BD prepares for Chinese FDI surge, export spurt

Govt intel suggests removing 12 roadblocks

Published :

Updated :

Bangladesh prepares to receive prospective higher Chinese foreign direct investment (FDI) under its broader strategy to strengthen trade competitiveness amid challenges linked to its graduation from least-developed country (LDC) status and forex constraints.

The government moves for action on intelligence tips that higher FDI inflow from China could play a transformative role in several key sectors. Bangladesh's position as world's second-largest exporter of readymade garments makes it a strong candidate to absorb relocated Chinese apparel manufacturing, driven out by rising labour costs and shifting global trade dynamics.

The report on findings, shared with top government officials, including the interim government's Adviser for the Ministry of Finance, the Chairman of BIDA, the Secretary of the Ministry of Commerce, and the Chairman of the NBR, outlines both opportunities and obstacles to seizing them. The Financial Express has obtained a copy of this confidential document.

Speaking to the leading financial daily, Mahbubur Rahman, Secretary of the Ministry of Commerce, confirmed government's awareness of the issues raised for clearing the decks for trade on a higher trajectory. "We are informed of most of the issues, and the government wants to increase Chinese FDI," he stated.

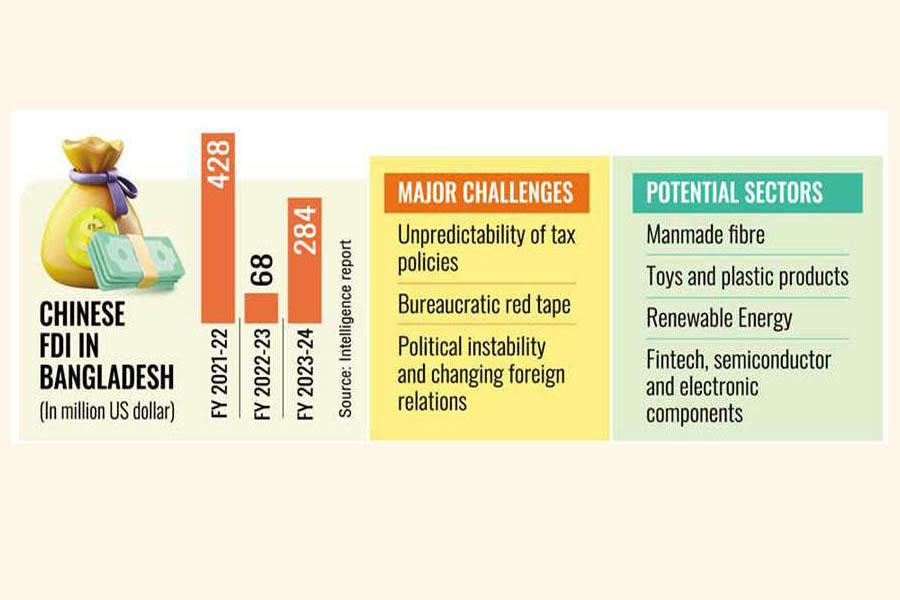

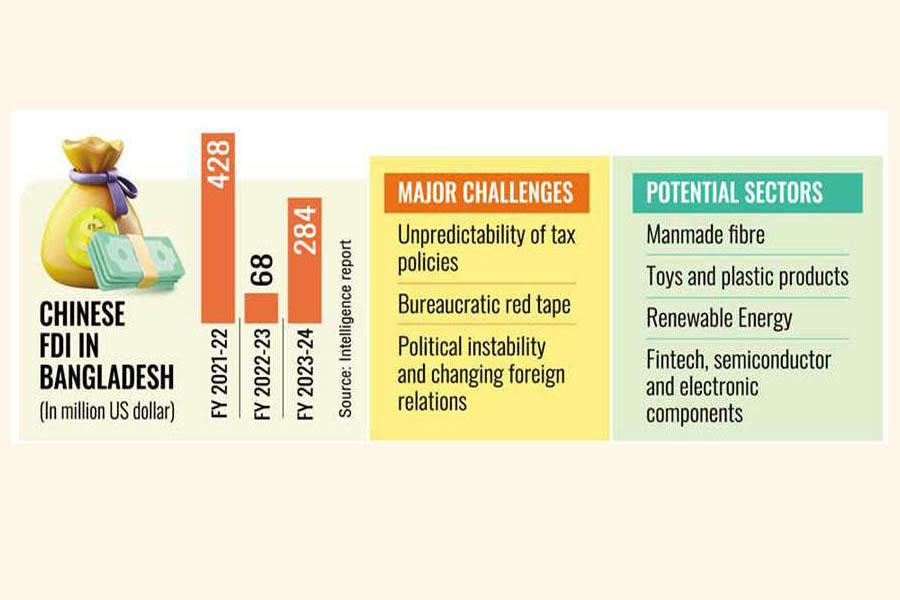

The report highlights 12 major hurdles impeding Chinese investment flows. These include unpredictable tax policies, bureaucratic inefficiencies, energy shortages, infrastructure constraints, political instability, and the impact of shifting global alliances.

The report recommends 15 must-dos that include establishing a unified political consensus on FDI policy, allowing Chinese investors to repatriate profits in their currency, yuan, adopting stable tax frameworks, and crafting sector-specific investment strategies.

