Published :

Updated :

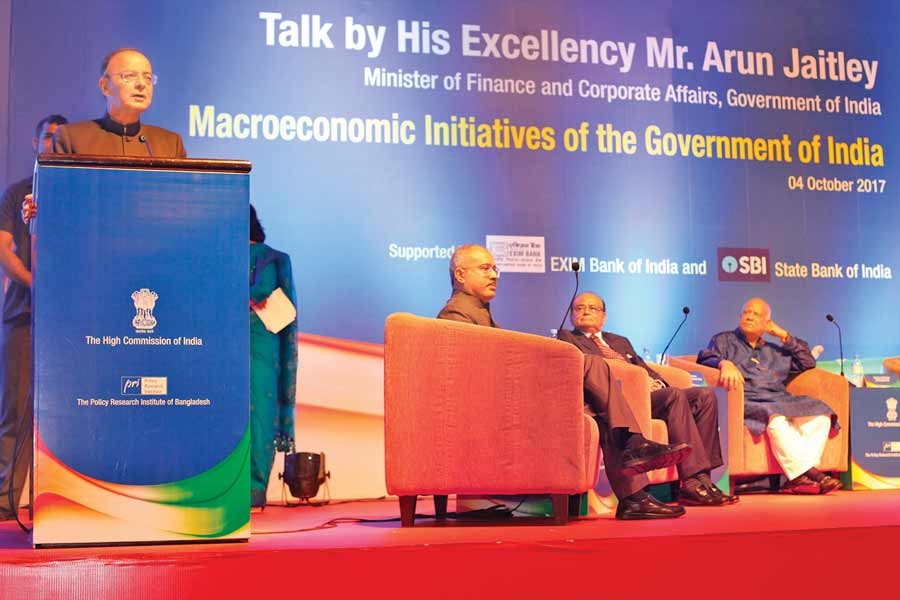

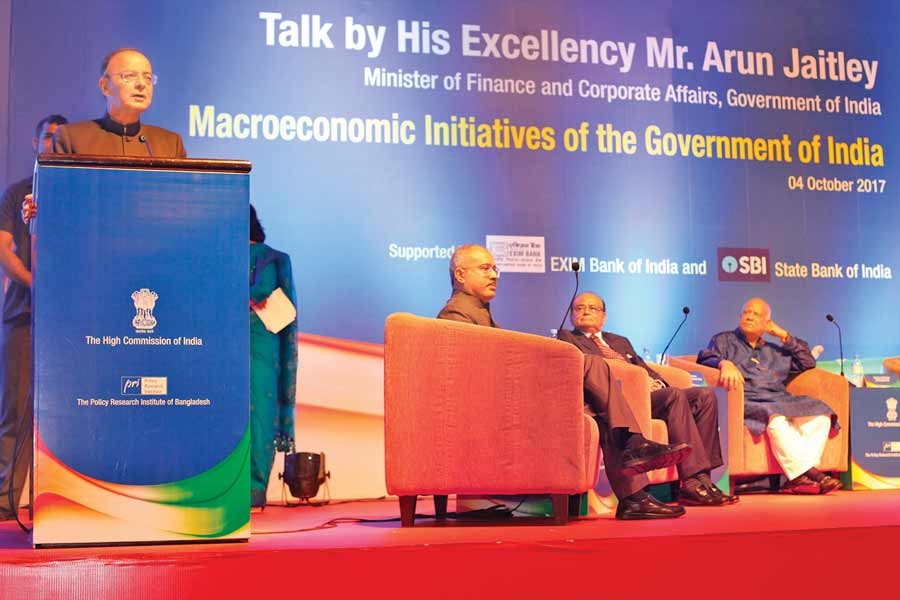

Indian Finance Minister Arun Jaitley speaks at the public lecture on 'Macroeconomic Initiatives of the Government of India' at a Dhaka hotel on Wednesday. Bangladesh Finance Minister AMA Muhith, Policy Research Institute Chairman Dr. Zaidi Sattar and Indian High Commissioner Harsh Vardhan Shringla were also present. — FE Photo

India's recent demonetisation drive and its move to become a cashless society can offer valuable lessons for economies like Bangladesh, Indian Finance Minister Arun Jaitley said on Wednesday.

