Banks see NPLs make quantum leap to Tk3.45t

Soured loans in banking system rise by Tk 2.0t YoY until last December

SIDDIQUE ISLAM and JUBAIR HASAN

Published :

Updated :

Classified loans in Bangladesh's banking sector keep rising fast with the cumulative volume having made a quantum leap by over Tk 2.0 trillion year on year till last December, official statics show.

Classified loans in Bangladesh's banking sector keep rising fast with the cumulative volume having made a quantum leap by over Tk 2.0 trillion year on year till last December, official statics show.

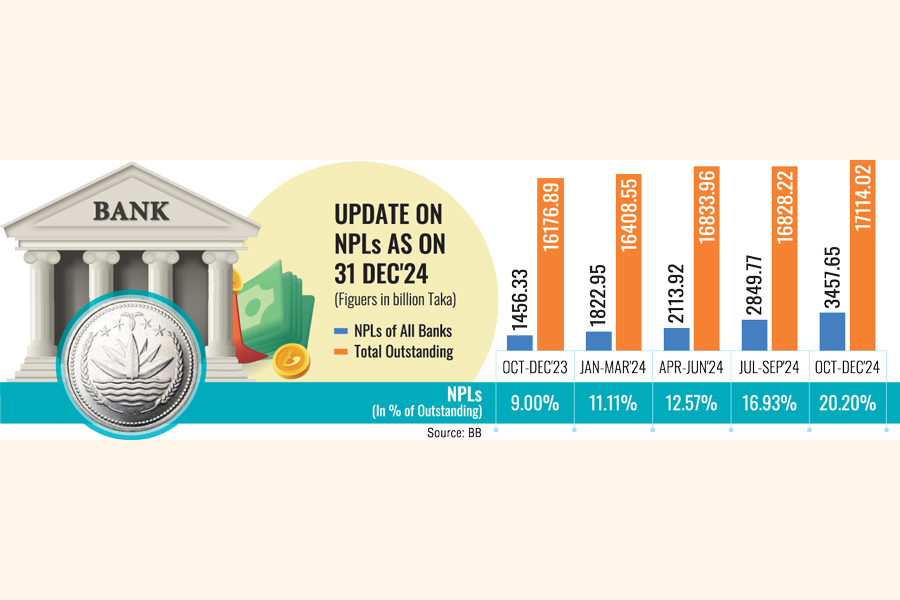

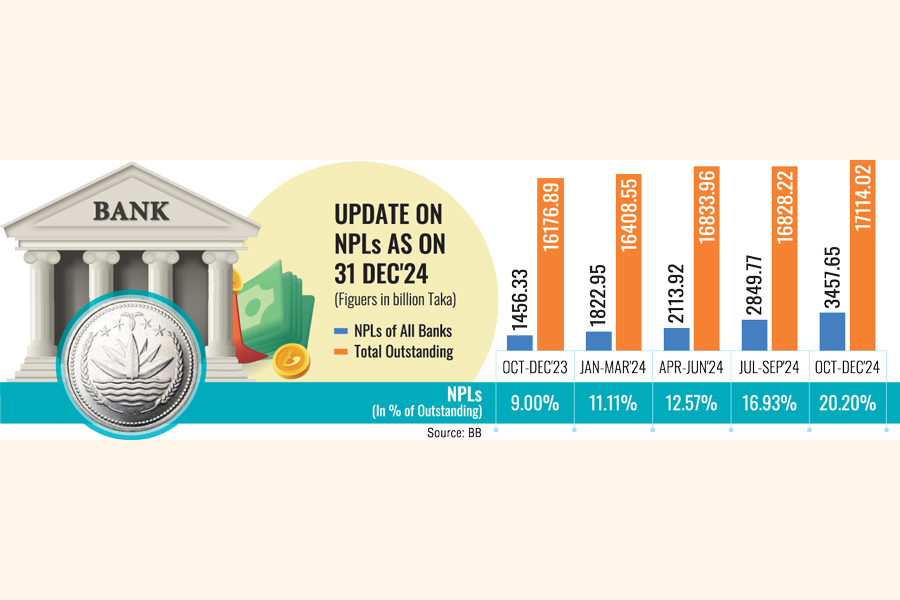

With such leaps in the volume of non-performing loans (NPLs), the figure hit a record-high Tk 3.45 trillion by the end of last calendar year, accounting for 20.20 per cent of the entire loans worth Tk 17.11 trillion disbursed by the country's commercial banks.

