Published :

Updated :

Three decades after the formal inception of the World Trade Organization (WTO) as a successor of the General Agreement on Tariffs and Trade (GATT), tariffs are still a key tool for navigating global trade. As the average tariff applied by WTO members on a most-favoured nation (MFN) basis has nearly halved during the period, global trade in goods jumped by four times. In other words, tariff cuts by the countries helped them reduce the cost of trade and ultimately enhance trade. Nevertheless, the importance of tariffs is reasserted by the United States (US) President Donald Trump, who launched his tariff war immediately after assuming the Oval Office in Washington DC. One of the core objectives of the GATT/WTO is reducing tariffs to increase rule-based trade. A tariff is generally a customs duty imposed by a country on goods imported from the rest of the world.

The first principle of WTO is known as MFN, which is when WTO members extend the same trade treatments, including tariff rates and market access, to all other members. So, MFN treatment is the prohibition of discrimination in international trade. To comply with the principle, WTO members must impose MFN tariffs on imports from the other members. A working paper of the WTO, released last month, showed that more than 80 per cent of the global trade in goods is conducted on an MFN basis. This means that trading partners treat one another in a non-discriminatory manner in most cases.

The paper titled 'Significance of Most-Favoured-Nation Terms in Global Trade: A Comprehensive Analysis' divided global imports in 2022 into four segments. These are: (1) MFN duty-free trade; (2) MFN dutiable trade; (3) MFN dutiable trade eligible for, but not using, preferential market access; and (4) trade under preferential duty regimes. It also showed that 51 per cent of the global trade is now tariff-free, 27 per cent is MFN dutiable, and only 17 per cent is subject to preferential tariffs. Though the data used in the study is based mostly on 2022, it may be considered a general scenario.

The scenario indicates that despite various disruptions and troubles in global trade, countries have reduced tariffs significantly although more reduction was possible. So, there is room to cut the tariffs further, although Donald Trump has announced tariff hikes on imports from Canada, Mexico and China and is set to impose higher tariffs on imports from the European Union (EU). China, however, retaliated immediately by announcing an increase in customs duties on various products importable from the US. Trump's action may instigate some other nations, especially those that maintain a higher tariff regime, to keep the level unchanged. Some countries may also be encouraged to raise tariffs to put pressure on their rivals shortly. In this process, the US president is trying to reverse the course of global trade.

Another study finding is that despite a remarkable proliferation of preferential market access under the Generalised System of Preference (GSP) and preferential trade agreements (PTAs), it is yet to reduce the tariff across the nations significantly. During the last three decades, countries have negotiated more than 500 PTAs, or RTAs, and some 340 have been enforced by the countries that are part of these agreements.

The WTO working paper, jointly prepared by Tomasz Gonciarz and Thomas Verbeet, also presented data from 157 countries regarding their imports on MFN and preferential trade arrangements, showing that 66 per cent of the global imports are made by top-10 countries and 85 per cent by the top 20 countries. It identified that advanced small nations are used to importing almost 100 per cent of the products MFN tariff-free. Among the top 20 importers in 2022, Singapore and Hong Kong imported all the products without imposing tariffs. The ratio was 83 per cent for Japan and 70 per cent for Canada. Among the top 20 importers, India is the most restrictive economy, as reflected in its tariff structure. Only five per cent of the Indian imports were based on MFN duty-free in 2022, whereas 69 per cent of the total imports were subject to MFN tariff.

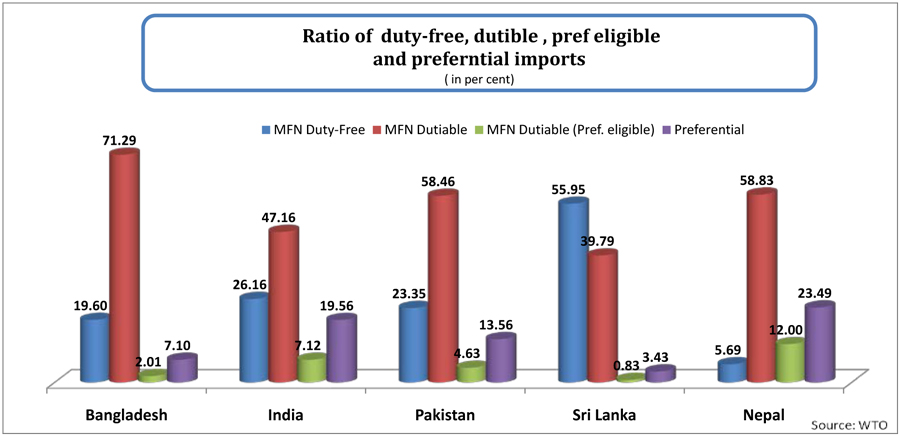

Bangladesh's situation is similar to India's. In 2022, around 72 per cent of the country's imports were subject to MFN tariffs, while 20 per cent were MFN duty-free imports. The report also showed that around seven per cent of Bangladeshi imports were on a preferential basis during the period under review.

World Tariff Profile 2024, jointly published by WTO, International Trade Centre (ITC) and UN Trade and Development (UNCTAD), showed that MFN simple average tariff of Bangladesh was 14.10 per cent in 2023.

There is a shortcoming in Bangladesh-related statistics in the study. It showed that the total imports by Bangladesh in 2022 were US$ 47,247 million. It is almost half of the actual import value of the year, as the World Trade Profiles-2023 put the value at US$ 88,234 million (in 2022). When contacted, the authors of the paper, however, clarified the thing. In reply to an email query sent by this scribe, they said: "To clarify your query regarding Bangladesh's total import data, as explained in the third paragraph of the "4 Data" section, when data for a given reporter and year is not available in either the WTO's Integrated Database or UN Comtrade, we use the nearest available year's data as a substitute. In the case of Bangladesh, Annex Table 4 in our paper reflects data from 2018, as that was the most recent available in our sources at the time of compilation. This varies from the statistical profiles which uses aggregated statistics, whereas we need to have very detailed data by national tariff line in order to do our calculations." The researchers' reply unveiled a big flaw in furnishing trade-related statistics in detail on time to the WTO or UN by Bangladesh. So, the authorities need to take care of the matter. Nevertheless, it can be safely assumed that the import pattern in terms of MFN and preferential tariff regimes do not change significantly in 2022 or later years from 2018.

The tariff patterns also reconfirm that despite a significant liberalisation in trade, there is still room to rationalise the country's tariff regime. As Bangladesh is moving ahead to graduate from the Least Developed Country (LDC) category by the end of 2026, it will face tariff barriers in different markets. However, by reducing import tariffs, Bangladesh can create opportunities to export its products to markets with reduced tariffs, potentially boosting its economy. This strategy will require the country to focus on MFN duty-free and preferential imports and to sign free trade agreements with partner countries.

asjadulk@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.