"Cash leads to tax evasion, cash leads to shadow economy, cash leads to corruption," Mr Jaitley, who is now on a three-day official visit to Dhaka, said in a programme at a city hotel.

"Excessive cash can also lead to suppression of the poor. Because, a man who is in possession of excessive cash, is able to deprive the state of the revenue, which otherwise could be used for benefit of the poor."

"In India, we have also seen that many terrorist activities were supported by and thriving upon cash fund," said Mr Jaitley while delivering a public lecture on the macro-economic initiatives of the Indian government.

The Indian finance minister was also enthusiastic about the effect of the recent demonetisation scheme of his government, which he claimed, has resulted in greater digitalisation of transactions and reduction of corruption.

"Now that the demonetisation is complete, the number of digitalised transactions has increased in India, while the number of income taxpayers has suddenly increased also. Terrorists have also been squeezed off their cash fund."

"I really hope that research organisations like the Policy Research Institute will make a close study of this initiative to see what others can learn," Mr Jaitley added.

The Indian finance minister, in his speech, also focused on the process that was followed by the Indian government to bring the vast population of the country under formal banking system and to take the Indian society into a 'lesser cash direction'.

"Three years ago, we found that around 42 per cent of the Indian population were unbanked. However, since our nationwide programme of financial inclusion started, 300 million new bank accounts have been opened."

"As part of this process, representatives or correspondents of the banks visited every home, while large campaigns using billboards and other materials were carried out to popularise the banking system."

"The process was predominantly led by the public sector banks, while the private sector banks also cooperated in it," he added.

The Indian finance minister also elaborated the low-cost insurance and pension schemes that were used for incentivising people to maintain these new bank accounts.

He also explained the subsidies, provided to the poor underprivileged bank account holders to encourage them to keep more money in these new bank accounts.

"To ensure that such subsidies are properly targeted towards common people, we have come up with a programme called 'Aadhar' that is unique in India. Under the programme, every Indian has to get a unique ID number, which in turn, is also linked with their mobile number and bank accounts."

"This system helps us to ensure that subsidies are provided to the poor and deserving people."

"At the same time, instead of providing subsidies in terms of subsidized prices, they are now provided through cash transfer," the Indian minister noted.

"As a result, while everybody buys their products at market prices, the poor or the deserving people have a certain amount of cash transferred to their bank accounts. The effect of this scheme is that most of the zero-balance accounts have now become operational."

"Consequently, the portion of zero-balance accounts has decreased from 78 per cent to less than 20 per cent."

Highlighting the introduction of Goods and Services Tax (GST) in India, Mr Jaitley said, "This new tax system, which brings an entire chain of economic activities into one tax structure, also makes tax evasion tougher."

"This would result in further expansion and growth of the Indian economy," he added.

Speaking on the occasion, Bangladesh Finance Minister A M A Muhith said, "Experience from the rest of the world shows that ICT can be one of the strongest tools in eliminating corruption."

Chairman of Policy Research Institute (PRI) Dr. Zaidi Sattar, in his speech, said a high-performing Indian economy, complemented by prudent but expansionary macro-economic policies, could offer an external stimulus to Bangladeshi economy by creating additional demand for goods and services, thus giving a boost to the country's exports.

"About 75 to 80 per cent of our imports from India are immediate and capital goods that feed our manufacturing sector, which is good for jobs and growth."

Reflecting on India's experience in implementing demonetization and GST, Dr. Sattar said Bangladesh can learn from India in this respect.

Earlier, the two finance ministers inaugurated the cashless services at India's visa application centres in Dhaka's Shyamoli area and in Sylhet. In addition, the Dhaka representative office of the Exim Bank of India was also inaugurated during the event.

High Commissioner of India in Bangladesh Harsh Vardhan Shringla also spoke on the occasion.

mehdi.finexpress@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.