Published :

Updated :

Bangladesh, which is close to important south and southeast Asian markets, is a potential location for setting up a an Offshore Financial/Business Centre (OFC/OBC). With the interim government announcing a plan to establish a Free Trade Zone (FTZ) and attract global investment, the country is poised for an important shift in its financial landscape. Examining the feasibility of setting up an OFC/OBC in Bangladesh is necessary in this connection. The use of it as a monetary policy tool as well as economic facilitator may also be examined.

In the April 2025 Investment Summit, DP World Chairman expressed interest in investing the country after meeting with Chief Advisor Prof Muhammad Yunus. It offered Bangladesh’s FTZ plan a promising boost. In line with successful models like the Jebel Ali Free Zone in the United Arab Emirates (UAE), a national committee has been established, signifying progress towards a globally interconnected offshore financial centre.

With the OBU Act-2024, facilitated by FF Circular 11 (January 30, 2025) of Bangladesh Bank, the country has made a major institutional shift by enacting its first law to regulate offshore banking after 38 years despite the fact that it is a commercial bank’s banking unit or desk. Investor confidence is, however, dependent on more comprehensive system-wide reforms, such as the setting up OFCs or OBCs.

OFC decoded: The term ‘offshore’ refers to a geographical location outside of one’s home country. It is mostly used in the banking and financial sectors to describe ‘areas where regulations are different from the home country.’ It, however, means that an ‘offshore jurisdiction’ of ‘offshore centre’ may be located within a country although regulated differently.

Generally, the term ‘offshore financial centre’ of OFC is used for any country or a jurisdiction with financial centres comprising of financial institutions that deal primarily with non-residents and/or in foreign currency on a scale out of proportion to the size of the host economy. In other words, non-resident owned or controlled institutions play a vital role within such financial centres. The International Monetary Fund (IMF) in 2007, offered a definition of OFCs: “An OFC is a country or jurisdiction that provides financial services to non-residents on a scale that is incommensurate with the size and financing of its domestic economy.” Despite some limitations, the IMF definition is widely accepted across the world.

Globally, OFCs such as the Cayman Islands, Singapore, Hong Kong, Malaysia, Mauritius and Luxembourg are important in determining economic and financial outcomes by virtue of their ability to facilitate capital flows, enhance currency liquidity, and provide alternative financing windows. The significance of such viewpoints is now increasing for Bangladesh as it endeavours to strengthen its monetary and financial systems in the face of changing global dynamics.

In order to attract foreign direct investment (FDI), maintain currency stability, and establish connections with global financial markets, Singapore, Dubai, and India’s GIFT City have all effectively used offshore centres.

Following the global practice, Bangladesh may actively consider establishing an OFC or OBC which will be able to manage money, enhance net foreign assets, and help maintain price and economic stability by stabilising the local currency. OFC will target the benchmark interest rate on foreign currencies, and manage liquidity inflows and outflows to protect against inflation and currency shocks. This calculated action may bring a new opportunity for financial integration as well as indirect monetary policy intervention through increased regulatory innovation, liquidity management, and capital inflows.

However, it also raises concerns about capital flight, money laundering, and regulatory flaws that could jeopardise Bangladesh’s financial system’s stabilisation. OFCs are well known for ‘hiding tax liabilities or ill-gotten gains from authorities’. In this connection, the establishment of a strong regulatory framework, meticulous risk management protocols, and international collaboration are necessary for the effective implementation of OFCs in Bangladesh.

AS a stratigic monetary tool: Traditionally, central banks use tools such as interest rate adjustments, open market transactions, and reserve requirements to regulate the money supply to contain inflation and maintain macroeconomic stability. In a globalised financial system, offshore financial centres provide supplementary, market-driven processes that affect monetary dynamics through private sector contacts and cross-border finance.

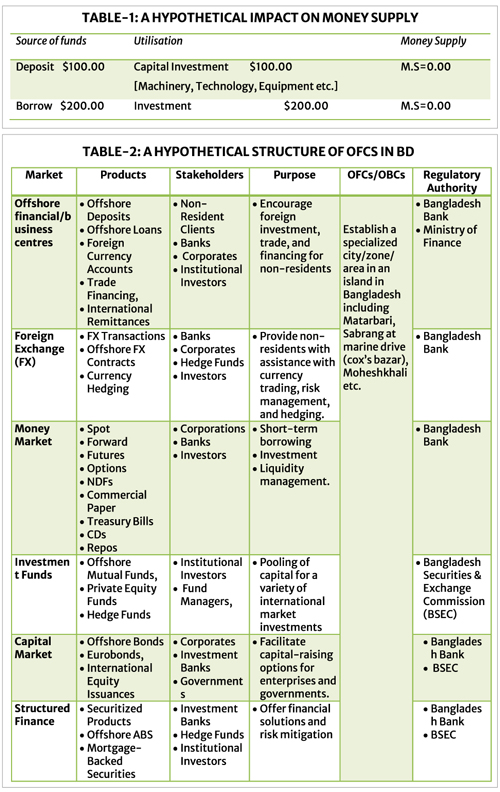

The offshore jurisdiction usually has minimal or no taxation, and provide regulation and legal frameworks promoting international financial transactions with less transparency. Several studies ((Blinder, A. S., 2008 and Hutchison, M. M., 2009) show that a non-convertible offshore financial centre offers extensive financial services, low tax rates, and appeals to foreign investors. So, the centre may influence monetary policy by directly effecting capital flows and liquidity management on the Financial Account. Funds channelled through OFC may have zero effect on money supply. It is hypothetically illustrated in Table-1.

On the other hand, a fully convertible offshore financial centre may facilitate total currency convertibility and encourage unfettered capital movement, potentially impacting exchange rates and monetary stability and directly affecting the current account.

