Published :

Updated :

Hefty budget-deficit financing bloats government borrowing to Tk595.16 billion in the first four months of the current fiscal year and much of the money goes for repaying debts to the central bank.

Officials said Wednesday the ministry of finance borrowed Tk 595.16 billion from all the scheduled banks through issuing treasury bills and bonds during the July-October period while Tk 391.07 billion was paid to the central bank, according to a confidential report prepared by the Bangladesh Bank (BB) on government borrowing from the banking system.

Actually, the government borrowed the money from the banks during the period of this fiscal year partly to meet budget deficit but its net borrowing stood over Tk 204.09 billion during the period.

The net bank borrowing of the government was deficit Tk 31.82 billion in the same period of the FY'24, according to the official figures.

"The government has been forced to borrow more from the banking system mainly due to lower revenue mobilization in recent months," a senior official familiar with the government debt-management activities told the FE.

He also said economic uncertainty besides the severe floods in different part of the country affected revenue mobilization in the first quarter of the current fiscal year.

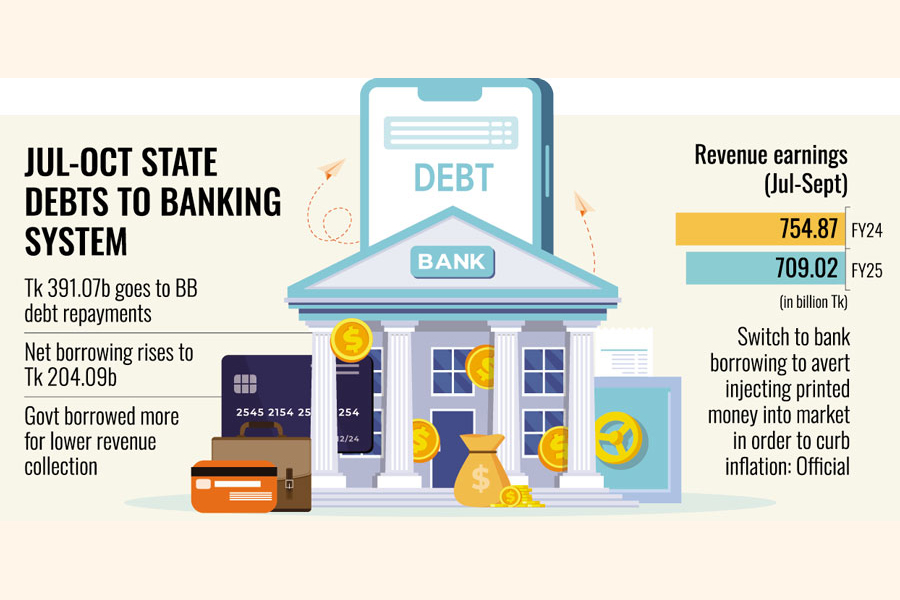

According to provisional data from the National Board of Revenue (NBR), revenue mobilization decreased by 6.07 per cent or Tk 45.84 billion in the July-September period compared to the same time last year.

In the first quarter, the NBR mobilized Tk 709.02 billion, down from Tk 754.87 billion in the same period of last year. The target for this period was Tk 964.99 billion.

"We expect that revenue collection will be enhanced in the second quarter of this fiscal as the country's overall economic activities will be revamped," the official notes about a rebound.

Explaining the switch in deficit financing he says the government has borrowed mainly from the commercial banks to avert injecting fresh funds by the central bank into the market by printing money in order to curb inflationary pressure on the economy.

However, the outstanding figures of ways-and-means advances (WMAs) facility stood at Tk 120 billion while overdraft (OD) drawing facility was Tk 106.49 billion.

The government is now empowered to borrow up to Tk 120 billion from the central bank under the WMAs to meet its day-to-day spending without issuing any securities.

In addition, it is entitled to borrow a maximum of Tk 120 billion through OD drawing facility from the central bank for the same purpose.

Taking to the FE, another official said the interim government is likely to slash its bank-borrowing target in the near future amid the latest downtrend in implementation of the annual development programme (ADP) and other expenditures amid tightfisted spending.

The implementation rate of the ADP in the Q1 of FY'25 hit a new low in at least 15 years amid cautious spending by the interim government and disruptions due to political turmoil.

The government spent Tk 132.15 billion, or 4.75 per cent of its ADP outlay, in the July-September period of the current fiscal year 2024-25, according to the official figures.

The net government bank borrowing is set to be Tk 1375.00 billion (1.37 trillion) for the FY'25 in a rise from Tk 1323.95 billion in the previous year, according to the budget documents.

However, the government revised upward its bank-borrowing target to Tk 1559.35 billion from the proposed Tk 1323.95 billion for the past FY '24. But the net government borrowing from banks was Tk 942.82 billion by the end of FY '24.

Under the arrangement, the government will borrow Tk 726.82 billion by issuing long-term bonds while the remaining Tk 648.18 billion through treasury bills (T-bills).

Currently, four T-bills are being transacted through auctions to adjust the government borrowings from the banking system. The T-bills have 14-day, 91-day, 182-day and 364-day maturity periods.

Furthermore, five government bonds, with tenures of two, five, 10, 15 and 20 years respectively, are traded on the market.

Meanwhile, the commercial banks prefer to invest their excess funds in the government securities because of better returns and safety, according to a senior executive of a leading private commercial bank.

"Lower demand for credits particularly from the private sector has also pushed up investment in the risk-free government securities in recent months," the private banker explains.

siddique.islam@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.