Hamstrung by such all-time-high volume of NPLs, banks limit their credit supply to the borrowers. Besides, banks' profitability is also dented as they have to maintain a portion of funds for NPL provisioning.

The country's central bank, Bangladesh Bank (BB), predicts that the rising trend in NPLs would continue in the coming quarters as it revised overdue-status-counting system for term lending to a curtailed tenure of six months from previous nine months.

According to some senior bankers, this counting arithmetic will be revised further from March 31, 2025 and onwards when such loans will be classified within three months instead of the current six months.

Briefing reporters about the latest data, Bangladesh Bank Governor Dr Ahsan H. Mansur Wednesday revealed the tip of the iceberg as he said the NPL buildup in banks continued on the back of jumps in bad loans on several occasions in the past.

He said the uptrend would continue in the months ahead as it has not reached the optimum level yet because the central bank is not showing controlled NPL-related data as in the past.

Simultaneously, the governor said, the overdue-status-counting system for term lending is being changed from 180 days to 90 days. "So, we'll be seeing a faster and accelerated climbing of NPL in coming days, which is not an apprehension but a reality," he said.

According to the data, the share of classified loans rose to 20.20 per cent of the total outstanding loans during the period under review from 9.00 per cent a year before. It was 16.93 per cent as on September 30, 2024.

Classified loans include substandard, doubtful and bad/loss of total outstanding credits. The total outstanding credits amounted to Tk 17.11 trillion by the end of 2024, in a rise from Tk 16.18 trillion a year before. It was Tk 16.83 trillion as on September 2024.

In terms of the category of banks, the ratio of classified loans in the state-owned commercial banks (SoCBs), like on other occasions, remained high.

During the period, the total amount of NPLs with six state-owned SoCBs rose to Tk 1.37 trillion or 42.80 per cent from Tk 657.81 billion as on December 31, 2023. It was Tk 1261.11 billion in the third quarter (Q3) of 2024.

On the other hand, the total amount of classified loans with 43 private commercial banks (PCBs) reached Tk 2.0 trillion in the final quarter of last calendar year from Tk 709.82 billion a year ago. It was Tk 1498.06 billion in Q3 of 2024.

The NPLs of nine foreign commercial banks (FCBs), on the other hand, came down to Tk 26.99 billion during the period under review, from Tk 32.01 billion in Q4 of 2023. It was Tk 32.46 billion in Q3 of last calendar year.

The classified loans with three specialised banks (SBs), however, rose to Tk 64.32 billion in Q4 of 2024, from Tk 56.69 billion a year ago. It was Tk 58.14 billion as on September 2024.

Such growing NPL buildup in banks caused serious concerns to bankers who fear further pressure on their liquidity situation in the coming months.

Managing director and chief executive officer of Mutual Trust Bank (MTB) PLC Syed Mahbubur Rahman says the real picture of NPL in banks started getting exposed, in the changed context now.

He feels the volume of dud loans could increase further in the coming months following implementation of the new classified-loan-counting system effective from later next month.

The experienced banker says the regulator has been taking various remedial steps for streamlining the banking industry in recent months. "If the steps are appropriate and the next elected government embraces those, then we could see a turnaround in banking landscape."

Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development (InM), told the FE that the lending capacity of the banks would continue to fall with rising buildup of non-performing assets of the banks.

As a matter of fact, the financial health of banks will be weakening, which will accentuate public sufferings in the form of squeezing liquidity supply, predicts Dr Mujeri, also a former chief economist of the central bank.

The noted economist says the central bank is only sharing the data about the classified loans, not about the recovery of the defaulted loans in detail.

"People have the right to know the measures taken to recover the public money," he notes.

siddique.islam@gmail.com and jubairfe1980@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.