Published :

Updated :

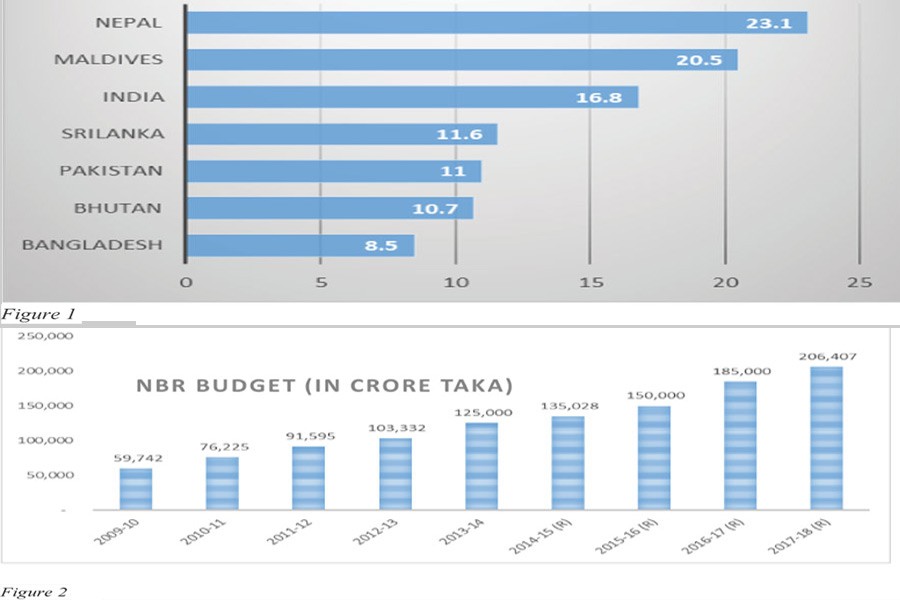

It is widely known that the tax-to-GDP ratio of Bangladesh is still below 10 per cent. Compared with the tax-to-GDP ratios of some of its neighbours, Bangladesh has the lowest ratio (see figure 1).

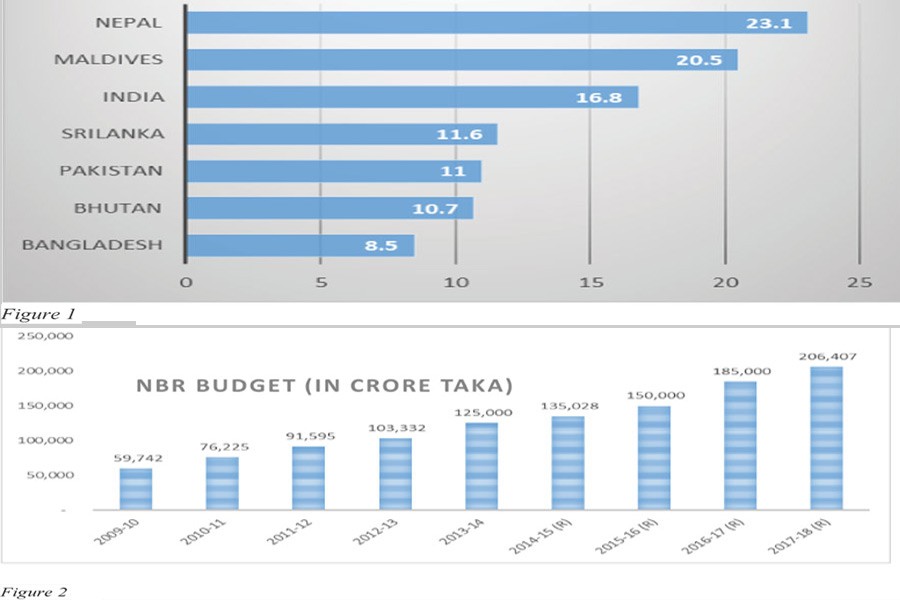

Despite such a low ratio, Bangladesh has shown significant success in terms of revenue collection. Interestingly, this has happened in spite of resource limitation and very limited use of information technology (IT). The year-on-year collection data (Figure 2) proves that the National Board of Revenue (NBR) has played a significant role through a 3.5 time increase in revenue collection over the past nine years.

However, is this enough for Bangladesh to achieve the middle-income country status by 2021?

Recently in a pre-budget discussion meeting, Chairman of the NBR emphasised on increasing the number of tax offices and employees across the country in a bid to widen the tax net. Yes, the increase of officers might increase the capacity of the tax administration. They might visit door-to-door and bring more people under the net. But will it really widen the tax net? Most people are afraid of facing officials from the NBR. Dishonest officials might end up engaging in underhanded transactions. All of these might act as a deterrent against widening the base.

