Economists give mixed feelings on MPS

Contractionary monetary policy to continue

Published :

Updated :

Stubborn inflation induces contractionary monetary policy and pared-down GDP growth in Bangladesh for the second half of this fiscal year, prompting economists to take a critical view of the remedies outlined.

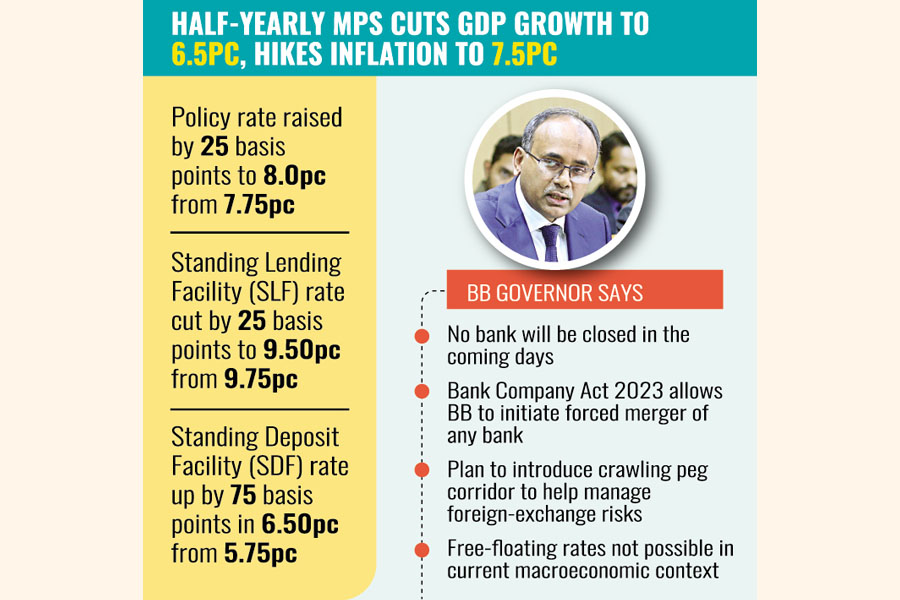

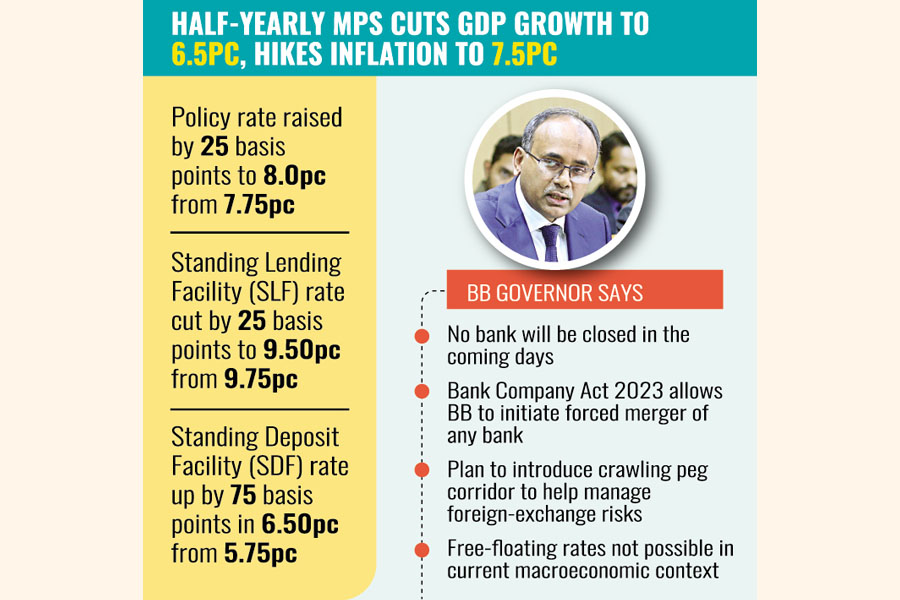

The targeted annual gross domestic product (GDP) growth has been lowered to 6.5 per cent, pulled by contraction in money supply, in governmental bid to contain inflation now officially hiked to 7.5 per cent.

