Published :

Updated :

The inter-bank call-money rate edged down slightly on Wednesday, a day after the cut in daily cash reserve requirement (CRR) by 50 basis points, giving more flexibility to the banks for maintaining their CRR.

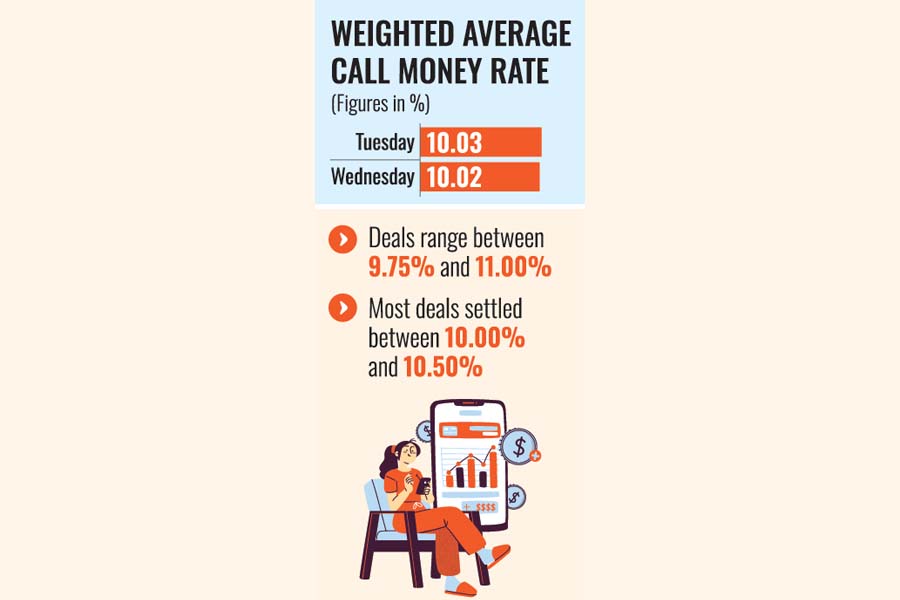

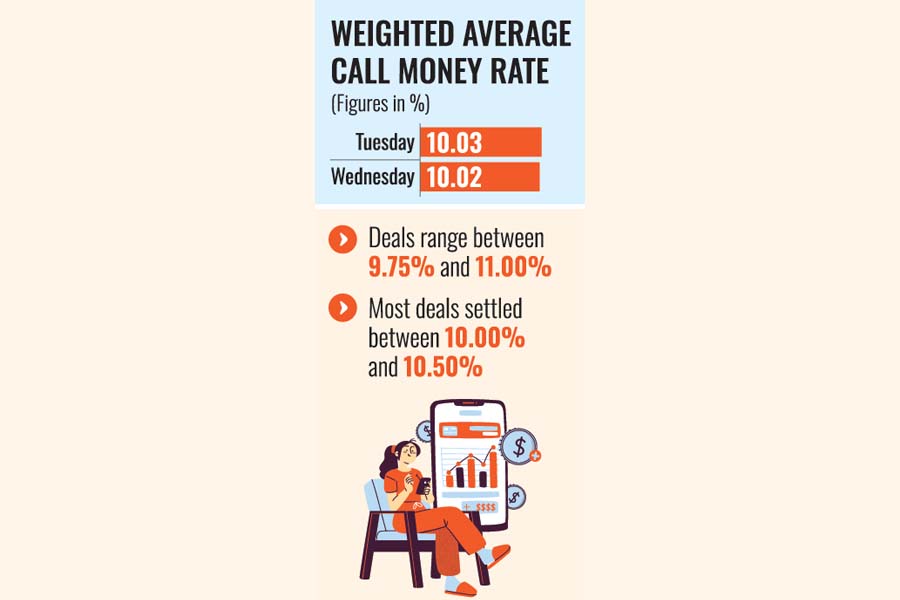

The weighted average rate (WAR) of call money came down to 10.02 per cent on the day from 10.03 per cent of the previous day. It was 10.05 per cent a week before.

The call rate remained unchanged at a range between 9.75 per cent and 11.00 per cent on the day from the previous level.

However, most of the deals were settled at rates varying between 10.00 per cent and 10.50 per cent, according to market operators.

They also said the downward trend of call money rate is likely to continue for the next couple of days as all the scheduled banks are allowed to maintain a lower daily CRR with the central bank.

But pressure on the call money market may intensify in the middle and at the end of the month, they hinted.

On Tuesday, the central bank relaxed its CRR rules after nearly five years, aiming to ease liquidity pressure on the market.

Under the revised rules, the banks are now allowed to maintain the reserve at minimum 3.0 per cent instead of 3.5 per cent earlier on a daily basis, but the bi-weekly average will remain unchanged at 4.0 per cent in the end.

"It would be tougher to say whether the relaxation in daily CRR rules will bring any positive outcome as the country's money market is not functioning properly," Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development (InM), told the FE while replying to a query.

On the other hand, the transaction volume of the call money market almost doubled on the day after implementation of the revised CRR rules, according to the central bank's latest statistics.

Total turnover in the inter-bank call money market rose to Tk 54.21 billion on Wednesday from Tk 27.77 billion a day ago. It was Tk 36.09 billion on Wednesday last.

"We've relaxed our CRR rules aiming to help the banks manage their funds efficiently amid the ongoing liquidity pressure in the market," a senior official of the Bangladesh Bank (BB) told the FE.

He also said such a move will also help keep the money market stable before the upcoming Eid-ul-Fitr.

"All the scheduled banks may use around Tk 80 billion in additional funds on daily basis following relaxation of the CRR rules," the central banker said while replying to a query.

Talking to the FE, a senior treasury official at a leading commercial bank said such relaxation has created a room to use around Tk 80 billion but the overall CRR requirement of 4.0 per cent remains unchanged.

"Through these revised rules, individual banks are getting more breathing space to maintain their respective CRR," the senior banker noted.

In April 2020, the central bank slashed the daily CRR requirement to 3.5 per cent from the previous 4.5 per cent, in order to increase the flow of liquidity in the market and implement the stimulus packages by the government at that time to tackle the negative impact of the Covid-19 pandemic.

At that time, the BB brought the bi-weekly CRR requirement to 4.0 per cent from 5.0 per cent earlier.

siddique.islam@gmail.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.