Digitalisation is a critical enabler for the country in its quest to move to modern tax administration. It can play an important role in facilitating and easing tax authorities' interaction with taxpayers and improving compliance, forecasting and collection of revenue. Former Finance Minister AMA Muhith had underscored the importance of digitalisation in last year's budget speech. In paragraph 216, he had mentioned that initiatives have been taken to make the tax management system fully automated and digitised by increased use of ICT in tax administration. E-TIN registration is working smoothly; on-line return submission system has been introduced, plan of enhancement is also being taken. It can be hoped that a considerable number of taxpayers will submit their returns online in the coming years.

There is no doubt that e-TIN registration process has been moving forward seamlessly. Provision of e-notice has been brought under section 178 but it is not mandatory and tax officials are not using any mail servers hosted by NBR. They are using gmail or Yahoo email addresses instead. Provision of electronic filing has been brought under section 178B, but those have not been made mandatory in the respective sections. Provision for automatic furnishing of information has also been brought into section 113A but such information can be filed only by a notice in official gazette by the NBR. These provisions are being incorporated starting with the Finance Act 2016 till Finance Act 2018. Have we seen much success out of it? We need to find out the underlying reasons and work on the barriers.

Currently, National Identification Number (NID) is mandatory for obtaining a TIN for an individual and Registrar of Joint Stock Companies (RJSC) registration number is linked with a company ETIN. Without national ID (NID), an individual is usually not allowed to open a bank account. One cannot register a plot of land or a building without the NID. However, is it easy for an assessing officer to automatically cross check whether a company has disclosed all the bank accounts including loan accounts in the financial statements without invoking section 113F? This is a manual exercise and not invoked quite frequently. Will it be possible for an assessing officer to automatically determine whether the individual has disclosed all the land, apartment, bank account, FDR, BO account, motor vehicle, loan from Bank/NBFI, credit card transactions, club membership information etc.? These scenarios need to be reviewed holistically and not in isolation.

INDIAN EXPERIENCE: The situation of neighbouring India can be considered in this regard. The country has integrated their Central Board of Direct Taxation (CBDT) with many other government departments. India has also automated their tax administration and data processing to a great extent.

Since 2012, India has made e-filing of return mandatory for those with annual income of more than Rs 1.0 million. However, one does not need a digital signature to authenticate the tax return in such a case. CBDT has been an early adopter of technology. It has formulated specific directorates to deal with computerisation-related initiatives and have benefited significantly in terms of improved compliance, enhanced processing and increased taxpayer satisfaction. Some attributes of digital tax administration are as follows:

- CBDT's e-filing website facilitates filing of returns, responses to non-compliance-related letters, filing of rectification requests etc. In such ways, the CPC has now eliminated the need for income tax staff and officers to manually compute tax, interest and penalties.

- The Centralised Processing Centre (CPC) is now providing a comprehensive and end to-end service to taxpayers to process their returns in an automated mode in order to compute the final refunds due from them or work out their tax liability.

- Receiving full credit of taxes withheld (TDS) was a dream for Indian taxpayers till only a few years ago. With the use of technology-based reconciliation, TDS records are now aligned and taxpayers are made aware of the credit they will receive even before they file their returns. Moreover, online access to Form 26AS has afforded significant relief to taxpayers, since it provides all the details of taxes paid as Advance Tax, Self-assessment Tax, taxes deducted or collected, and refunds made to them during the year.

- With the implementation of the CPC, the tax refund-processing mechanism has been automated. In the process, a large percentage of taxpayers have been surprised to find tax refunds credited to their bank accounts before they are expecting them.

- Real time tax updates sent by the Income Tax Department through emails and SMS have facilitated its interaction with taxpayers.

- Risk identification and audit also uses technology for risk profiling of taxpayers and transactions to conduct targeted assessments

These measures have significantly enhanced the transparency of the procedure and eliminated manual intervention in the audit selection process, allowing a great relief to the taxpayers of India.

CBDT has recently introduced Centralised Verification Scheme, 2019 for centralised issuance of notice and for processing of information or documents and making available the outcome of the processing to the Assessing Officer vide Notification No. 05/2019 dated 30th January 2019

PROMISING INITIATIVES: The changes in policy in Bangladesh over time have helped the government in terms of increasing revenue collection. At the same time, a number of 'fintech' companies have arrived in the scene to provide e-filing services to the tax-payers. Using a government portal, anyone can file a return for free. Charges are only applicable if certain third-party portals are used.

The above initiatives implemented by the tax administration have increased taxpayers' confidence and encouraged their voluntary compliance.

Digital Bangladesh can become a reality if special emphasis is placed on the application of digital technologies in line with Vision 2021 and Vision 2041. To achieve this vision we must embrace technology. Hence structural reforms need to be undertaken like establishment of dedicated IT team consisting of IT strategist, operational and monitoring teams, as well as integration with other departments of the government with matters relating to revenue.

Snehasish Barua is a member of the Institute of Chartered Accountants of Bangladesh (ICAB)

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.