Amnesty on undisclosed offshore assets should be for last time, says Mannan

Published :

Updated :

Planning Minister MA Mannan on Sunday said the amnesty offered in the proposed budget for legalising offshore assets of Bangladeshi nationals should be for the last time and the rate of tax should be at least 10 per cent, instead of 7 per cent proposed in the fiscal layout.

"I'm not in favour of 7 per cent, at least it should be 10 per cent," he said while speaking at a post- budget virtual discussion.

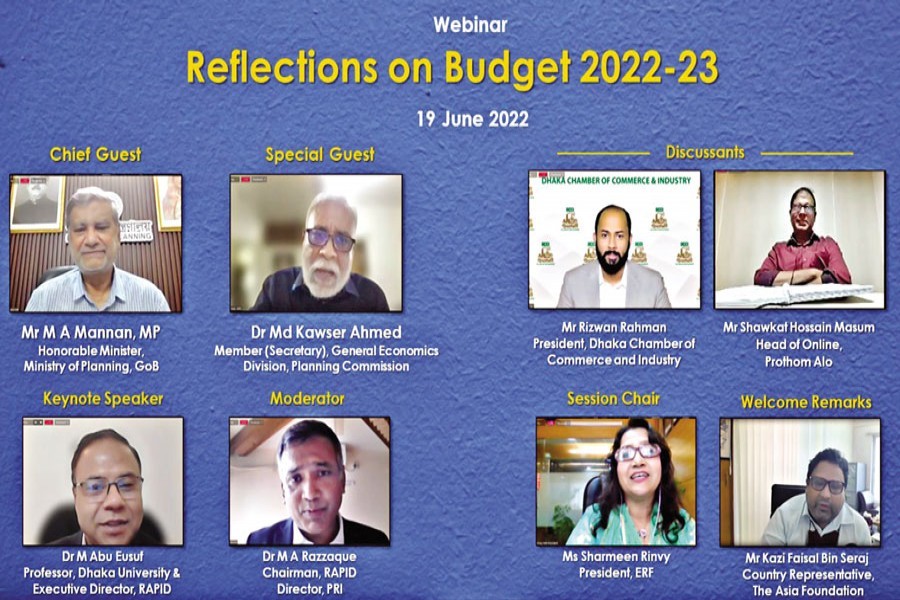

Economic Reporters' Forum, The Asia Foundation (TAF) and Research and Policy Integration for Development (RAPID) jointly organised the webinar titled "Reflections on Budget 2022-23".

Replying to a question, he said, "The offer is better than bad."

However, the minister emphasised formulating a stricter law and introducing harsher punishments to stop smuggling and siphoning of the country's money and resources.

He observed that it has become difficult to check such movement of money nowadays.

"As many countries allow it, it is the rule of the world now to legalise such money," he said.

The minister expressed his frustration saying that the money will not come back even after this offer. "Those who smuggle do not do it to bring back," he said.

Mr Mannan also said it is actually a desperate move on the part of the Finance Minister to bring back smuggled money.

President of Dhaka Chamber of Commerce and Industry Rizwan Rahman said allowing such money in the economy has a bad impact.

He added the inflow creates bubble and once bubble goes off, it creates havoc on the economy and people.

Mr Rahman said such amnesty for undisclosed money in the capital market during the period of last caretaker government created disaster in the market in 2010, from which recovery hasn't come as yet completely. "So please do it cautiously, there are risks," he said.

He said businesses pay more than 25 per cent tax while doing business in the country whereas the smuggled money will be legalised at 7 per cent tax, which means the government is offering 18 per cent discount for smuggling money. He added such policy will decrease revenue income as well.

The DCCI president urged the government to increase allocation for social safety net to 3 per cent at least. He also called for special allocation for the flood-hit population segment.

The DCCI chief said provision of spot fine by NBR officials will increase harassments and complexities rather than easing the tax process.

Head of Online of The Daily Prothom Alo Shawkat Hossain Masum said there are written manuals of IMF and OECD about how to bring back smuggled money and legalise undisclosed income.

According to the manuals, these provisions can't be continued for year after year but Bangladesh has already offered this opportunity for 20 times, he added.

Mr Masum said it is not in line with the international laws and rules that no question could be made if one legalises such money. There should be difference between "black money" and "undisclosed income"," he added.

He said raising question and even carrying out investigation is legal in case money is not earned in a legal way even after legalising undisclosed income.

Member Secretary of General Economics Division Dr Md Kawser Ahmed said there is not enough breathing and fiscal space for the finance minister to increase allocation in essential sectors like education, safety net and health.

"Our Tax-GDP ratio is one of the lowest in the world, how the government would allocate funds in necessary sectors," he said.

However, he said the government has made efforts to increase allocation in necessary sectors.

Executive Director of RAPID Dr Abu Eusuf presented a keynote paper at the programme.

The keynote said resource mobilisation efforts and promises, as envisaged in the budget speech and 8th Five Year Plan, needs to be materialized.

Tax reforms should be accelerated to address the growing inequality, it said.

Considering the inflationary pressure, the keynote said taxable income exemption limit should be relaxed to support the middle-class.

It also said a concrete recovery plan backed by timely initiative is extremely important to build the pandemic-battered education sector.

ERF President Ms Sharmeen Rinvy chaired the event while RAPID Chairman Dr Mohammad Abdur Razzaque moderated it.

bdsmile@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.