export sector for LDCs and digital delivery services rising, these countries are falling short of potential gains. According to the report, tourism contributed more than 5 per cent of GDP in most LDCs, although high revenues do not automatically translate into jobs or value retention. UNCTAD noted that the dominance of travel and transport in LDC services exports has created structural vulnerabilities. In 2024, travel accounted for 36.9 per cent of exports and transport for 31.7 per cent, but LDCs' combined share of global travel and transport exports was just 1.1 per cent, reflecting limited competitiveness. LDCs' share in the global digitally deliverable services trade was only 0.16 per cent in 2024. These exports are concentrated in a few LDCs led by Bangladesh, Ethiopia, Senegal, Nepal, Cambodia, and Uganda.

Fifth, weak and inadequate data on the sector continue to limit effective policymaking to tap the prospects of the services trade. Trade in services is generally defined as the exchange of intangible products across borders, which can occur directly or indirectly, and includes services embodied in traded goods or provided through foreign investment in affiliates. Unlike trade in goods, trade in services is complex and sometimes difficult to measure.

The share of services in total global exports increased to 22 per cent in 2019-2023, from 18 per cent on average in 2005-2009. It stood at around 24 per cent last year. In line with the global trend, LDCs' services exports grew 13.5 per cent in 2022-2024 on average, according to UNCTAD. In nominal terms, services exports by LDCs reached $52.1 billion last year, up from $12.1 billion in 2005. During these two decades, LDCs' combined merchandise exports increased to $274 billion from $74 billion. Bangladesh was the top merchandise exporter among the LDCs in 2024, according to the World Trade Organization (WTO). WTO estimates also showed that Ethiopia was the largest exporter of commercial services in 2024, followed by Tanzania and Bangladesh. Trade in commercial services is determined by subtracting government goods and services from total trade in services. The share of government services in total trade in services is quite small.

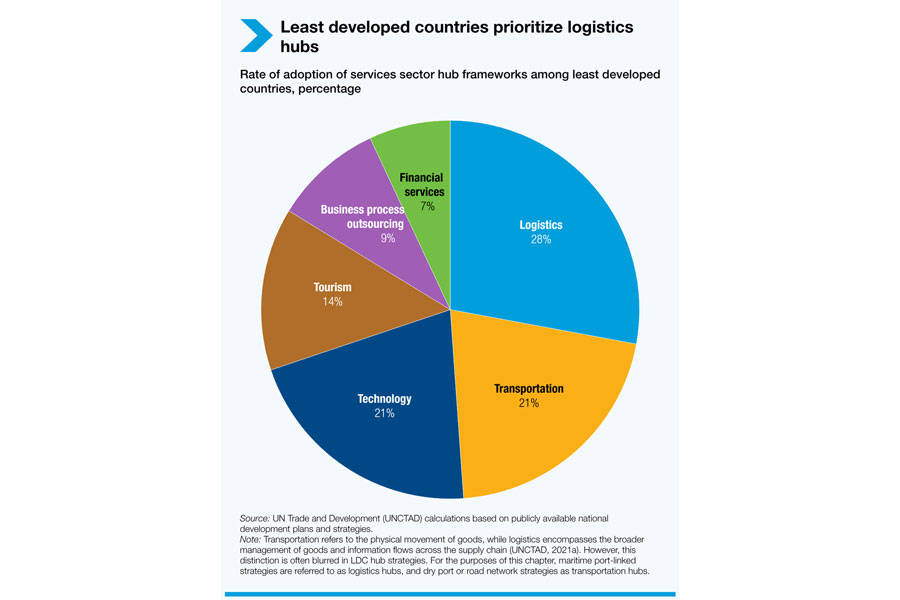

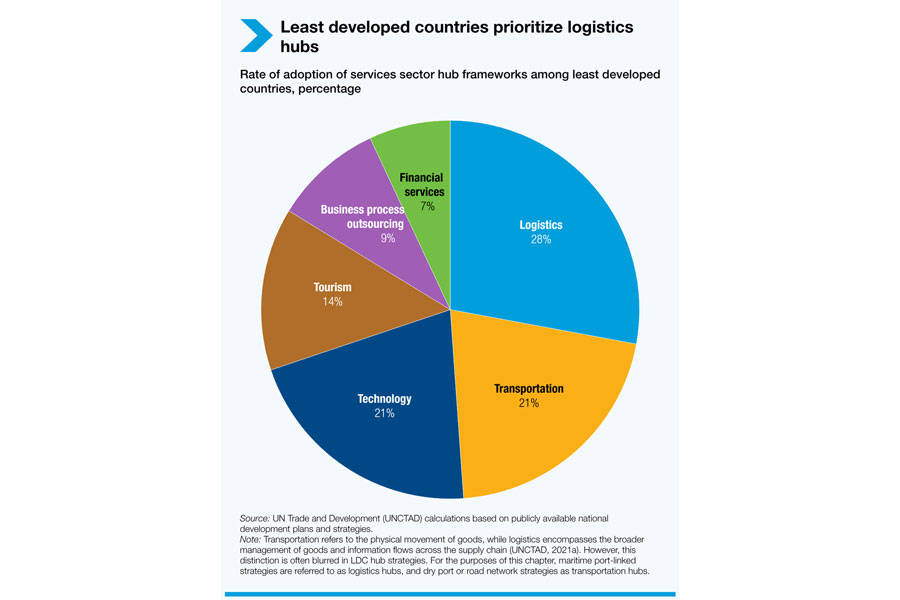

Overall, the UNCTAD publication outlined the challenges facing LDCs and provided policy guidelines to overcome them. For instance, it noted that LDCs are increasingly adopting hub strategies, meaning they are concentrating investment and policy support in specific services or locations. It found that LDC policymakers have prioritised logistics hubs, followed by transportation and technology hubs. Logistics covers the management of goods and information flows across the supply chain, while transportation refers to the physical movement of goods. The report confined maritime port-linked strategies to logistics hubs and dry port or road network strategies to transportation hubs. The UN agency also cautioned that hub strategies may be costly and deepen debt vulnerabilities. At present, around half of the LDCs are in debt distress.

Between 1994 and 2024, only eight countries emerged from the LDC category. Now, four more countries are in the final phase of graduation: Bangladesh, the Lao People's Democratic Republic and Solomon Islands are scheduled for graduation this year; and Solomon Islands is scheduled for graduation next year. As LDC-graduation appears as a critical challenge for these countries, the Least Developed Countries Report 2025 is a timely document to guide these countries to thoroughly examine their services sectors. It will also help them prepare to cope with post-graduation challenges.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.