Rules allowing exit from locked-in TIN ready

Provision of de-registration as taxpayer to get through parliament

Published :

Updated :

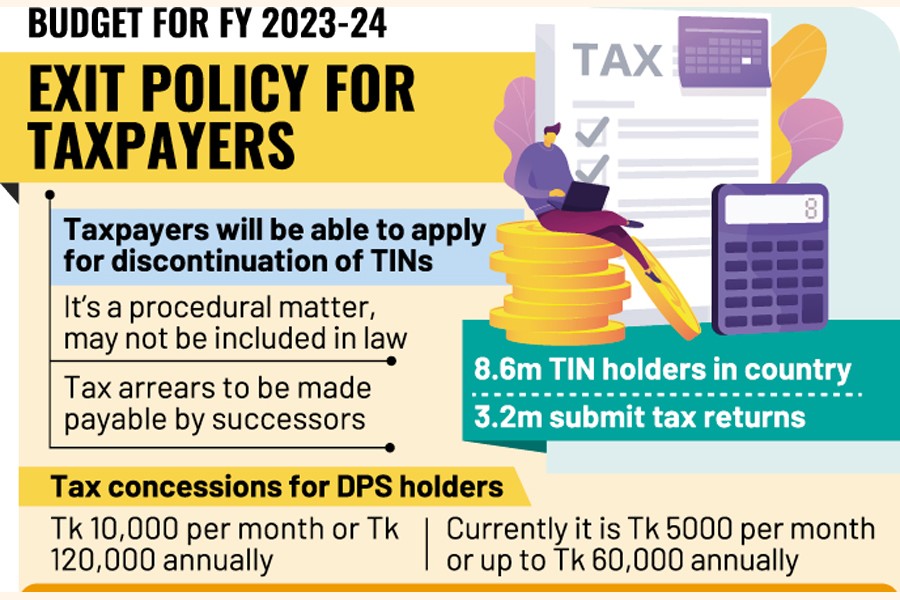

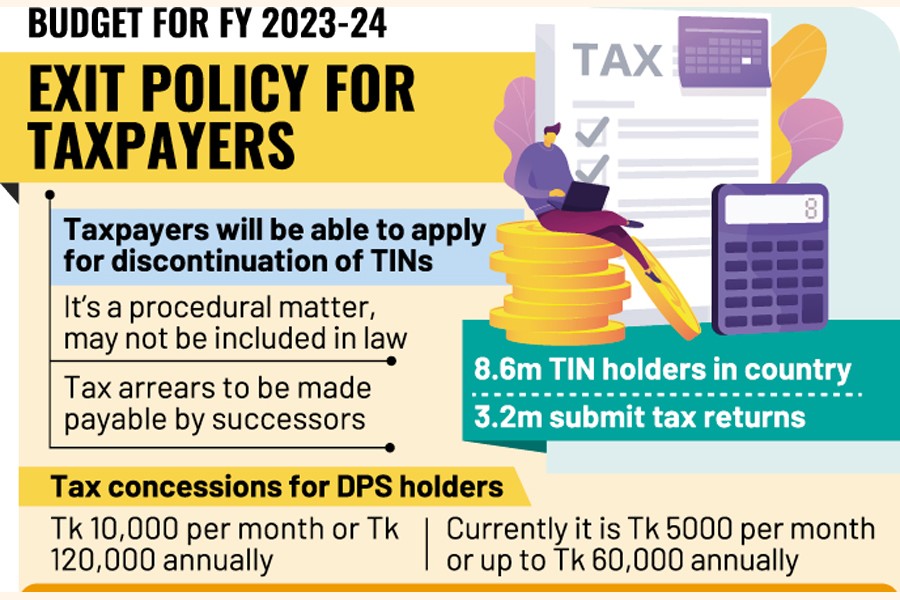

The government is set to introduce exit policy for taxpayers for the first time to rid cross-sections of people, including expatriates, locked in TIN forever once taken.

The revenue authority is likely to incorporate a provision of de-registration into the law for the taxpayers who are searching ways to exit from tax net for various reasons.

Under the provision, to be placed with the new budget before Parliament on June 1, 2023, taxpayers will be able to apply for discontinuation of their Taxpayer Identification Number (TIN) to the tax authority by explaining valid reasons.

Currently, people who obtain TIN once get locked — they cannot stop or discontinue the registration even after death.

Former income-tax member Aminur Rahman says tax arrears would be payable by successors of the deceased but there must be a provision for exit from the tax net.

“It’s a procedural matter, may not be included in the law,” he added.

A senior tax official in a field- level tax office says taxmen have to follow up all TIN-holders by sending notices though they know those taxpayers did not exit — either deceased or left the country.

“We would be able to spend time scrutinizing the well-off section and expand tax net rather than wasting time on inactive TINs,” he adds.

According to sources, the TIN- holders could discontinue their registration making the TIN dormant during fiscal year (FY 2023-24).

They would be able to resume the TIN again by submitting application to the tax department.

Currently, there are 8.6 million TIN-holders under the National Board of Revenue (NBR). Of them, only around 3.2 million submit tax returns.

Officials said the wide gap between TIN-holders and return submissions would be minimised after introduction of ‘de-registration’ provision.

They said the number of actual taxpayers who are paying taxes regularly would be known after introduction of the provision.

The ICT wing of the NBR would make the TIN dormant on its server after getting instruction from the tax offices concerned, they said.

It was a longstanding demand from both the taxpayers and taxmen to introduce the de-registration provision in tax law.

Under the Company Act, a company could wind up its operations following some procedures. But, tax registration of the company remained active for years due to absence of such provision in the tax law.

Officials said in the upcoming financial year, the fiscal measures would be devised to encourage savings in the commercial banks through DPS to increase liquidity flow into banks.

From the upcoming fiscal, DPS- holders would get tax concessions worth Tk 10,000 per month or Tk 120,000 annually. Currently it is Tk 5,000 per month or up to Tk 60,000 annually.

doulotakter11@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.