On prospects for export to the vast market of China, it points out that currently, Bangladesh accounts for only 0.04 per cent of China's total imports. The report estimates that if this share rose to just 1%, Bangladesh's export earnings from China could jump to around $26 billion annually.

It also notes that Bangladesh missed out during the 2018 US-China trade war, when countries like Vietnam and Cambodia benefited from redirected Chinese investments. The report urges the government to act "proactively" this time to seize similar emerging opportunities.

"Improving the overall business climate would not only attract foreign investors but also encourage domestic entrepreneurship," the report says, while stressing the importance of regulatory vigilance to ensure Chinese investments align with national interests.

It identifies high-potential sectors for Chinese FDI, but warns of major hurdles that stand in the way.

The intelligence report outlines strong prospects for attracting Chinese foreign direct investment in emerging sectors, while also cautioning against persistent structural and policy challenges.

Key areas identified for Chinese investment include manmade fibre, toys and plastics, renewable energy, fintech, semiconductors, and electronics. The report emphasises the urgency of diversifying the readymade garment (RMG) sector, which remains heavily reliant on cotton. With 70 per cent of the global textile market now dominated by manmade fibres, investment from China in artificial fibre production could help Bangladesh align better with global market demands.

Plastic products and toy manufacturing are also flagged as promising sectors. China's global leadership in these industries, combined with Bangladesh's emerging presence, creates opportunities for technology transfer to improve product quality and boost export potential. Additionally, China's recent approval to import Bangladeshi mangoes, guavas, and jackfruits, and its interest in other agro-and fishery products such as Hilsa, present new avenues for investment in agro-processing, which could also reduce post-harvest losses.

The report also highlights China's interest in Bangladesh's renewable energy ambitions. With the goal of sourcing 40 per cent of electricity from renewables by 2040, local manufacturing of solar panels, batteries, and other components, in collaboration with Chinese firms like LONGi, could significantly contribute to this transition.

In the jute sector, where Bangladesh accounts for around 70 per cent of global production, rising global demand for sustainable packaging presents another window of opportunity. However, to compete internationally, access to advanced technologies-potentially through Chinese partnerships-is deemed essential.

The pharmaceutical sector, already exporting to over 150 countries and meeting nearly all of its domestic demand, could also benefit from increased Chinese investment. Local production of active pharmaceutical ingredients (APIs), most of which are currently imported from China, would reduce costs and improve competitiveness, specifically in the post-graduation trading era.

Other identified sectors include medical equipment, digital payments, infrastructure, port management, power, telecommunications, ICT, tourism, shipbreaking, kitchen appliances, bicycles, and furniture.

Despite these promising areas, the report notes that foreign investors face significant challenges in Bangladesh. Tax policies remain inconsistent and subject to sudden changes, undermining investor confidence. Delays in repatriating profits due to ongoing dollar shortages further weaken the investment environment.

The report criticises widespread bureaucratic inefficiencies, corruption, and a lack of coordination among regulatory bodies, which result in delays in approval, licensing, and land acquisition. It also highlights a shortage of skilled workers, particularly in high-tech industries such as semiconductors, robotics, and electric vehicles. Poor language proficiency in both English and Chinese compounds this skills gap.

Infrastructure limitations, especially at key ports like Chattogram and Mongla, along with underdeveloped internal logistics networks, continue to hamper investment efforts. Political instability, periodic unrest, and changing foreign -policy dynamics-such as growing pressure from global alliances like the QUAD-add further uncertainty for long-term planning.

Frequent gas and electricity disruptions have also impacted industrial productivity. The fragmentation of responsibilities among multiple investment -promotion agencies-such as BEZA, BIDA, BEPZA, and the Hi-Tech Park Authority-has created confusion among investors who seek a single point of contact.

Report-recommended reforms: The intelligence report outlines a series of policy reforms aimed at boosting Chinese foreign direct investment in Bangladesh, amid 12 major challenges. Key proposals include allowing profit repatriation in yuan during dollar shortages and promoting its use in trade and loan repayments.

It also suggests improving consular services and launching direct flights between Bangladesh and major Chinese business hubs.

To enhance the investment climate, the report calls for stable tax policies, streamlined customs and land-acquisition procedures, and sector-specific strategies in RMG, agro-processing, renewable energy, pharmaceuticals, jute, and the digital economy.

It urges full operationalisation of Chinese-designated special economic zones (SEZs), with dedicated zones for agro and fisheries to meet export standards.

Other key recommendations include launching joint training programmes with China, ensuring political consensus on investment policy, and forming a special commission to maintain investor confidence.

The report proposes integrating agencies such as BEZA, BEPZA, and the Hi-Tech Park Authority under BIDA to create a unified investor platform, and digitising all OSS services.

Improved training for BIDA staff, longer tenures post-training, and a focus on energy -sector reform are also highlighted. The report stresses the need to reverse recent credit -rating downgrades through swift financial reforms and suggests using successful Chinese-backed projects like the Padma Rail Link and Payra Power Plant in global PR efforts.

Bangladesh is advised to pursue RCEP membership for enhanced trade access and to tap into investment from non-resident Bangladeshis via dedicated policies or SEZs.

Finally, the report urges steps to counter negative perceptions by addressing fraud, extortion, and quality concerns in FDI projects.

newsmanjasi@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.