Published :

Updated :

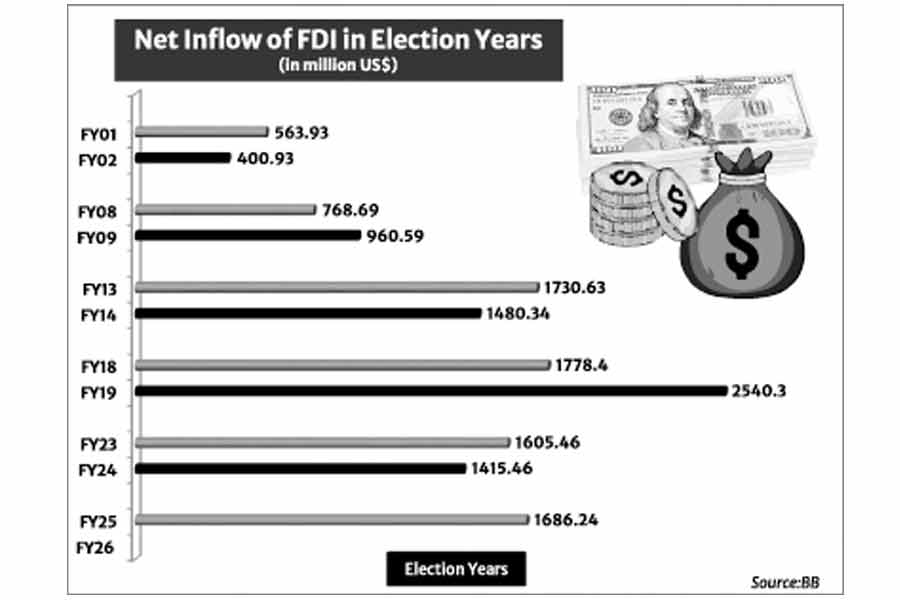

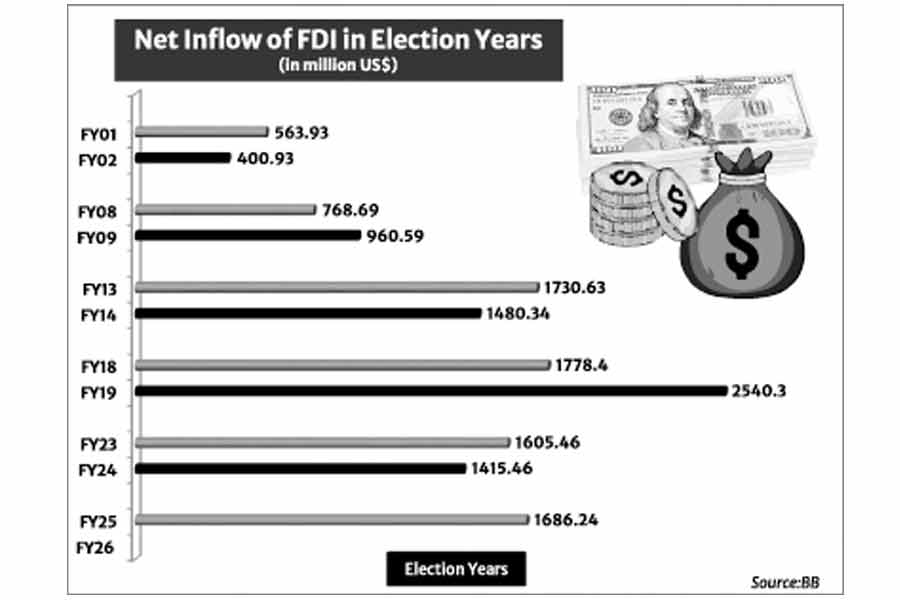

Notwithstanding various efforts and policy supports, inflow of foreign direct investment (FDI) in Bangladesh is still nominal. The annual average net inflow of FDI stood at $1.60 billion in the last 10 years which is less than one per cent of the country's gross domestic product (GDP). Like many key economic indicators, the repressive regime of Hasina also inflated the FDI statistics to mislead people about the success in relation to economic advancement. That's why, at one stage, annual inflow of FDI was reported to cross $3 billion level. The net FDI in terms of balance of payments (BoP), however, never crossed $2 billion level except FY19.

After the fall of the authoritarian regime on August 5 in 2024 due to student-led mass uprising, Bangladesh Bank revised the FDI data in order to comply with the International Monetary Fund (IMF)'s updated version of BoP estimation guideline. As a result, the amount of net inflow of FDI declined sharply compared to the data reported on the basis of half-yearly survey. Though the process of revision started in FY15, it gained momentum two years ago. Due to revision, the real scenario of FDI turns out to be disappointing. For instance, net FDI was $3249.68 million in FY23, as per the survey-based reporting. The latest revision has made it $1605.40 million.

