Published :

Updated :

Bangladesh's foreign-exchange reserves are taking a tumble as the central bank goes on selling a record volume of US dollar to the commercial banks having an acute forex dearth to settle their mounting overseas transactions.

To avoid the overshooting of exchange rates because of the shortfall of the dollar on the money market, Bangladesh Bank (BB) kept injecting the greenback into the banks for last eight months, official sources have said.

Such growing sale of the dollar from the central bank has put more pressure on the country's foreign-currency reserves already under stress because of growing import costs, largely for global price rises.

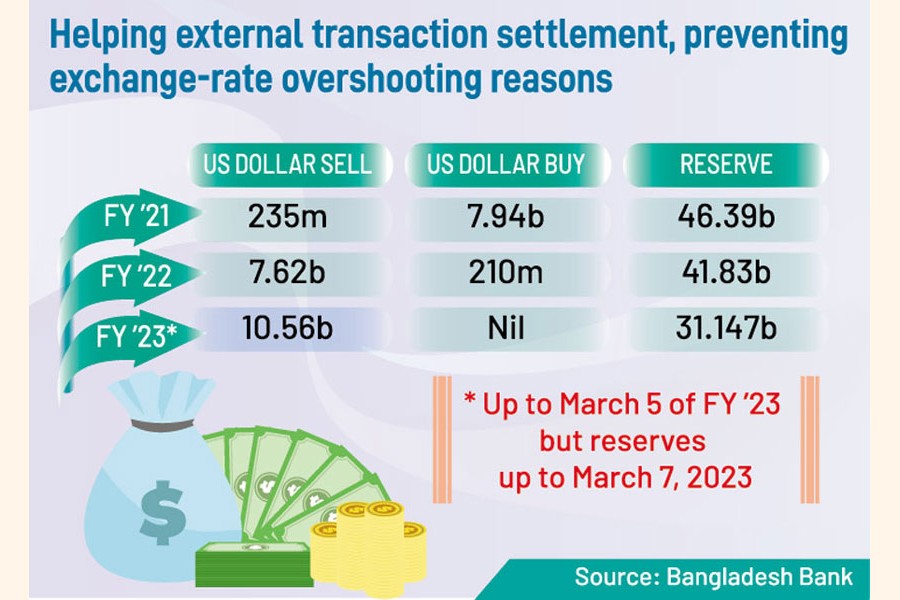

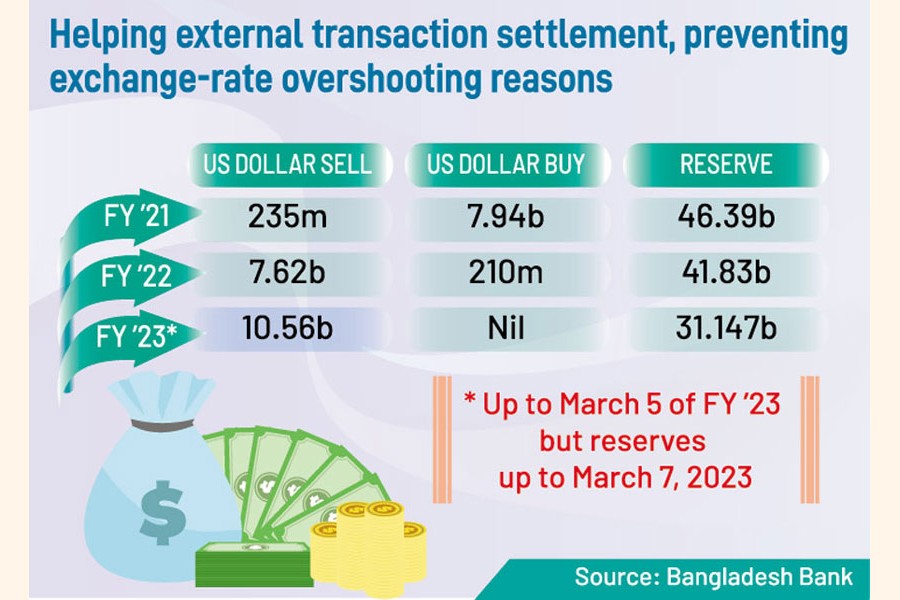

According to BB statistics, the central bank purchased US$ 7.93 billion from the market and sold US$ 235 million in the financial year (FY) 2020-2021. The arithmetic was altogether different in the previous fiscal (FY'22) as it bought US$210 million while sold US$ 7.62 billion to the banks.

And the upward trend in selling dollar has intensified further in the ongoing fiscal year of 2022-2023 with US$ 10.56 billion sold out as on March 05, 2023. But the BB has not bought a single penny so far this financial year.

Because of the ongoing forex dearth, the queue of commercial banks to the central bank to buy the greenback to settle LCs (letter of credit) continues to be longer in recent months, sources at the BB said.

The state-run banks, in particular, are taking an increased volume of dollar support from the central bank for settling import payments for Bangladesh Petroleum Corporation, Bangladesh Agricultural Development Corporation and Bangladesh Chemical Industries Corporation and so.

"We (the BB) sold US$ 10.56 billion so far this fiscal (until March 05, 2023), which is the highest in a fiscal year in the history of Bangladesh," says a BB official, who prefers to be anonymous.

He said the central bank is selling a large volume of the US currency to stabilise the exchange rate, prices of essential commodities by stopping the scope of rapid depreciation of the currency.

The BB official said the central bank had purchased huge volume of US dollars from the market in FY'21 when a record inflow of remittance amounting to US$ 24.77 billion was recorded. There was lockdown, which restricted people's movement and the hundi business was not in operation because of the Covid-induced shocks.

"That's why a record number of remittances had come. As the supply was huge, the BB purchased more foreign currency to make a balance in the market," the BB official said.

Now the situation completely reversed. The supply is under stress because of the external factors but the cost of commodities goes up significantly globally following the Russia-Ukraine war, according to the official.

"So, cost of commodities has gone up globally and the currency depreciation is happening in a faster way. BB is now selling US dollars to overcome this double whammy as much as it can," the official says.

When contacted, managing director and chief executive officer of Mutual Trust Bank (MTB) Limited Syed Mahbubur Rahman said the banks face difficulties in settling LCs because of the forex dearth. As a result, he said, banks are trying to use window of buying US dollars from the BB to meet foreign-currency obligations.

Considering the current macroeconomic situation, the BB is selling more dollars but it should not be on continuous basis. "There is average monthly need of US$ 4.5 billion to settle import bills. Can the BB meet the requirement regularly? I think they should not. Otherwise, BB will run out of dollars. It is the bank who will earn dollars to meet their obligations."

Research director of Bangladesh Institute of Development Studies (BIDS) Dr Monzur Hossain said the BB as part of its market intervention releases dollar to the market as the supply-demand gap gets enhanced in recent times.

"The BB needs to sell dollar to stabilise the exchange rate but it should not release the greenback at a level that might create more pressure on the reserves," he suggests.

According to the central bank data, the size of reserves was US$ 46.39 billion in FY'21.The reserves declined to US$ 41.83 billion in FY'22 when BB's dollar sales started increasing. The reserves as on March 7 of this fiscal stood down at 31.147 billion and it is believed that the record dollar sale contributes largely to the significant fall.

jubairfe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.