Merchandise export highest, yet misses annual target

Bangladesh earns $55.55b in FY23, riding on robust RMG growth

Published :

Updated :

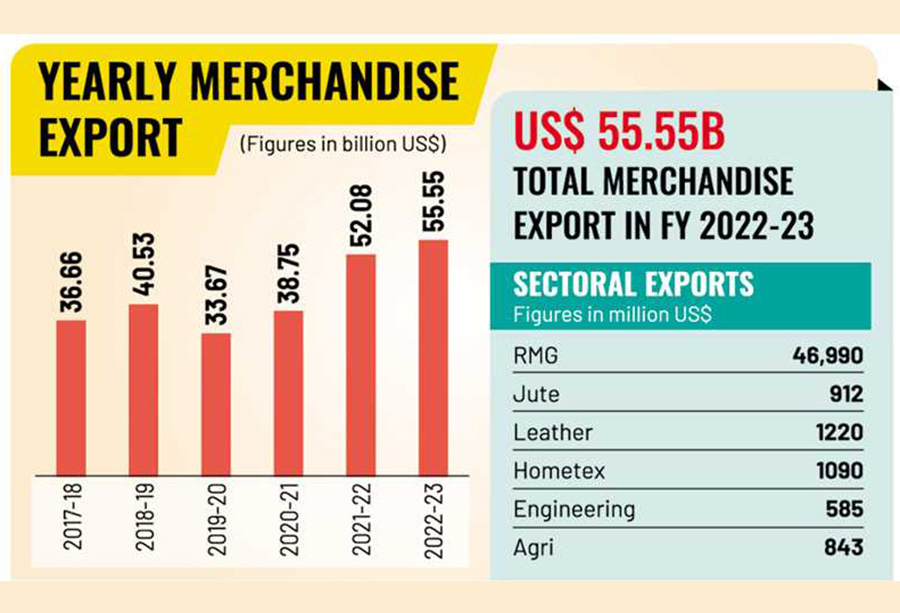

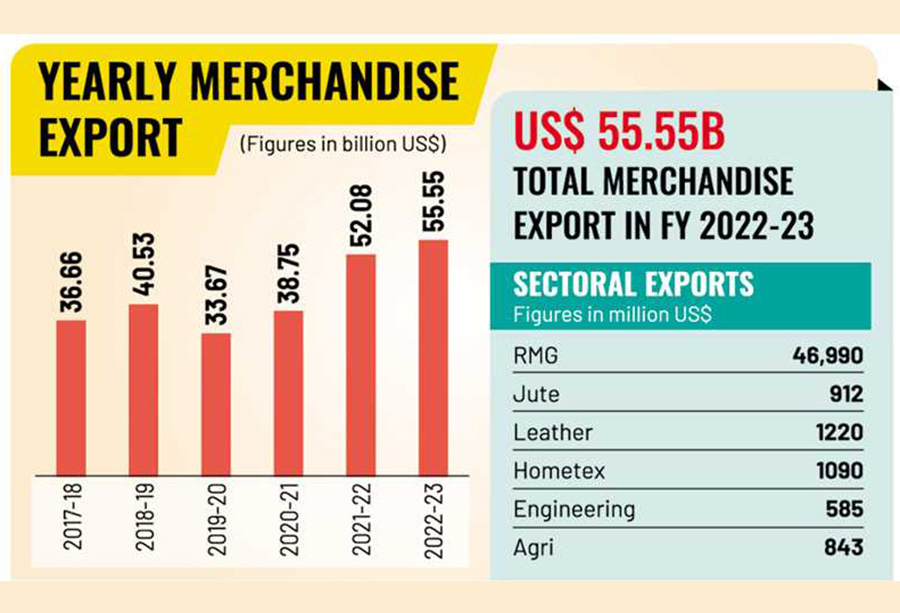

Bangladesh bagged a record-high US$55.55-billion earning from merchandise export in the just-past fiscal year, riding on a double-digit growth for readymade garments, in a little relief amid forex crunch.

Yet, the export growth of 6.67 per cent missed the annualized target by 4.21 per cent. The FY2022-23 target was $58 billion.

