Published :

Updated :

The issue concerning the effect of fiscal policy on growth is quite old. However, recently the extent to which fiscal policy affect growth has attracted both theoretical and empirical debate especially in the developing countries due to budget deficits, existing governance issues and their aspiration to move up the ladder of growth.

Fiscal policy is an important policy of the government for the overall management of the government's revenues and expenditures required for maintaining macroeconomic stability and growth.

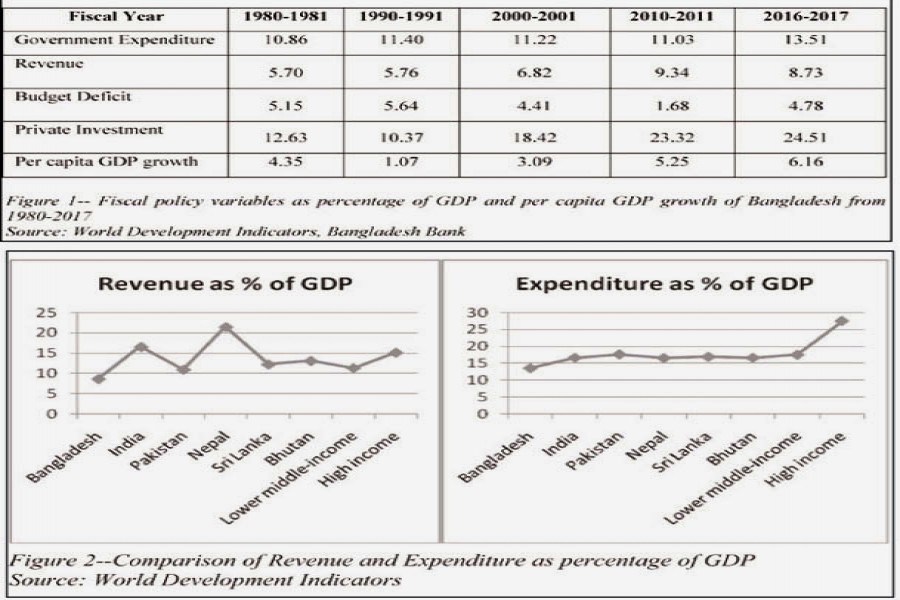

Public financing in Bangladesh has gone through diverse changes over the past few decades. Overview of the fiscal policy variables as percentage of gross domestic product (GDP) and per capita GDP growth of Bangladesh spanning from 1980-2017 are presented in figure 1.

It is evident that government expenditure, i.e. both government consumption and investment, along with revenue and private investment have all experienced a gradual increase over the decades. From FY 1980-81 to FY 2016-17, government expenditure has moved up by 2.65 per cent from 10.86 per cent to 13.51 per cent. Revenue performance oscillated, varying from 5.70 to 8.73. Budget deficit also varied between lowest in FY 2010-11 and highest in FY 1990-91. Largely on average, budget deficit remained below 06 per cent of GDP. Private investment as percentage of GDP has doubled from FY 1980-81 to FY 2016-17. Per capita GDP growth has been quite impressive and over the last eight years, it has remained over 05 per cent. So the question arises: are government expenditure and revenue collection playing any role in the growth of the country?

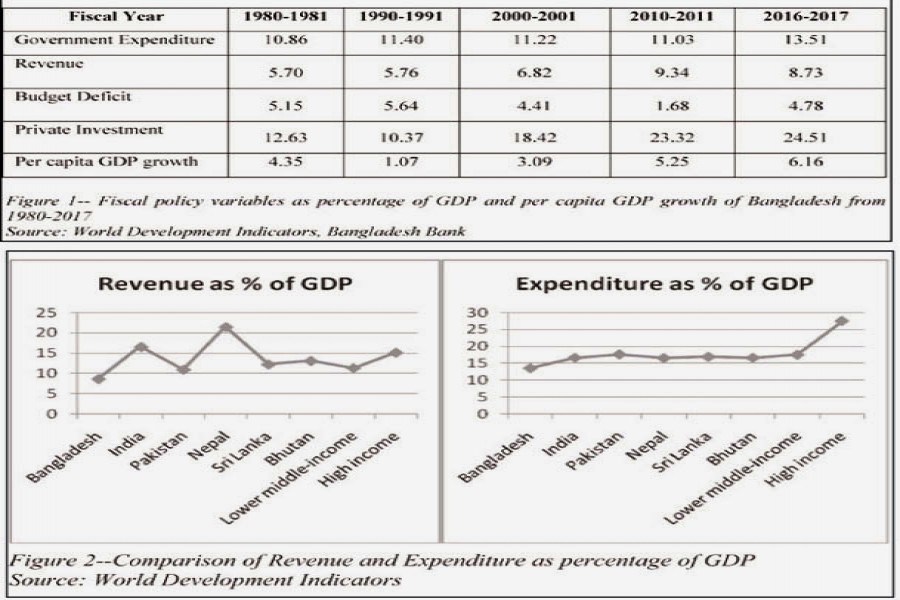

Budget deficit of Bangladesh has been lower than other lower middle-income countries. Consequently expenditure-GDP ratio and revenue-GDP ratio is still lower than neighbouring India and other lower middle-income countries. Therefore, it will be interesting to understand how the different fiscal instruments affect growth in the overall macro-policy as well as governance, as fiscal performance also depends on it.

Against this backdrop, a study was conducted at the Bangladesh Institute of Governance and Management (BIGM). This study investigated the impact of key fiscal instruments: government investment, revenue and budget deficit, on growth by examining the governance indicators. Additionally, this study delved into this impact under three different scenarios: aggregate investment-GDP and revenue-GDP ratio impact; impact of budget deficit; and PCA (principal components analysis) constructed fiscal policy impact. Employing ARDL (Autoregressive Distributive Lag) technique, findings posit in the context of Bangladesh fiscal policy played a significant positive role in economic growth though its effectiveness and significance eroded to a certain extent in the presence of governance indicator. The findings concluded that over the study period, the overall governance, risks and uncertainty issues of Bangladesh were not holding back its growth and development. However, improvement of governance perspective will certainly enhance the productivity of fiscal policy and growth.

From a policy perspective, prudent government investment, efficient and effective revenue composition and productive private investment will accelerate economic growth. In addition, the government should eye better financial management and human resource policies, taking into consideration the country's risk and uncertainty indicators akin to governance issues to enhance growth. Government should spend on human and physical capital. This can further catalyse and strengthen human capital in the country.

Mowshumi Sharmin is the Assistant Director (Research) at the Bangladesh Institute of Governance and Management (BIGM).

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.