The central bank of Bangladesh Wednesday unveiled a contractionary monetary policy statement (MPS) for the January-June period for containing the high inflation.

As part of tightening the money supply, the Bangladesh Bank raised its policy rate by 25 basis points to 8.0 per cent from 7.75 per cent.

The MPS, to define liquidity management, reduces the policy rate corridor from ± 200 basis points to ± 150 basis points.

The Standing Lending Facility (SLF) rate will be reduced by 25 basis points to 9.50 per cent from 9.75 per cent, and the Standing Deposit Facility (SDF) rate will be increased by 75 basis points to 6.50 per cent from 5.75 per cent, according to the MPS.

Bangladesh Bank Governor Abdur Rouf Talukder rolled out the MPS at the BB headquarters in Dhaka. BB chief economist Dr Habibur Rahman made presentation on the MPS.

Stating that the main objective of the MPS is to contain inflation, he said there are two factors to intervene in the inflationary pressures: economic and non-economic factors. The central bank deals with the economic factors while several ministries or divisions, for example, the ministry of Commerce, deal with the non-economic factors.

The governor said: "Such contractionary MPS will continue as long as the rate of inflation comes around 6.0 per cent."

On higher inflation, the monetary instruments take time to transmit to arrest the inflation.

"But its growing trend has been arrested through our last MPS," the governor said.

On the reserves depletion, he said once the financial account becomes

balanced, the reserves will go up.

The governor said to stabilize the exchange rate and prevent reserves loss, the central bank is contemplating the implementation of a crawling peg system, which would be linked to a carefully selected basket of currencies and operate within a predefined exchange-rate corridor.

"By setting a competitive equilibrium exchange rate at the midpoint of this corridor, BB would establish a stable benchmark while retaining the flexibility to intervene in the market, as necessary, to maintain the currency within the designated boundaries," the MPS sates about crawling peg.

However, the BB-projected growth of broad money is set to be 9.7 per cent and this is aligned with the revised GDP target at 6.5 per cent and inflation at 7.5 per cent.

The projected growth in public-sector credit is 27.8 per cent which reflects government's selective expenditure on priority projects as part of its austerity measures.

The private-sector credit growth is forecast to be lower at 10 per cent from 11 per cent. "This projection is underpinned by BB's supply-side interventions."

The banking system's net foreign assets or NFA projected to decrease by 2.4 per cent for fiscal year 2024.

The reserve money is to decrease 1.0 per cent following the pause in 'devolvement' or money creation.

The BB has stopped the "devolvement" through which the central bank provides funds to the government instead of banking channels.

However, economists say the MPS is weak in the sense that there is no reform for the banking industry which lacks proper governance.

"The MPS is weak on actions. A lot was expected since there is no longer the election excuse for deferring reforms," says Dr Zahid Hussain, an independent economist of Bangladesh.

"The increase in policy rate comes with a decrease in the rate on the SLF. This gives a mixed message on the monetary-policy stance."

Dr Hussain points out that the MPS does not explain why BB did not switch to a market-based exchange rate by September 2023. This was their commitment in the previous MPS.

Instead, it is contemplating introducing a crawling peg without specifying how and when.

"One does not get a sense of urgency in addressing the foreign-exchange shortage."

Dr M Masrur Reaz, chairman and CEO of the Policy Exchange of Bangladesh, finds the hike in the policy rate justified as he says this is "appropriate and unavoidable".

Also, he finds the MPS to be steering the right direction in attracting money from outside the banking system.

However, the MPS mentions that several challenges stand ahead, primarily in the near-term fiscal-policy stance, global fuel-price dynamics amidst instability in the Middle East, and the prices of essential commodities in the international market.

"These factors collectively pose significant challenges in the ongoing battle to contain inflation," the economist says.

jasimharoon@yahoo.com

For all latest news, follow The Financial Express Google News channel.

For all latest news, follow The Financial Express Google News channel.