Published :

Updated :

Micro, Small, and Medium Enterprises (MSMEs) are the driving force behind many of the large economies worldwide. While their presence serves as a hub for entrepreneurship development in countries like Bangladesh, most of them struggle to access finance. This lack of access hinders their ability to sustain growth and ensure success, even when they have the potential for a significant positive impact. Enterprise data and access to necessary funding can be effectively integrated into digital finance platforms. Digitisation of financial services helps banks or financial institutions transform their financing processes. The advancement of financing process innovation has entered a new era through the utilisation of digital technology, where both borrowers and financiers can benefit from credit scoring–based assessment processes. The credit scoring method evaluates a prospect in the shortest possible time, allowing prospective borrowers to know their scores and the assessment criteria on which the lending amount is determined. In this system, prospects are aware of the indicators on which they have been evaluated and scored.

The platform of Industry 4.0 incorporates digital lending as part of embedded finance for financiers. As a component of embedded finance, digital credit scoring involves machine-based processes that help minimise time and costs compared to conventional credit scoring methods. Almost all countries around the world use credit scoring methods to assess individuals and micro or small businesses for loans to meet their liquidity needs. Some rely on traditional credit scoring methods, while others implement digital credit scoring systems. Traditional methods involve collecting data physically and relying on paper-based documents, as the necessary digital infrastructure is not yet in place. In such cases, financiers often rely on visual assessments of prospective borrowers to judge their creditworthiness. This approach entails high costs and significant time to serve borrowers. As a result, borrowers are sometimes denied the necessary funds and may remain unaware of the reasons behind the rejection. In contrast, the digital ecosystem – comprising technology, channels, customers, strategy, and culture – has made life easier for all stakeholders.