Now that the national elections is going to take place on Thursday, everything has become the poll-centric. There is also speculation that the inflow of FDI might go up after the election. Empirical data showed that inflow of FDI declined in the election years on three occasions and increased on two occasions in the last two and a half decades. [Due to lack of adequate data on FDI in the early 1990s, FDI situation during the national elections (5th) in 1991 and 1996 (6th and 7th within 100 days) has not been taken into consideration.]

Statistics available with Bangladesh Bank showed that net inflow of FDI in FY02 declined to $400.98 million from $563.93 million in FY01. The eight national elections took place on October 1 in 2001 which was also the first day of the second quarter of FY02. The decline in FDI by around 29 per cent was disappointing for the newly elected Khaleda-led government at that time.

The FDI jumped by around 25 per cent in FY09, the year when ninth national elections took place. The date was December 29 in 2008. Net inflow of FDI reached at $960.59 million in FY09 from $768.69 million in FY08. The surge in FDI was a confidence booster for the newly elected Hasina-led government.

The 10th general elections took place on January 5 in 2014, at the middle of the FY14 and it was a highly controversial one. Hasina re-elected as the prime minister in 2014. For the foreign investor reacted negatively, as net FDI declined by 14.50 per cent to $1480.3 million in FY14 from $1730.6 million in FY13.

The 11th general elections was far more disputed as ballot boxes at a large number of polling booths across the country allegedly were stuffed with fake ballots in night before the day of election, December 30 in 2018. Through the heavily rigged and manipulated elections, tyrant Hasina was re-elected. Net FDI surged by 42.85 per cent in FY19 to $2540.30 million from $1778.40 million in FY18. The big surge in FDI at that time also raised questions aplenty as allegation of data manipulation by the government surfaced.

Finally, during the 12th national elections on January 7 in 2024, also at the middle of the FY24, net inflow of FDI declined. The FDI dropped by 11 per cent to $1415.46 million in FY24 from $1605.46 million in FY23. Though Hasina got re-elected through massive vote engineering, her repressive regime survived for six months after the election. Student-led mass uprising compelled her to step down and flee to New Delhi on August 5 in 2024.

After Yunus-led interim government assumed the power, it has stepped up a number of reform measures in various sectors. One of the measures is checking and revising the flaws of the economic indicators. Under the initiative, Bangladesh Bank has revised the of FDI data in line with the internationally updated calculation method with a calculation that covered the FY20 and latter years. As a result, a significantly lower amount of FDI has been recorded in contrast with the previously reported data up to FY23.

As the current fiscal year (FY26) is the election year, there is an indication that the net FDI will finally lower than $1686.24 million in FY25. During the first quarter (July-September) of FY26, net inflow of FDI recorded at $315.09 million. As per the balance of payments (BoP) table, net inflow of FDI in the first five months (July-November) of the current fiscal year estimated to $651 million.

Meanwhile, global FDI increased by 14 per cent last year to an estimated $1.6 trillion, according to UN Trade and Development (UNCTAD).

According to the latest Global Investment Trends Monitor, released by the UNCTAD in the last month, FDI flows to developed economies jumped 43 per cent to $728 billion. European Union alone recorded a 56 per cent jump. By contrast, FDI flows to developing economies dropped by two per cent to $877 billion, accounting for around 55 per cent of the global FDI.

"Lower-income countries were hit the hardest, with three quarters of least developed countries experiencing stagnant or declining inflows," said the investment monitor report.

For Bangladesh, the observation is not fully applicable as the country witnessed a big jump in FDI in the first nine months of 2025. During the January-September period of the last year, the net inflow of FDI stood at $ 1,406.59 million, compared with $ 1,270.39 million in January-December 2024. The main reason is the resumption of normal economic activities, which was seriously disrupted during the July mass uprising.

Nevertheless, comparisons between calendar and fiscal years can sometimes create confusion. This article focuses on the fiscal year to examine the impact of the election on FDI and finds that a decline in FDI in an election year is normal, while a rise is an exception. Foreign investors generally follow a wait-and-see policy to monitor election-centric political developments and the early moves of the newly elected government. The existing multinational entities (MNEs) continue their regular operations without injecting fresh capital or expanding their commercial activities. FDI may rebound in the next fiscal year provided that the newly elected government ensures socio-political stability in the post-election period.

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.