Published :

Updated :

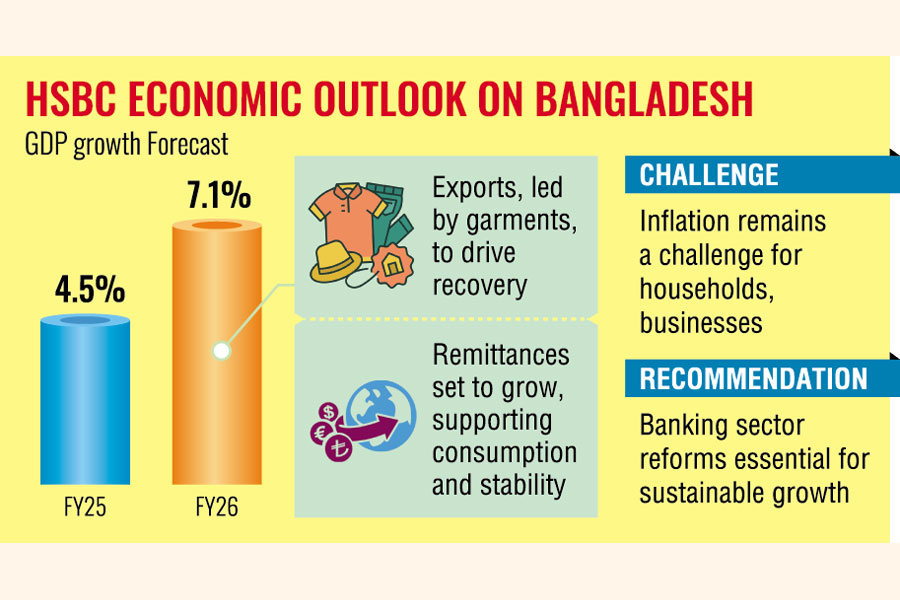

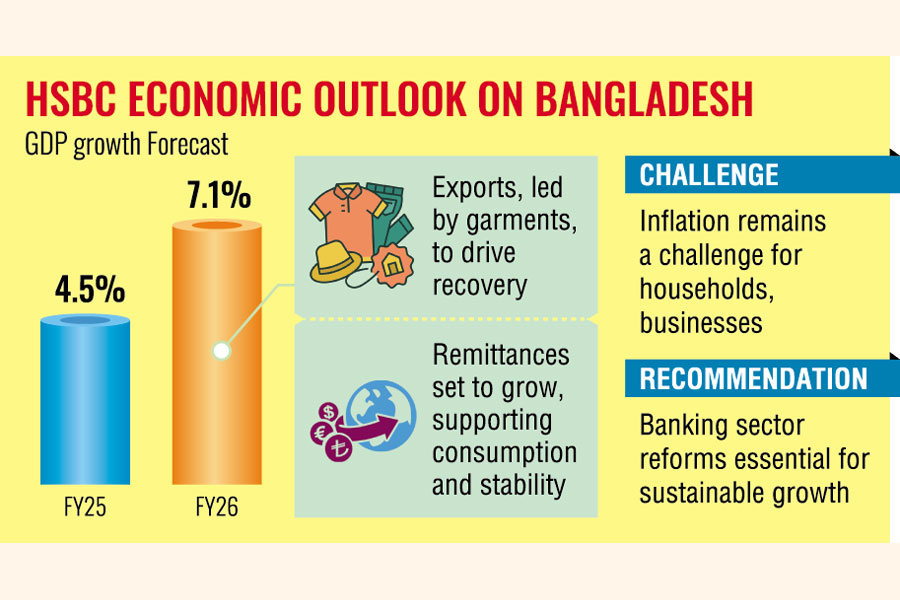

Bangladesh's economy is expected to rebound significantly over the coming year, with GDP growth making a leap to 7.1 per cent in FY2025-26, according to a latest HSBC projection.

Although the growth rate has been revised to 4.5 per cent for FY2024-25, the country is set to bounce back, driven by strong export performance and rising remittances, says Frederic Neumann, Chief Asia Economist and Co-Head of Global Research Asia at the Hong Kong and Shanghai Banking Corporation or HSBC.

These insights were shared during an economic outlook webinar titled 'Navigating Bangladesh's Crossroads', organised by the HSBC Bangladesh chapter, incidentally in the wake of politico-economic changes in the country.

The event highlighted global and Asian market developments and provided perspectives on Bangladesh's economic future.

Based on latest HSBC Global Research report on Bangladesh 'Regaining balance - Bangladesh looks to recovery', Neumann said, "Even though Bangladesh's GDP growth rate has been set to a revised 4.5 per cent for FY2024-25, the country will rebound to 7.1 per cent in the following year.

" This growth will be largely driven by exports and remittances, both of which are showing positive signs despite the ongoing challenges in the global economy."

Neumann strikes an upbeat note on the trade front, notwithstanding headwinds, saying that the garment sector, which accounts for 83 per cent of the country's exports, is expected to grow by the demand from international markets.

At the same time, imports, which had been strained by rising global energy prices, are now stabilising, reflecting a recovery in domestic demand and easing cost pressures.

He also mentions that remittances are anticipated to grow driven by improved employment conditions in key overseas markets. This rise in remittances will not only support household consumption but also play a significant role in sustaining the broader economic recovery.

However, Mr Neumann also notes that while these factors are promising, challenges remain, particularly with inflation. This will continue to affect both household spending and business costs.

The HSBC recommends structural reforms in the banking sector and efforts to control inflation as essential for unlocking Bangladesh's full economic potential and ensuring long-term, sustainable growth.

The webinar was told that "Bangladesh is already well on its way to recovery".

"Macroeconomic adjustments undertaken in recent months, and robust economic fundamentals, should pave the way for growth to rebound over the coming year. A rapid implementation of reforms would help to speed up the process further."

The event was also attended by Md Mahbub ur Rahman, Chief Executive Officer, HSBC Bangladesh, and Gerard Haughey, Country Head of Wholesale Banking, HSBC Bangladesh.

Almost 300 clients and stakeholders were also in attendance at the virtual event.

sajibur@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.