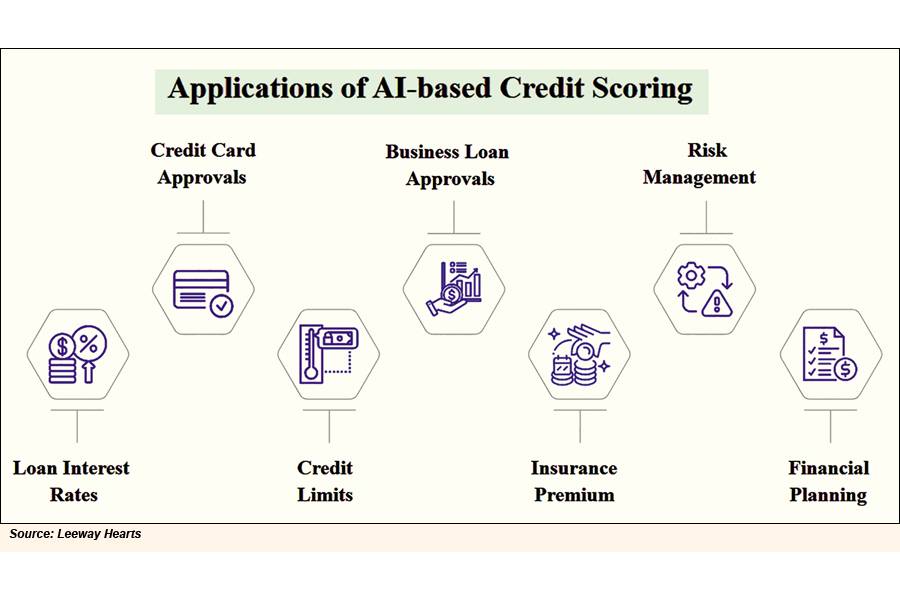

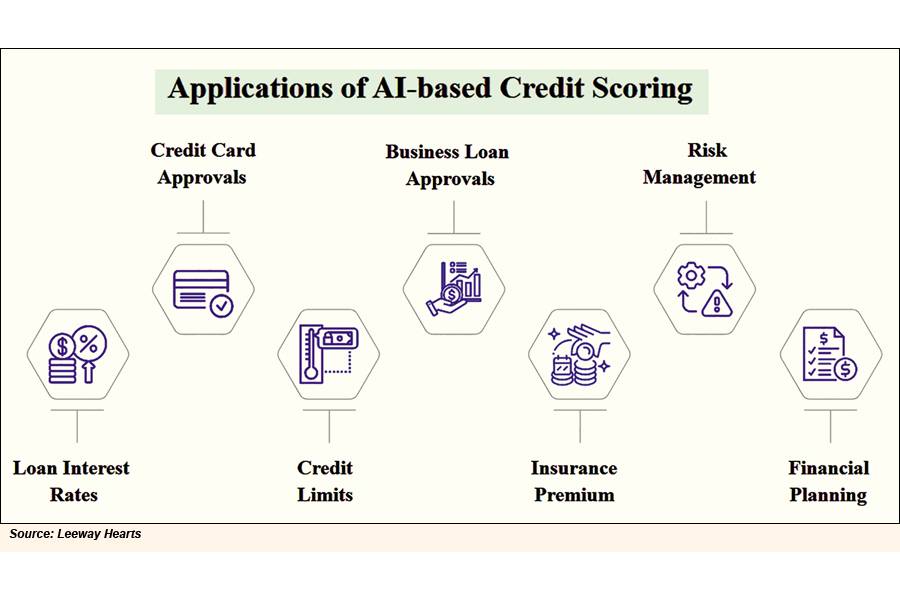

According to LeewayHertz, an AI development company, AI-based credit scoring enables creditors to make informed lending decisions by evaluating the creditworthiness of prospective borrowers. They identified several areas where AI-based credit scoring is applied—not only in credit assessment, determining loan interest rates, and setting credit limits for individuals and small businesses, but also in determining insurance premiums, risk management, portfolio analysis, financial planning, counselling, behavioural analysis, customer segmentation, internal and regulatory compliance, credit score simulation, default risk prediction, early warning signals, peer-to-peer lending, and financial health monitoring. These applications are briefly outlined below:

AI-driven credit scoring is one of the most effective approaches to digital credit scoring. Here, AI algorithms uncover a multitude of available data about a prospect through numerical representation. The scoring mechanism considers factors such as credit transaction history, credit utilisation, search history, web activity, and interests to assess a prospect’s financial behaviour by analysing data retrieved from credit bureaus.

The final score, derived from the multiplication of weightings with individual components, enables a lender to determine the credit limit, loan terms, interest rates, tenure, repayment methods, and more. AI-driven credit scoring also utilises alternative data drawn from social media profiles, online shopping behaviour, utility payments, educational background, and other sources. In contrast, conventional methods rely on primary data to evaluate a prospective borrower’s creditworthiness, such as physical site visits, face-to-face interviews, direct net worth calculations, stock verification, and so on.

These differences reflect the intricacies of AI-based credit scoring. In traditional financing methods, lender bias may lead to both over-financing and under-financing of a borrower—each carrying significant risk for an organisation. Data manipulation is easier in conventional systems, whereas the integrity of alternative data in digital systems is more secure and less prone to tampering. This ensures greater accuracy in finalising credit structures and loan terms, thus helping reduce the financing gap.

In this system, borrowers can also be informed of the specific reasons behind credit limit determinations. Through data integration, AI-based credit scoring alerts borrowers about the usage of borrowed funds, thereby controlling non-performing activities. Under a digital ecosystem, borrowers are aware that all information gleaned from them is used to generate alternative data. By providing this data, technology drives global interconnectivity. As a result, investors can gain a competitive edge in the global marketplace.

In developing economies worldwide, there are numerous MSMEs that significantly contribute to employment creation, value addition, economic resilience, innovation, and competitiveness—both domestically and globally. The best outcomes from this sector depend on the vitality of a robust and competitive MSME environment.

To ensure the sustainability of MSMEs in Bangladesh, the government should formulate innovative policies to enable entrepreneurs to operate competitively within a digital landscape. Simultaneously, access to finance must be ensured through banks and non-bank financial institutions (NBFIs). Inclusion will be enhanced when MSMEs operate under a digital ecosystem, which will, in turn, strengthen the availability and reliability of alternative data. By doing so, financiers will be able to assess MSMEs more efficiently, leading to quicker lending decisions—enabled by the digitalisation of financial services, or digital finance. At this point, it is imperative to generate innovative ideas and implement comprehensive policies at entrepreneurial, institutional, and economic levels to make the MSME sector more vibrant and future-ready.

Dr. Md Helal Uddin is the Secretary General of Bangladesh Chamber of Industries (BCI), and Sanjoy Pal is a seasoned banker and Financial Modeling & Valuation Analyst (FMVA®) certified from Corporate Finance Institute, Canada. pal.sanjoy25@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.