Economists express such view as FY23 sees imbalance widen to $8.2b

BoP deficit deteriorates 'worryingly'

Published :

Updated :

Higher external spending against lower earnings caused Bangladesh's balance-of-payments (BoP) situation to deteriorate into a large deficit worth US$8.2 billion in the past fiscal, thus further denting its forex reserves.

Many leading economists paint such picture of the country's transactions with the rest of the globe as "worrying".

The fiscal 2022-23 BoP woes have largely been driven by a sharp deficit in financial account and current account.

Bangladesh had a financial-account surplus of more than $15.5 billion in FY 2021-22. But it was in large deficit amounting to $2.1 billion in FY 2023 in a reversal of the macroeconomic health.

The current-account deficit or CAD stood at $3.3 billion in June last although it eased to a large extent in FY 2023 on the back of tight imports to weather foreign-exchange crunch. Imports dropped by nearly 16 per cent during the period under review.

Only the capital account, another key component of the BoP, was in surplus, at $473 million or up by 161 per cent than FY 2022.

Economists familiar with the matter told the FE that the picture for the year as whole remained concerning, as tightfisted import added up to price rises and squeezing production on the other hand.

The BoP deficit bloated by about $1.6 billion in FY23 relative to FY22 despite $15.3-billion decline in current-account deficit driven primarily by 15.8-percent decline in imports, says Dr Zahid Hussain, a former lead economist of the World Bank.

"The disruption to the economy caused by imports affected all sectors. This clearly is not a sustainable approach to correcting external imbalances."

Dr Hussain notes that a sharp turnaround from surplus to a large deficit in the financial account was the story of the year.

"This was driven by the inability to roll over short-term debt, large deficit in commercial bank holdings of net foreign assets, massively increased outflows on account of trade credit and decline in net MLT disbursements," the economist says explaining the reasons behind the worrying situation of the financial account.

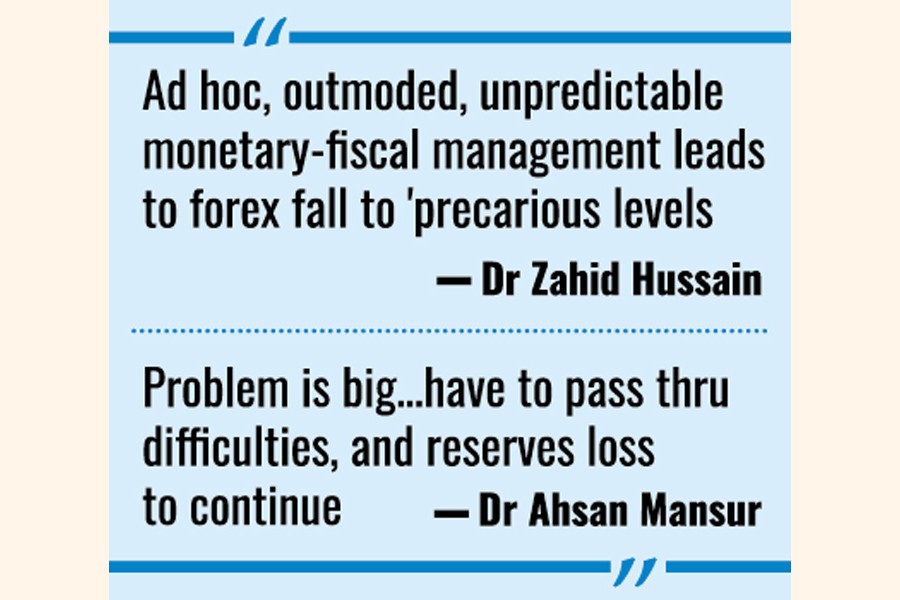

In his view, ad hoc, outmoded and unpredictable monetary and fiscal management contributed to this state of affairs, leading to depletion of foreign-exchange reserves to "precarious" levels.

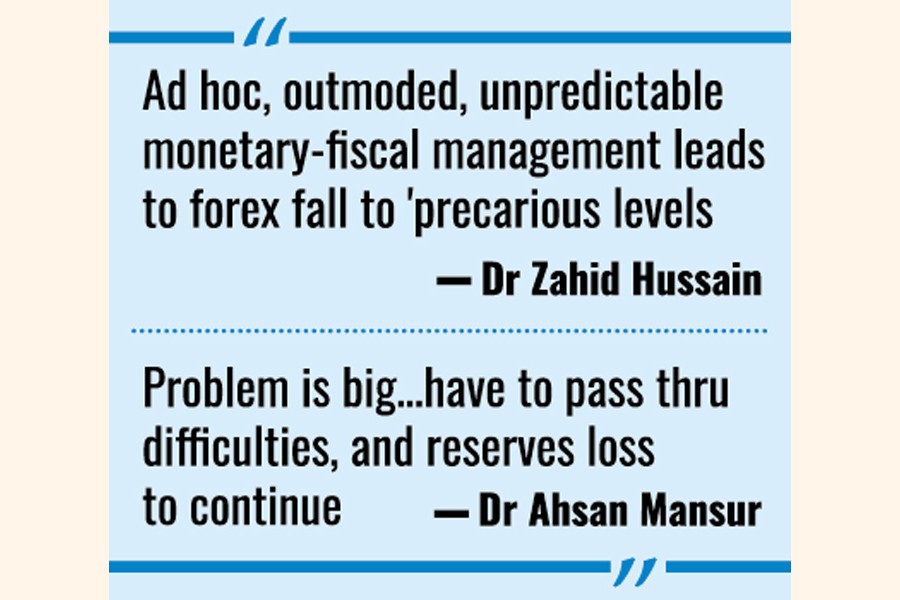

Dr Ahsan H. Mansur, executive director at the Policy Research Institute of Bangladesh or PRI, told the FE that there is huge problem in overcoming the worse situation of the BoP.

"The problem is big [in overcoming the situation],"

Bangladesh should settle some international obligations which the country cannot do overnight.

"We need to settle the liabilities relating to gas, power and even fertilizers."

Dr Mansur said some short-term borrowing by private sector should be settled to improve the health of the financial account.

"Actually we have to pass the time through difficulties, and reserve loss will continue," Dr Mansur notes taking a long view ahead of the economic affairs.

However, the trade balance was in deficit at $17.2 billion in FY 23, down by over 48 per cent from the level of FY 2022.

Export receipt increased 6.28 per cent in FY 2023 while import spending dropped 15.76 per cent during the period under review.

jasimharoon@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.