Published :

Updated :

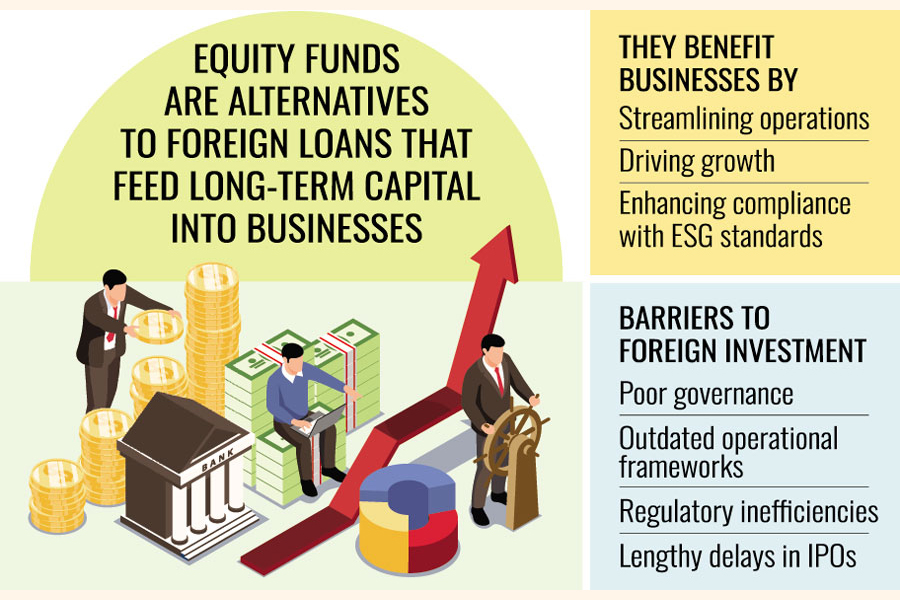

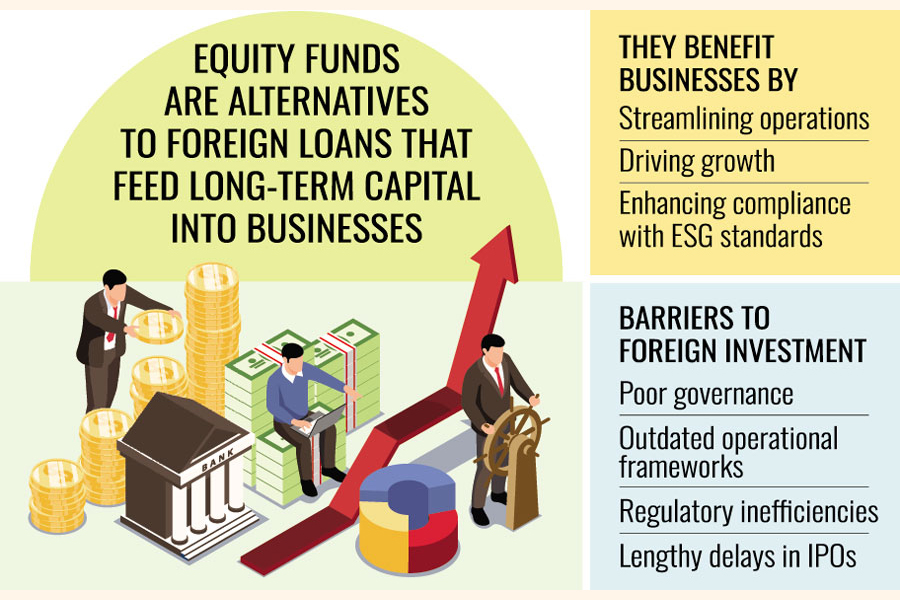

Amid the ongoing foreign exchange volatility, local businesses could attract substantial capital through "foreign private equity funds", offering a lifeline to the crisis while fostering sustainable growth.

Launched in 2020, the foreign private equity fund BMA, supported by globally renowned institutions, such as British International Investment (BII), Dutch development bank FMO, and Norway's Norfund, focuses on high-potential sectors, including manufacturing, agriculture, food, and financial services.

BMA distinguishes itself as the only private equity fund exclusively mandated to invest in Bangladesh.

Traditionally, local corporate entities rely on banks, the capital market, or foreign loans for financing. However, foreign loans often come with high variable interest rates, restrictive conditions, and short-term repayment schedules, posing challenges for sustainable growth.

Khalid Quadir, managing partner of BMA

Private equity provides a viable alternative by injecting long-term capital into businesses, helping them streamline operations, drive growth, and enhance compliance with environmental, social, and governance (ESG) standards.

"We can invest between $10 million and $25 million in a single company and are open to investing in diversified sectors," said Khalid Quadir, managing partner of BMA.

He emphasised the untapped potential in Bangladesh's agricultural sector, which boasts an annual turnover exceeding $40 billion.

Quadir identified the light engineering sector as particularly promising. "This sector has the potential to replicate China's success in manufacturing and innovation, positioning Bangladesh as a mini China," he said.

BMA has already demonstrated this strategy through its investment in ACI Motors, a market leader in agricultural mechanisation and automotive.

The fund focuses on investing in compliant and well-governed companies like ACI Motors to create jobs and drive sustainable growth.

A notable success story is Japanese conglomerate Mitsui & Co's recent acquisition of a substantial stake in ACI Motors.

"Such investments bring global confidence, as major players feel reassured when they see foreign investments have already been established," Quadir said. He also emphasised BMA had facilitated a conducive partnership within ACI Motors for new global players to join in. He believes this could be a replicable model for other aspiring businesses.

ACI Motors assembles and distributes branded agrarian machinery, including products from Japan's Yanmar, motorcycles from Yamaha, and commercial vehicles from China's Foton.

Despite its potential, the country faces multiple hurdles to attract large foreign capital infusion. Many local corporations struggle with poor governance and outdated operational frameworks.

Regulatory inefficiencies, particularly at the Bangladesh Securities and Exchange Commission (BSEC), also deter private equity investments. For instance, initial public offerings (IPOs), a common exit strategy for such private equity funds, face lengthy delays.

Private equity funds often resort to alternative exit strategies, such as selling stakes to foreign entrepreneurs or local sponsors. Typically, they aim to exit within five years. But in Bangladesh, these investments often remain tied up for over a decade due to regulatory delays.

To attract more private equity investments, Bangladesh must implement regulatory reforms to enable smoother exits for investors.

As the country transitions from a developing economy to a middle-income one, fostering technology-driven industries will be crucial to maintaining competitiveness.

"With improved compliance, governance, and sustainability, Bangladesh can draw even greater foreign direct investment and private equity funding," said Dr M Masrur Reaz, chairman and CEO of Policy Exchange of Bangladesh, a private think tank.

He emphasised such investments were vital for local businesses in this critical period.

jasimharoon@yahoo.com

bikashju@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.