Bangladesh can consider an OFC/OBC as a strategic monetary policy tool rather than a comprehensive liberalisation strategy. It could establish a unique offshore financial hub focused on enhancing connectivity within South Asia and ASEAN, attracting Islamic finance, green bonds, and technological investments, while enhancing monetary and financial sovereignty through diversification. Bangladesh can incorporate its new banking regulations into a comprehensive offshore financial centre or offshore business centre structure.

How it MAY work: In contrast to more conventional methods like interest rates, reserve requirements, or open market operations, which Bangladesh Bank currently uses, OFC can act as an indirect but effective monetary policy tools. OFC usually works by influencing the larger financial environment through international capital flows, foreign currency liquidity, and offshore borrowing/lending regimes, whereas traditional instruments directly affect liquidity and inflation through local banking processes.

OFCs influence the money supply through mechanisms such as currency swaps, offshore deposits, and capital repatriation, which contrast with the central bank’s regulated domestic operations. For example, Offshore Banking Units (OBUs) in Bangladesh efficiently increase the available credit base and money supply by using up to 30 per cent of their regulatory capital from Domestic Banking Units (DBUs). This is accomplished through market-based offshore operations and is comparable to the multiplier effect that is typically connected with central bank initiatives.

In addition, OFCs draw FDI and remittances, and offer a platform for foreign currency management and hedging. All of these have an impact on local liquidity and the exchange rate. OFCs bring dynamic, market-responsive mechanisms that interact with global capital markets, either enhancing or reducing domestic monetary trends, in contrast to the static character of conventional methods. As a result, even though OFC is not considered standard monetary tools, its growing function in controlling liquidity, maintaining exchange rate stability, and affecting credit availability makes them complementary and strategically important monetary policy tool in a networked financial system.

By using global capital flows to affect important macroeconomic factors including liquidity, interest rates, currency rates, and the money supply, the establishment of an OFC can be a strategic addition to a nation’s monetary policy toolkit. OFCs function through the architecture of global finance, facilitating cross-border investment, enabling risk management, and luring foreign capital under advantageous regulatory and tax regimes, in contrast to traditional instruments like interest rate adjustments or open market operations.

OFCs also provide liquidity to the domestic financial system by attracting foreign capital inflows through tax breaks and regulatory latitude, which can reduce interest rates and boost the economy. On the other hand, they can also direct domestic money abroad in pursuit of risk diversification or higher rates, which could affect local liquidity and lead to central bank action to preserve monetary stability. Thus, OFCs serve as both channels and buffers, affecting the domestic money supply in accordance with the more general objectives of monetary policy.

Additionally, by providing alternate channels for capital allocation and investment, OFCs lower domestic financial volatility, promote financial innovation, and offer tools for hedging and diversification. Additionally, they provide as venues for regulatory arbitrage, which, when properly controlled, can enhance domestic laws by providing flexibility without jeopardising systemic stability. Well-regulated OFCs can strengthen creditworthiness, draw in long-term investment, and assist the central bank in better managing inflation, exchange rate pressures, and economic shocks when they are closely linked with a nation’s monetary governance. Therefore, OFCs are more than just offshore financial havens; they may also serve as sophisticated enhancers of monetary policy, offering leverage and flexibility in a financial system that is becoming more interconnected by the day.

In order to maintain price stability and economic expansion, Bangladesh Bank controls the money supply through the use of instruments such as interest rates, reserve requirements, and open market operations. With foreign reserves of about $21 billion, broad money (M2) is valued at Tk 17 trillion as of 2024. Due to changes in capital allocation, Bangladeshis’ offshore assets decreased from $8.145 billion in 2021 to $5.91 billion in 2022. Liquidity and foreign exchange availability are impacted by the Tk 83,826 crore ($9.5 billion) in loans held by offshore banking units (OBUs). Maintaining Bangladesh’s macroeconomic stability still depends on effective monetary policy that is in line with controlling both domestic and foreign financial flows.

Variety of instruments: A wide variety of financial instruments that are essential for international liquidity and capital mobility are traded by offshore banking and financial centres. These consist of commodities futures, money market instruments, hedge funds, private equity, and foreign exchange. Centres for SBLC monetisation, trade financing, collateral transfers, and international guarantees include the Cayman Islands, Singapore, and Hong Kong because they provide regulatory simplicity and tax neutrality. These products have a major impact on financial flows, encourage investment, and stabilise markets in both host and participant nations by promoting risk management, improving liquidity, and drawing in international capital.

So, Bangladesh may consider setting-up strategically placed integrated offshore zones like Matarbari, Moheshkhali, Sabrang (Marine Drive), and the Northern Special Economic Zone (NSEZ) in order to optimise the advantages of OFCs or OBCs. By providing competitive tax holidays, regulatory flexibility, and streamlined processes in line with international OFC best practices, these zones can serve as pilots for OFC operations. To ensure the integrity and security of offshore transactions, a strong legal and compliance framework must be established, especially to implement the Countering the Financing of Terrorism (CFT) and Anti-Money Laundering (AML) standards.

OFCs and OBCs should support capital inflows, financial instrument diversity, and Taka stability in line with Bangladesh’s larger monetary policy objectives in order to increase macroeconomic resilience. Furthermore, if Shariah-compliant, there is an opportunity for OFC to open an investment window of the Islamic banks in the country.

End note: In the real word, to what extent a full-fledged OFC can perform as a strategic monetary tool is a matter of thorough study backed by empirical evidences. For Bangladesh, it is a new concept and requires further examination. The experiences of the country’s OBUs, however, indicate that the policymakers need to look into the matter and seriously consider setting up an OFC in Bangladesh.

Md Saidul Islam CDCS is First Vice President and Head of OBU

The Premier Bank PLC, Gulshan Branch. sayedcdcs@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.