Officials, however, welcome the goods-export earnings at this trying time as a “blessing at” as the country faces a foreign-currency crunch with the dollar reserves sinking to or below $30 billion.

In the fiscal 2021-22, the country earned US$52.08 billion, according to Export Promotion Bureau (EPB) data released Monday.

Save RMG, plastic, and non-leather footwear among 10 major sectors, frozen and live fishes, agricultural products, jute and jute goods, leather and leather goods, home textiles, chemical products including pharmaceuticals, and engineering products witnessed negative growth throughout the financial year.

According to the EPB data, single-month earnings in June 2023 stood at US$5.03 billion in a 2.51-percent growth over June 2022. In June 2022, export earnings were US$4.90 billion.

And again the June’23 earnings also fell short of target by 9.61 per cent.

Out of the annual total of US$55.55 billion, readymade garment or RMG exports fetched US$ 46.99 billion, recording a growth of 10.27 per cent during the July-June period.

The sector’s earnings slightly exceeded the target set for the fiscal 2022-23 by 0.41 per cent.

In the corresponding period of FY22, the country earned US$ 42.61 billion from apparel exports.

In FY23, the knitwear subsector of RMG earned US$ 25.73 billion, registering a growth of 10.87 per cent, while earnings from woven garments amounted to US$ 21.25 billion, up by 9.56 per cent.

Home textiles witnessed about 32.47-percent negative growth, with earnings amounting to US$ 1.09 billion.

Asked about the export performance as per official reckonings, Bangladesh Garment Manufacturers and Exporters Association (BGMEA) president Faruque Hassan attributed the positive growth in the country’s largest foreign-currency- earning sector to value-added garment items and exports to new and non-traditional markets, among others.

“Machinery up-gradation, diversification for value-added items, which entrepreneurs are now adopting to sustain their competitiveness, and rising exports to new markets like Japan, Australia, Korea and India helped maintain the positive growth,” he said.

He mentions that a number of local apparel makers are in Paris now to showcase their latest innovations despite problems here. Such participation helps in raising confidence among buyers.

Last fiscal, unit prices of locally made clothing items also increased, he said.

The industry leader, however, appeared apprehensive that export in the coming months might not sustain the positive growth as many factories are running below their production capacity.

According to the EPB data, jute sector experienced negative growth during the just-ended fiscal year.

Exports of jute and jute goods dropped 19.1 per cent to US$ 912.25 million from US$ 1.12 billion in the same period of fiscal year of 2021-22.

Earnings from agricultural items like vegetables, fruits, and dry foods also suffered a negative growth of about 27.47 per cent to US$ 843.03 million during the July-June period of FY23.

According to the official statistics, engineering-product shipments declined 26.37 per cent to US$ 585.85 million.

Export earnings from frozen and live fishes decreased by 20.76 per cent to US$ 422.28 million in the same period.

Pharmaceutical exports stood at US$ 175.42 million, registering a 7.08-percent negative growth in tandem with the losing lot.

Bangladesh received US$1.22 billion from the export of leather and leather goods in the July-June period of FY23, registering a negative growth of 1.74 per cent.

Earnings from footwear other than leather items, however, grew by 6.61 per cent to US$ 478.86 million during the period.

The EPB also showed export of plastic products having witnessed a 26.23-percent growth to US$ 209.86 million.

Talking to the FE on Monday, executive director of Policy Research Institute of Bangladesh Dr Ahsan H Mansur said export growth slowed down in last few months of the fiscal year 2022-23 mainly because of the global economic crisis which also affected Bangladesh.

“If we look into the US market, Bangladesh is relatively in better position compared to China, Vietnam and India,” he said, adding that RMG sector sustained its competitiveness on the global market.

But sectors beyond RMG could not perform well consistently as, if any sector does well in a fiscal, it fails to maintain the same pace in next year, he explains the export enigma and terms such situation ‘concerning’.

“So, no sector can be said perform good and identified as growing or potential ones,” he said, adding: “All are stressing for products diversification which is not happening.”

munni_fe@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.